India’s largest bank State Bank of India has moved to a new interest rate regime on large savings account deposits as well as short-term loans. Earlier, SBI had announced that it will link its interest rate on savings account with a balance above Rs1 lakh and short-term loans like overdraft and cash credit facility to Reserve Bank of India’s repo rate, effective 1 May 2019. The interest rates on large SBI savings account deposits and interest rate on some short-term loans will automatically change as and when RBI changes its repo rate. This will help in better transmission of RBI’s policy rates into the banking system. India’s largest bank State Bank of India has moved to a new interest rate regime on large savings account deposits as well as short-term loans. Earlier, SBI had announced that it will link its interest rate on savings account with a balance above Rs1 lakh and short-term loans like overdraft and cash credit facility to Reserve Bank of India’s repo rate, effective 1 May 2019. The interest rates on large SBI savings account deposits and interest rate on some short-term loans will automatically change as and when RBI changes its repo rate. This will help in better transmission of RBI’s policy rates into the banking system. |

| Source- DD News |

LIC Housing Finance (LIC HFL) has launched ‘Udyam’, a skilling center in Bengaluru. It was launched in association with Lok Bharti Education Society, the implementing partner. The Centres of Excellence will provide training to marginalised youth in the BFSI, retail, and IT/ ITES sectors. LIC Housing Finance (LIC HFL) has launched ‘Udyam’, a skilling center in Bengaluru. It was launched in association with Lok Bharti Education Society, the implementing partner. The Centres of Excellence will provide training to marginalised youth in the BFSI, retail, and IT/ ITES sectors. |

| Source: The Hindu Business Lines |

The Netherlands has emerged as the third largest foreign direct investor in India during 2017-18, with investments pegged at about $2.67 billion across sectors. The Netherlands was also the second largest destination for foreign investment by Indian companies, after Singapore, with investments worth $12.8 billion in 2017. The Netherlands has emerged as the third largest foreign direct investor in India during 2017-18, with investments pegged at about $2.67 billion across sectors. The Netherlands was also the second largest destination for foreign investment by Indian companies, after Singapore, with investments worth $12.8 billion in 2017. |

| Source: The Hindu Business Line |

Bharti AXA General Insurance, a private non-life insurer, has tied up with financial marketplace Wishfin’s insurance arm Wishpolicy, to offer two-wheeler insurance to customers via WhatsApp. This service option is an instant and additional customer service option for policyholders, apart from Bharti AXA General Insurance’s multiple channels, including its network of branches, customer care and contact centre, dynamic portal, and intelligent chatbot. Bharti AXA General Insurance, a private non-life insurer, has tied up with financial marketplace Wishfin’s insurance arm Wishpolicy, to offer two-wheeler insurance to customers via WhatsApp. This service option is an instant and additional customer service option for policyholders, apart from Bharti AXA General Insurance’s multiple channels, including its network of branches, customer care and contact centre, dynamic portal, and intelligent chatbot. |

Canara Bank and its life insurance partner Canara HSBC Oriental Bank of Commerce Life Insurance launched ’Webassurance’ to enable its customers to purchase life insurance in a convenient and hassle-free way. This Life Insurance is jointly owned by Canara Bank (51%) and Oriental Bank of Commerce (23%) and HSBC Insurance Holdings (26%), the Asian insurance arm of HSBC. Canara Bank and its life insurance partner Canara HSBC Oriental Bank of Commerce Life Insurance launched ’Webassurance’ to enable its customers to purchase life insurance in a convenient and hassle-free way. This Life Insurance is jointly owned by Canara Bank (51%) and Oriental Bank of Commerce (23%) and HSBC Insurance Holdings (26%), the Asian insurance arm of HSBC. |

| Source: The Hindu Business Line |

State Bank of India (SBI) has launched India’s first ‘Green Car Loan’ (Electric Vehicle) to encourage customers to buy electric vehicles. The new scheme ‘Green Car Loan’ will offer the loan at 20 basis points lower than the interest rate on the existing car loan schemes. SBI has already notified 100% migration to EVs (Electric Vehicles) by 2030 in order to decrease carbon footprints, thus being in line with the government’s pledge of ensuring 30% EVs on road by 2030. State Bank of India (SBI) has launched India’s first ‘Green Car Loan’ (Electric Vehicle) to encourage customers to buy electric vehicles. The new scheme ‘Green Car Loan’ will offer the loan at 20 basis points lower than the interest rate on the existing car loan schemes. SBI has already notified 100% migration to EVs (Electric Vehicles) by 2030 in order to decrease carbon footprints, thus being in line with the government’s pledge of ensuring 30% EVs on road by 2030. |

| Source: Uniindia |

|

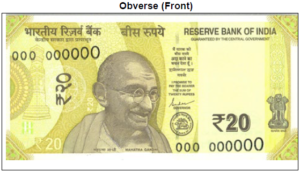

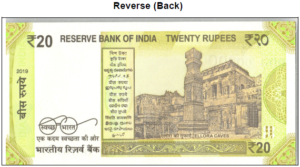

| The Reserve Bank of India will shortly issue ? 20 denomination banknotes in the Mahatma Gandhi (New) Series, bearing the signature of Shri Shaktikanta Das, Governor, Reserve Bank of India. The new denomination has the motif of Ellora Caves on the reverse, depicting the country’s cultural heritage. The base colour of the note is Greenish Yellow. The dimension of the banknote will be 63 mm x 129 mm. |

| Source: RBI |

The Reserve Bank of India (RBI) has divested its entire stake held in National Housing Bank (NHB), the regulator for housing finance companies, and National Bank for Agriculture and Rural Development (Nabard) to the government, which now holds 100% in these entities.

