Chef Angad Singh Rana has won QualityNZ Culinary Cup 2020. The award was announced by Cricket legend and Chennai Super Kings coach Stephen Fleming. Chef Angad Singh Rana grabbed the QualityNZ Culinary Cup 2020 alongside INR 50,000 worth of QualityNZ lamb and seafood and a Weber BBQ valued at over INR 46,000. This award is the New Zealand’s first ‘Virtual’ Chef competition – the ‘Quality NZ Culinary Cup’ held in India. The competition had quite 120 entries of which were shortlisted as finals. The panel of judges included the heads of the Culinary Association, Chef Davinder Kumar, Chef Salil Fadnis, Chef Jugesh Arora and Stephen Fleming.

Chef Angad Singh Rana has won QualityNZ Culinary Cup 2020. The award was announced by Cricket legend and Chennai Super Kings coach Stephen Fleming. Chef Angad Singh Rana grabbed the QualityNZ Culinary Cup 2020 alongside INR 50,000 worth of QualityNZ lamb and seafood and a Weber BBQ valued at over INR 46,000. This award is the New Zealand’s first ‘Virtual’ Chef competition – the ‘Quality NZ Culinary Cup’ held in India. The competition had quite 120 entries of which were shortlisted as finals. The panel of judges included the heads of the Culinary Association, Chef Davinder Kumar, Chef Salil Fadnis, Chef Jugesh Arora and Stephen Fleming.

|

Union Petroleum and Natural Gas Minister, Dharmendra Pradhan has launched the Indian Gas Exchange (IGX). IGX is the first nationwide online delivery-based gas trading platform. The trading platform will enable market participants to trade in standardised gas contracts. IGX is fully automated with a web-based interface and it provides seamless trading experience to the customers. The new electronic trading platform for natural gas is an indicator of the centre’s progressive policy. This will help the nation move towards free-market pricing of natural gas. IGX has been incorporated as a wholly-owned subsidiary of the Indian Energy Exchange (IEX), which is India’s energy market platform. Union Petroleum and Natural Gas Minister, Dharmendra Pradhan has launched the Indian Gas Exchange (IGX). IGX is the first nationwide online delivery-based gas trading platform. The trading platform will enable market participants to trade in standardised gas contracts. IGX is fully automated with a web-based interface and it provides seamless trading experience to the customers. The new electronic trading platform for natural gas is an indicator of the centre’s progressive policy. This will help the nation move towards free-market pricing of natural gas. IGX has been incorporated as a wholly-owned subsidiary of the Indian Energy Exchange (IEX), which is India’s energy market platform. |

ICICI Bank has introduced an online overdraft(od) facility ‘Insta FlexiCash’ for its salary account customers. The end-to-end fully digital facility is often accessed with no documentation, using the Bank’s internet banking platform without visiting a bank branch. This facility is meant to guard ICICI Bank Salary Account customers against missing their Equated Monthly Instalments (EMIs) or cheque bounces thanks to insufficient funds by providing short-term instant credit. Customers can easily avail of this facility by initiating their application online. ICICI Bank has introduced an online overdraft(od) facility ‘Insta FlexiCash’ for its salary account customers. The end-to-end fully digital facility is often accessed with no documentation, using the Bank’s internet banking platform without visiting a bank branch. This facility is meant to guard ICICI Bank Salary Account customers against missing their Equated Monthly Instalments (EMIs) or cheque bounces thanks to insufficient funds by providing short-term instant credit. Customers can easily avail of this facility by initiating their application online. |

|

Important Features of ‘Insta Flexicash’:

|

International Day of Family Remittances is observed on 16th June every year. The day recognizes the contribution of over 200 million migrants to improve the lives of their 800 million family members back home and to create a future of hope for their children. This year International Day of Family Remittances is celebrated under the theme: “Building resilience in times of crisis”

