National Bulk Handling Corporation (NBHC) has released Kharif Crop estimation for the year 2018-2019. According to the report, the basmati rice production is expected to decline by 9.24% to 5.18 million metric tonnes. The total oilseeds production is estimated to be 19.87 million metric tonne which is 5.36 % lower as compared to the year 2018. The pulses production is projected to be dropped to 9.10 million tonnes. National Bulk Handling Corporation (NBHC) has released Kharif Crop estimation for the year 2018-2019. According to the report, the basmati rice production is expected to decline by 9.24% to 5.18 million metric tonnes. The total oilseeds production is estimated to be 19.87 million metric tonne which is 5.36 % lower as compared to the year 2018. The pulses production is projected to be dropped to 9.10 million tonnes. |

| Source: The Economic Times |

India’s new e-commerce policy came into effect From February 1, 2019. A new set of policy rules had been formed for the e-commerce companies. Department for Promotion of Industry and Internal Trade (previously DIPP) gave them a 60-day window period for aligning themselves to the government’s modified foreign direct investment (FDI) rules. India’s new e-commerce policy came into effect From February 1, 2019. A new set of policy rules had been formed for the e-commerce companies. Department for Promotion of Industry and Internal Trade (previously DIPP) gave them a 60-day window period for aligning themselves to the government’s modified foreign direct investment (FDI) rules. |

Important Highlights of the new policy:

|

| Source- The Hindu |

Bank of India, Bank of Maharashtra and Oriental Bank of Commerce have been allowed to exit the PCA framework fully. The three lenders were part of 11 government-owned banks put under the framework in 2017 and 2018. In December, the government had announced a capital infusion of Rs 10,000 crore for Bank of India, Rs 5,500 crore for Oriental Bank of Commerce and Rs 4,500 crore for Bank of Maharashtra, which helped the banks coming out of the framework. The RBI had invoked PCA for Bank of Maharashtra in June 2017, Oriental Bank of Commerce in October and Bank of India went into the framework in December that year. The RBI’s decision to impose lending restrictions on these banks had become a flashpoint between the regulator and the government, which wanted the lending capacity to be freed up. Bank of India, Bank of Maharashtra and Oriental Bank of Commerce have been allowed to exit the PCA framework fully. The three lenders were part of 11 government-owned banks put under the framework in 2017 and 2018. In December, the government had announced a capital infusion of Rs 10,000 crore for Bank of India, Rs 5,500 crore for Oriental Bank of Commerce and Rs 4,500 crore for Bank of Maharashtra, which helped the banks coming out of the framework. The RBI had invoked PCA for Bank of Maharashtra in June 2017, Oriental Bank of Commerce in October and Bank of India went into the framework in December that year. The RBI’s decision to impose lending restrictions on these banks had become a flashpoint between the regulator and the government, which wanted the lending capacity to be freed up. |

| Source: BloombergQuint |

‘Kisan Suvidha loan’ for small and marginal farmers has been launched by Ujjivan Small Finance Bank. The scheme will attempt to reach the bottom of the pyramid with products and services. Kisan Suvidha loan can be used by farmers for both agriculture and allied activities. The product is specially designed to cater to the needs of customers for various allied and agricultural activities. It provides loans to individuals with an amount ranging from Rs. 60000 to Rs. 2 Lakh to fulfill the customized needs of the mass market segment. ‘Kisan Suvidha loan’ for small and marginal farmers has been launched by Ujjivan Small Finance Bank. The scheme will attempt to reach the bottom of the pyramid with products and services. Kisan Suvidha loan can be used by farmers for both agriculture and allied activities. The product is specially designed to cater to the needs of customers for various allied and agricultural activities. It provides loans to individuals with an amount ranging from Rs. 60000 to Rs. 2 Lakh to fulfill the customized needs of the mass market segment. |