The central bank has sold its stake in NHB in the month of March, while it sold the stake in Nabard in February. RBI had 100% shareholding in NHB, which was divested for INR1,450 crore. The Nabard stake was divested in two phases. RBI had 72.5% stake in Nabard amounting to INR1,450 crore, out of which 71.5%, worth INR 1,430 crore was divested in October 2010 and the residual shareholding was divested in February 2019 for INR 20 crore.

NHB is the regulator for housing finance companies while NABARD is responsible for regulating and supervising the functions of Co-operative banks and RRBs.

The move is part of ending the cross-holding in regulatory institutions and follows the recommendation of second Narasimham committee report of October 2001 and the RBI’s own discussion paper on the same entitled ‘Harmonizing the role and operations of development financial institutions and banks.’ The Reserve Bank of India (RBI) has divested its entire stake held in National Housing Bank (NHB), the regulator for housing finance companies, and National Bank for Agriculture and Rural Development (Nabard) to the government, which now holds 100% in these entities.

The central bank has sold its stake in NHB in the month of March, while it sold the stake in Nabard in February. RBI had 100% shareholding in NHB, which was divested for INR1,450 crore. The Nabard stake was divested in two phases. RBI had 72.5% stake in Nabard amounting to INR1,450 crore, out of which 71.5%, worth INR 1,430 crore was divested in October 2010 and the residual shareholding was divested in February 2019 for INR 20 crore.

NHB is the regulator for housing finance companies while NABARD is responsible for regulating and supervising the functions of Co-operative banks and RRBs.

The move is part of ending the cross-holding in regulatory institutions and follows the recommendation of second Narasimham committee report of October 2001 and the RBI’s own discussion paper on the same entitled ‘Harmonizing the role and operations of development financial institutions and banks.’

|

| The Narasimham panel had stated that RBI could not own those entities which are regulated by it. Earlier, based on the second Narasimham committee recommendations, the RBI had proposed to transfer its ownership in SBI, NHB, and Nabard to the government in October 2001. The current change in the capital structure of both these financial institutions was brought in by the government through amendments to the Nabard Act of 1981 and the NHB Act of 1987 which were notified in January 2018 and March 2018, respectively. |

| The Nabard came into existence on July 12, 1982, by transferring the agricultural credit functions of RBI and refinance functions of the then Agricultural Refinance and Development Corporation. Set up with an initial capital of Rs 100 crore, the development finance institution’s paid-up capital stood at Rs 10,580 crore as of March 2018. The decision to establish NHB was announced in the 1987-88 Budget. Following that, the National Housing Bank Bill, providing a legislative framework for the NHB, was passed by Parliament in the Winter session of 1987 and it became an Act on December 23, 1987. The National Housing Policy of 1988 envisaged setting up of NHB as the apex level institution for promoting the housing sector. |

BuyUcoin, second oldest Cryptocurrency Exchange in India, has introduced a new and unique platform for wholesale cryptocurrency trading. This platform works on ‘free trading model’ which means it charges zero fee on any trade. It is also known as OTC (Over-the-counter) Desk that allows users to trade on a large scale with low price fluctuations. BuyUcoin, second oldest Cryptocurrency Exchange in India, has introduced a new and unique platform for wholesale cryptocurrency trading. This platform works on ‘free trading model’ which means it charges zero fee on any trade. It is also known as OTC (Over-the-counter) Desk that allows users to trade on a large scale with low price fluctuations. |

| Source: Business Standard |

Markets regulator SEBI (Securities and Exchange Board of India) has reduced the minimum subscription requirement as well as defined trading lots for Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs). SEBI has also increased the leverage limit for InvITs from 49% to 70%. While making an initial public offer and follow-on offer, the minimum subscription shall not be less than Rs 1 lakh for InvITs and Rs 50,000 for REITs. Currently, in the case of a REIT issue, the minimum subscription from any investor in an initial offer and follow-on public offer is not less than Rs 2 lakh, while the same is Rs 10 lakh in case of InvIT. Markets regulator SEBI (Securities and Exchange Board of India) has reduced the minimum subscription requirement as well as defined trading lots for Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs). SEBI has also increased the leverage limit for InvITs from 49% to 70%. While making an initial public offer and follow-on offer, the minimum subscription shall not be less than Rs 1 lakh for InvITs and Rs 50,000 for REITs. Currently, in the case of a REIT issue, the minimum subscription from any investor in an initial offer and follow-on public offer is not less than Rs 2 lakh, while the same is Rs 10 lakh in case of InvIT. |

| Source: Economic Times |

You need to login to perform this action.

You will be redirected in

3 sec