International Day of Family Remittances is observed on 16th June every year. The day recognizes the contribution of over 200 million migrants to improve the lives of their 800 million family members back home and to create a future of hope for their children. This year International Day of Family Remittances is celebrated under the theme: “Building resilience in times of crisis”

|

The objective of the International Day of Family Remittances:

|

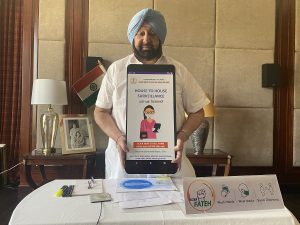

“Ghar Ghar Nigrani” mobile application has been launched by the Punjab government to check the community spread of COVID-19 in the state of Punjab. Under this initiative, state will undertake house to house surveillance in the state, covering the entire rural and urban population of Punjab above 30 years of age and will also cover persons below the age of 30 having co-morbidity or Influenza like Illness/Severe Acute Respiratory Illness until the elimination of the COVID-19 pandemic. The mobile application “Ghar Ghar Nigrani”, developed and designed in-house by the Health Department, will act as a tool for early detection as well as testing of the people for the novel coronavirus in order to prevent its community spread. “Ghar Ghar Nigrani” mobile application has been launched by the Punjab government to check the community spread of COVID-19 in the state of Punjab. Under this initiative, state will undertake house to house surveillance in the state, covering the entire rural and urban population of Punjab above 30 years of age and will also cover persons below the age of 30 having co-morbidity or Influenza like Illness/Severe Acute Respiratory Illness until the elimination of the COVID-19 pandemic. The mobile application “Ghar Ghar Nigrani”, developed and designed in-house by the Health Department, will act as a tool for early detection as well as testing of the people for the novel coronavirus in order to prevent its community spread. |

An Artificial Intelligence enabled robot “CAPTAIN ARJUN” has been launched by the Indian Railways’ Central Railway zone. The AI robot has been launched to intensify the screening of passengers and surveillance to keep a watch on anti-social elements. The above objectives will be achieved with the help of motion sensor, one PTZ camera and one Dome Camera installed on the robot. It also comprises sensor-based sanitizer as well as mask dispenser. The Cameras installed on the CAPTAIN ARJUN uses Artificial Intelligence algorithms to track suspicious and antisocial activity. It also comprises of inbuilt siren, motion activated spotlight along with an in-built internal storage in order to record in case of a network failure. The robot undertake the thermal screening of passengers and captures the temperature in a digital display panel. It also sounds an abnormal automatic alarm indicating a higher temperature than reference range. Hence, Captain ARJUN will provide enough protective cover to the passengers while undergoing the screening and also ensure security in the railway premises. An Artificial Intelligence enabled robot “CAPTAIN ARJUN” has been launched by the Indian Railways’ Central Railway zone. The AI robot has been launched to intensify the screening of passengers and surveillance to keep a watch on anti-social elements. The above objectives will be achieved with the help of motion sensor, one PTZ camera and one Dome Camera installed on the robot. It also comprises sensor-based sanitizer as well as mask dispenser. The Cameras installed on the CAPTAIN ARJUN uses Artificial Intelligence algorithms to track suspicious and antisocial activity. It also comprises of inbuilt siren, motion activated spotlight along with an in-built internal storage in order to record in case of a network failure. The robot undertake the thermal screening of passengers and captures the temperature in a digital display panel. It also sounds an abnormal automatic alarm indicating a higher temperature than reference range. Hence, Captain ARJUN will provide enough protective cover to the passengers while undergoing the screening and also ensure security in the railway premises. |

