The Asian Development Bank has approved the 2nd tranche of USD 150 million (about Rs 1,065 crore) for West Bengal to boost capital investment and infrastructure in the state. The board of ADB approved a loan of $ 300 million (about Rs 2,130 crore) to continue a comprehensive series of fiscal reforms in West Bengal to revive financial health of public sector enterprises, the introduction of medium-term expenditure frameworks in two departments, and implementation of an integrated tax monitoring system, among others. The Asian Development Bank has approved the 2nd tranche of USD 150 million (about Rs 1,065 crore) for West Bengal to boost capital investment and infrastructure in the state. The board of ADB approved a loan of $ 300 million (about Rs 2,130 crore) to continue a comprehensive series of fiscal reforms in West Bengal to revive financial health of public sector enterprises, the introduction of medium-term expenditure frameworks in two departments, and implementation of an integrated tax monitoring system, among others. |

| Source: The Business Standard |

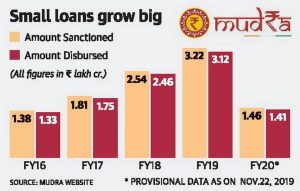

The Reserve Bank of India (RBI) has expressed concern over rising bad loans from Pradhan Mantri MUDRA Yojana (PMMY). This scheme was announced by Prime Minister Narendra Modi in April 2015, which offers faster credit, with ticket sizes starting from ?50,000 and going up to ?10 lakh, to small businesses. According to RBI, the percentage of MUDRA loans were at 2.52% in 2017-18, It has now raised to 2.89% in 2018-19. It also says that the number of loans being sanctioned under the scheme has increased greatly. The Reserve Bank of India (RBI) has expressed concern over rising bad loans from Pradhan Mantri MUDRA Yojana (PMMY). This scheme was announced by Prime Minister Narendra Modi in April 2015, which offers faster credit, with ticket sizes starting from ?50,000 and going up to ?10 lakh, to small businesses. According to RBI, the percentage of MUDRA loans were at 2.52% in 2017-18, It has now raised to 2.89% in 2018-19. It also says that the number of loans being sanctioned under the scheme has increased greatly. |

| Source: The Hindu |

Markets regulator SEBI imposed a total fine of Rs 40.5 lakh on 7 companies for indulging in fraudulent trading in the illiquid stock options segment on the BSE. The total fine levied on the firms, Rs 10.5 lakh was levied on Green Venture Securities Management Pvt Ltd while Morgan Financial Services, Niranjan Housing, Navrang Tradelinks, Niranjan Metallic, Nishu Leasing and Finance and Midpoint Tradelink faced a fine of Rs 5 lakh each. The reversal trades executed by the Notice were non-genuine in nature and created an impression of genuine trading volumes in respective contracts. Markets regulator SEBI imposed a total fine of Rs 40.5 lakh on 7 companies for indulging in fraudulent trading in the illiquid stock options segment on the BSE. The total fine levied on the firms, Rs 10.5 lakh was levied on Green Venture Securities Management Pvt Ltd while Morgan Financial Services, Niranjan Housing, Navrang Tradelinks, Niranjan Metallic, Nishu Leasing and Finance and Midpoint Tradelink faced a fine of Rs 5 lakh each. The reversal trades executed by the Notice were non-genuine in nature and created an impression of genuine trading volumes in respective contracts. |

| Source: The DD News |

The RBI expanded the scope of Special Non-Resident Rupee Accounts (SNRR account) by permitting non-residents to open such accounts for rupee-denominated overseas borrowings, trade credit and trade invoicing for popularising cross-border transactions in the domestic currency. Any person resident outside India, having a business interest in India, can open a non-interest bearing Special Non-Resident Rupee Account (SNRR account) with a bank for bona fide transactions in rupees. The restriction on the tenure of SNRR account, which is currently 7 years, has also been removed. RBI has also modified norms regarding re-export of unsold rough diamonds from the special notified zone of Customs without export declaration form (EDF) formality. The RBI expanded the scope of Special Non-Resident Rupee Accounts (SNRR account) by permitting non-residents to open such accounts for rupee-denominated overseas borrowings, trade credit and trade invoicing for popularising cross-border transactions in the domestic currency. Any person resident outside India, having a business interest in India, can open a non-interest bearing Special Non-Resident Rupee Account (SNRR account) with a bank for bona fide transactions in rupees. The restriction on the tenure of SNRR account, which is currently 7 years, has also been removed. RBI has also modified norms regarding re-export of unsold rough diamonds from the special notified zone of Customs without export declaration form (EDF) formality. |

| Source: The Business Standard |

The Reserve Bank of India superseded the board of debt-laden Dewan Housing Finance Corporation Limited (DHFL) as it intends to shortly initiate the process of resolution of the company under the insolvency and bankruptcy rules. The company is all set to become India’s first financier to land up in bankruptcy courts. The central bank superseded the board “owing to governance concerns and defaults by DHFL in meeting various payment obligations. R Subramaniakumar, ex-MD and CEO of Indian Overseas Bank has been appointed as the administrator. The Reserve Bank of India superseded the board of debt-laden Dewan Housing Finance Corporation Limited (DHFL) as it intends to shortly initiate the process of resolution of the company under the insolvency and bankruptcy rules. The company is all set to become India’s first financier to land up in bankruptcy courts. The central bank superseded the board “owing to governance concerns and defaults by DHFL in meeting various payment obligations. R Subramaniakumar, ex-MD and CEO of Indian Overseas Bank has been appointed as the administrator. |