| Source: Times Of India |

Reserve Bank of India has released a data on “Census on Foreign Liabilities and Assets of Indian Direct Investment Companies, 2017-18” which shows that the Foreign Direct Investment (FDI) has increased 18% to Rs. 28.25 lakh crore in FY18. FDI increased by Rs 4,33,300 crore, including revaluation of past investments, during 2017-18 to reach Rs 28,24,600 crore in March 2018 at market value. Overseas direct investment (ODI) by Indian companies increased by 5% to Rs 5.28 lakh crore. The census showed that Mauritius continued to be the largest source of FDI in India (19.7%) followed by the US and UK. In case of overseas investment by Indian companies, Singapore (17.5%) was the major destination, followed by the Netherlands and Mauritius. Reserve Bank of India has released a data on “Census on Foreign Liabilities and Assets of Indian Direct Investment Companies, 2017-18” which shows that the Foreign Direct Investment (FDI) has increased 18% to Rs. 28.25 lakh crore in FY18. FDI increased by Rs 4,33,300 crore, including revaluation of past investments, during 2017-18 to reach Rs 28,24,600 crore in March 2018 at market value. Overseas direct investment (ODI) by Indian companies increased by 5% to Rs 5.28 lakh crore. The census showed that Mauritius continued to be the largest source of FDI in India (19.7%) followed by the US and UK. In case of overseas investment by Indian companies, Singapore (17.5%) was the major destination, followed by the Netherlands and Mauritius. |

| Source: Business Today |

The Reserve Bank of India has stated that it will inject Rs 37,500 crore into the system through the purchase of government securities in February to increase liquidity. RBI stated that it has decided to conduct the purchase of government securities under Open Market Operations (OMOs) for an aggregate amount of Rs 375 billion in the month of February 2019 through three auctions of Rs 125 billion each during the 2nd, 3rd and 4th week. There will be no auction during the first week due to the scheduled Monetary Policy Committee (MPC) meeting. The Reserve Bank of India has stated that it will inject Rs 37,500 crore into the system through the purchase of government securities in February to increase liquidity. RBI stated that it has decided to conduct the purchase of government securities under Open Market Operations (OMOs) for an aggregate amount of Rs 375 billion in the month of February 2019 through three auctions of Rs 125 billion each during the 2nd, 3rd and 4th week. There will be no auction during the first week due to the scheduled Monetary Policy Committee (MPC) meeting. |

| Source: News on AIR |

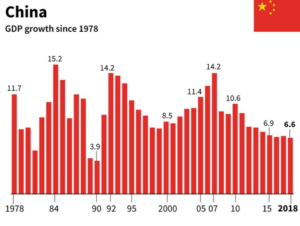

China’s economy grew at 6.6% in 2018, its slowest rate in almost 3 decades. The world’s 2nd biggest economy was grappling with the effects of the current trade war with the US and declining exports. In the 3 months to December, the economy grew 6.4% from a year earlier, down from 6.5 % in the previous quarter. China’s National Bureau of Statistics (NBS) stated that last year’s growth rate was down from 6.8% in 2017 and was the lowest since 1990 when the growth rate was 3.9%. China’s economy grew at 6.6% in 2018, its slowest rate in almost 3 decades. The world’s 2nd biggest economy was grappling with the effects of the current trade war with the US and declining exports. In the 3 months to December, the economy grew 6.4% from a year earlier, down from 6.5 % in the previous quarter. China’s National Bureau of Statistics (NBS) stated that last year’s growth rate was down from 6.8% in 2017 and was the lowest since 1990 when the growth rate was 3.9%. |

| Source: News on AIR |

HDFC Standard Life Insurance has changed its name to HDFC Life Insurance following the receipt of relevant approvals from regulatory authorities. The change in name is effective right off the bat and the company will henceforth operate under the name HDFC Life Insurance Company Ltd. it stated. HDFC Standard Life Insurance has changed its name to HDFC Life Insurance following the receipt of relevant approvals from regulatory authorities. The change in name is effective right off the bat and the company will henceforth operate under the name HDFC Life Insurance Company Ltd. it stated. |

| Source: The Hindu Business Line |

India Ratings and Research (Ind-Ra), a Fitch Group Company, estimated India’s GDP growth could touch 7.5 % in the financial year 2019-20 as against 7.2 % during current fiscal i.e. 2018-19. India Ratings believes investments are slowly but steadily gaining traction with gross fixed capital formation growing 12.2 % in FY19 and projected to clock 10.3 % in FY20. India Ratings and Research (Ind-Ra), a Fitch Group Company, estimated India’s GDP growth could touch 7.5 % in the financial year 2019-20 as against 7.2 % during current fiscal i.e. 2018-19. India Ratings believes investments are slowly but steadily gaining traction with gross fixed capital formation growing 12.2 % in FY19 and projected to clock 10.3 % in FY20. |

| Source: The Hindu Business Line |

|

|

| Source- AIR World Service |

You need to login to perform this action.

You will be redirected in

3 sec