A CSIR National Healthcare Supply Chain Portal named as “Aarogyapath” has been launched. “Aarogyapath” is an information platform developed by CSIR in partnership with Sarvodaya Infotech and institutional users and manufacturers / authorized suppliers of healthcare essentials. The portal has been launched with a vision of “providing a path which leads one on a journey towards Aarogya (healthy life)”. The platform is expected to fill the critical gaps in last-mile delivery of patient care within India via improved availability and affordability of healthcare supplies. The “Aarogyapath” portal will ensure single-point availability of key healthcare goods which would be helpful to customers in addressing various issues such as time-consuming processes to identify good quality products, lack of awareness about the latest product launches, dependence on limited suppliers, etc. The platform would serve manufacturers & suppliers to reach a wide network of customers efficiently by reducing the gaps in connectivity between them and potential demand centers. Hence it will facilitate a real-time availability of critical healthcare supplies. A CSIR National Healthcare Supply Chain Portal named as “Aarogyapath” has been launched. “Aarogyapath” is an information platform developed by CSIR in partnership with Sarvodaya Infotech and institutional users and manufacturers / authorized suppliers of healthcare essentials. The portal has been launched with a vision of “providing a path which leads one on a journey towards Aarogya (healthy life)”. The platform is expected to fill the critical gaps in last-mile delivery of patient care within India via improved availability and affordability of healthcare supplies. The “Aarogyapath” portal will ensure single-point availability of key healthcare goods which would be helpful to customers in addressing various issues such as time-consuming processes to identify good quality products, lack of awareness about the latest product launches, dependence on limited suppliers, etc. The platform would serve manufacturers & suppliers to reach a wide network of customers efficiently by reducing the gaps in connectivity between them and potential demand centers. Hence it will facilitate a real-time availability of critical healthcare supplies. |

An Internal Working Group (IWG) has been constituted by the Reserve Bank of India with a prime objective of reviewing the extant guidelines on ownership and corporate structure for Indian private sector banks. The Internal Working Group (IWG) will be headed by Dr. Prasanna Kumar Mohanty, Director, Central Board of RBI. The Internal Working Group (IWG) is supposed to submit its report by 30th September 2020. An Internal Working Group (IWG) has been constituted by the Reserve Bank of India with a prime objective of reviewing the extant guidelines on ownership and corporate structure for Indian private sector banks. The Internal Working Group (IWG) will be headed by Dr. Prasanna Kumar Mohanty, Director, Central Board of RBI. The Internal Working Group (IWG) is supposed to submit its report by 30th September 2020. |

About an Internal Working Group (IWG):

The Terms of Reference of the Internal Working Group is as follows:

|

Composition of the Internal Working Group:

The Internal Working Group (IWG) consists of 5 members:

|

State of the art flood warning system “iFLOWS” has been launched in Mumbai. The flood warning system was launched by Union Earth Sciences Minister Harsh Vardhan along with Maharashtra’s chief minister Uddhav Thackeray. I-FLOWS consists of seven modules: Data Assimilation, Flood, Inundation, Vulnerability, Risk, Dissemination Module and Decision Support System. The recently launched system “iFLOWS” will enable Mumbai to predict floods three days before they happen. As a result, administration will be able to save property as well as lives from the flood. Now, the city will become more resilient with the launch of system as it will provide early signs of the forthcoming danger during high rainfall and cyclone events. State of the art flood warning system “iFLOWS” has been launched in Mumbai. The flood warning system was launched by Union Earth Sciences Minister Harsh Vardhan along with Maharashtra’s chief minister Uddhav Thackeray. I-FLOWS consists of seven modules: Data Assimilation, Flood, Inundation, Vulnerability, Risk, Dissemination Module and Decision Support System. The recently launched system “iFLOWS” will enable Mumbai to predict floods three days before they happen. As a result, administration will be able to save property as well as lives from the flood. Now, the city will become more resilient with the launch of system as it will provide early signs of the forthcoming danger during high rainfall and cyclone events. |

West Bengal government has received a loan amount of Rs 1950 crore from the World Bank. The loan amount has been lend to the West Bengal Government to tackle COVID-19 situation and developmental work in the state. Out of the total amount of Rs 1950 crore, West Bengal Government will spend Rs. 850 crore on various Social-Welfare schemes while the remaining Rs 1,100 crore will be spent to create Industrial infrastructures. West Bengal government has received a loan amount of Rs 1950 crore from the World Bank. The loan amount has been lend to the West Bengal Government to tackle COVID-19 situation and developmental work in the state. Out of the total amount of Rs 1950 crore, West Bengal Government will spend Rs. 850 crore on various Social-Welfare schemes while the remaining Rs 1,100 crore will be spent to create Industrial infrastructures. |

You need to login to perform this action.

You will be redirected in

3 sec