| Source: The Economic Times |

The National Council of Applied Economic Research (NCAER) has pegged India’s gross domestic product (GDP) growth for 2019-20 at 4.9% as against 6.8 % in 2018 (or FY-19). It lowers its outlook due to the slowdown in almost all sectors & it is primarily driven by a simultaneous deceleration of all the drivers of aggregate demand. The National Council of Applied Economic Research (NCAER) has pegged India’s gross domestic product (GDP) growth for 2019-20 at 4.9% as against 6.8 % in 2018 (or FY-19). It lowers its outlook due to the slowdown in almost all sectors & it is primarily driven by a simultaneous deceleration of all the drivers of aggregate demand. |

| Source: The Business Standard |

The Government of India has issued fresh rules under the Insolvency and Bankruptcy Code (IBC) to govern the rescue of non-bank lenders. The new rules are likely to help out distressed shadow banks and housing financiers, which have been battling a liquidity crunch for a year. These entities will be covered by a special window under the bankruptcy code, which will be notified from time to time. Reserve Bank of India has been given the authority to decide which companies will be taken up to a bankruptcy tribunal under these rules. The bankruptcy tribunal will appoint an administrator who will be nominated by the regulator, will try to stitch together a turnaround plan. In case a turnaround of the financial institution is not possible, the tribunal will gather the views of the regulator before deciding to liquidate it. The Government of India has issued fresh rules under the Insolvency and Bankruptcy Code (IBC) to govern the rescue of non-bank lenders. The new rules are likely to help out distressed shadow banks and housing financiers, which have been battling a liquidity crunch for a year. These entities will be covered by a special window under the bankruptcy code, which will be notified from time to time. Reserve Bank of India has been given the authority to decide which companies will be taken up to a bankruptcy tribunal under these rules. The bankruptcy tribunal will appoint an administrator who will be nominated by the regulator, will try to stitch together a turnaround plan. In case a turnaround of the financial institution is not possible, the tribunal will gather the views of the regulator before deciding to liquidate it. |

| Source: The Live Mint |

Moody’s Investors Service has slashed India’s economic growth forecast to 5.6% for the fiscal year 2019. It stated that the government measures do not address the widespread weakness in consumption demand, as a reason for lowering the growth forecast. It also stated that the economic activity in India will pick up in 2020 and 2021 to 6.6 % and 6.7 % respectively. Moody’s Investors Service has slashed India’s economic growth forecast to 5.6% for the fiscal year 2019. It stated that the government measures do not address the widespread weakness in consumption demand, as a reason for lowering the growth forecast. It also stated that the economic activity in India will pick up in 2020 and 2021 to 6.6 % and 6.7 % respectively. |

| Source: The Economic Times |

The American financial service company Moody’s has downgraded India’s economic outlook to “Negative” from “Stable”. This downgrade was due to slow growth in the economy. It also predicted that slow growth would be prolonged and would also have debt rises. Moody’s has also predicted a budget deficit of 3.7% of the Gross Domestic Product (GDP) in the year through March 2020, which is a breach in the govt’s target of 3.3%. This was due to corporate tax rate cuts, slow growth etc. The long term foreign currency bond and bank deposit ceilings were unchanged at Baa1 and Baa2(both being 2nd lowest investment-grade score), respectively. The American financial service company Moody’s has downgraded India’s economic outlook to “Negative” from “Stable”. This downgrade was due to slow growth in the economy. It also predicted that slow growth would be prolonged and would also have debt rises. Moody’s has also predicted a budget deficit of 3.7% of the Gross Domestic Product (GDP) in the year through March 2020, which is a breach in the govt’s target of 3.3%. This was due to corporate tax rate cuts, slow growth etc. The long term foreign currency bond and bank deposit ceilings were unchanged at Baa1 and Baa2(both being 2nd lowest investment-grade score), respectively. |

| Source: The Economic Times |

Finance Minister Nirmala Sitharaman unveiled two new IT Initiatives – ICEDASH and ATITHI for improved monitoring and pace of customs clearance of imported goods and facilitating arriving international passengers. ICEDASH is an Ease of Doing Business monitoring dashboard of the Indian Customs helping the public see the daily Customs clearance times of import cargo at various ports and airports. The ATITHI app will facilitate hassle-free and faster clearance by Customs at the airports and enhance the experience of international tourists and other visitors at the airports. Finance Minister Nirmala Sitharaman unveiled two new IT Initiatives – ICEDASH and ATITHI for improved monitoring and pace of customs clearance of imported goods and facilitating arriving international passengers. ICEDASH is an Ease of Doing Business monitoring dashboard of the Indian Customs helping the public see the daily Customs clearance times of import cargo at various ports and airports. The ATITHI app will facilitate hassle-free and faster clearance by Customs at the airports and enhance the experience of international tourists and other visitors at the airports. |

| Source: The News on AIR |

You need to login to perform this action.

You will be redirected in

3 sec