Forms Of Business Organisation (Notes)

Category : 11th Class

Forms of Business Organisation

Facts that Matter

- Business activities cannot be performed in isolation. They need to be given a proper form.

- A business enterprise is an institutional arrangement to perform any business activity.

- The most appropriate form is determined by weighing the merits and demerits of each type of organization against one's own requirement.

- The revolutionary new concept of "One Person Company' (OPC) has been introduced by the Companies Act, 2013.

- This concept of OPC was first recommended by the expert committee of Dr. JJ Irani in 2005

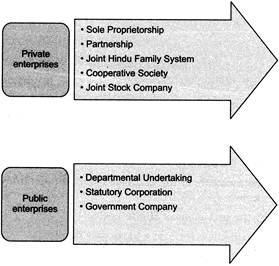

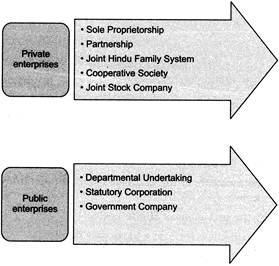

Classification

In case of corporate form of private enterprises the identity of the enterprise is a separate legal entity from that of the owner and in case of non-corporate form, the identity of the enterprise is not different from that of its owners.

Sole Proprietorship

Sole proprietorship refers to a form of business organization which is owned, managed and controlled by an individual who is the recipient of all profits and bearer of all risks.

Features of Sole Proprietorship

- It has easy formation and closure.

- It has unlimited liability.

- Owner is sole risk bearer and profit recipient.

- Owner has 100% control.

- There is no separate entity.

- There is lack of business continuity.

Merits of Sole Proprietorship

- It helps in quick decision making.

- It helps in confidentiality of information.

- It has direct incentive.

- It has sense of accomplishment.

- There is ease of formation and closure.

Limitations of Sole Proprietorship

- It has limited resources.

- It has limited life of a business concern.

- It has unlimited liability.

- It has limited managerial ability.

Suitability

Sole proprietorship is suitable in following cases:

- Where the personal attention to customer is required as in tailoring, and beauty parlour.

- Where goods are un-standardized like artistic jewellery.

- Where modest capital and limited managerial skills are required as in the case of a retail store.

JOINT HINDU FAMILY BUSINESS

- It is owned by the members of the undivided joint Hindu family and managed by the eldest member, known as KAETA.

- It is governed by the provisions of Hindu law.

- The basis of membership is birth in a particular family.

- There are two systems of JHF Business-

Ø Dayabhaga System: It is prevailing in West Bengal?both male and female members can become co - parceners.

Ø Mitaskshara System: It is prevailing all over India, except West Bengal. It allows only male members to become co - parceners.

Features

- Formation: For a Joint Hindu family business, there should be at least two members in the family and some ancestral property to be inherited by them.

- Membership: It is by virtue of birth in the family.

- Control: In it, control lies with the eldest member of the family known as "Karta". All other members can give only advice.

- Liability: Liability of Karta is unlimited but of all other members is limited to the extent of their share in property.

- Continuity: The business is not affected by the death or incapacity of Karta as in such cases the next senior male member becomes the Karta.

- Minor members: A minor can also become full-fledged member of Family business.

Merits

- Effective control: The Karta can promptly take decisions as he has the absolute decision making power.

- Continued business existence: The death, lunacy of Karta will not affect the business as next eldest members will then take up the position.

- Limited liability: The liability of all members except Karta is limited. It gives them a relief.

- Secrecy: Complete secrecy regarding business decisions can be maintained by Karta.

- Loyalty and co-operation: It helps in securing better co-operation and greater loyalty from all the members who run the business.

Limitations

- Limited capital: There is a shortage of capital as it is limited to the ancestral property.

- Unlimited liability of Karta: It makes him less enterprising.

- Dominance of Karta: Karta manages the business and sometimes he ignores the valuable advice of other members. This may cause conflict among members and may even lead to the breaking of the family unity.

- Hasty decisions: As Karta is overburdened with work. So sometimes he takes hasty and unbalanced decisions.

- Limited managerial skills: Limited managerial skills of Karta also poses a serious problem.

Partnership

- Partnership is a voluntary association of two or more persons who agree to carry on some business jointly and share its profits and losses.

- The partnership was evolved to overcome the shortcomings of sole proprietorship and Joint Hindu Family business.

- According to Indian Partnership Act, 1932, partnership is the relationship between persons who have agreed to share profit or loss of the business carried on by all or any one of them acting for all.

Features of Partnership

- Formation with an agreement between partners;

- Unlimited liability;

- Risk and profit bearing in an agreed ratio;

- Decision making and control by partners;

- Less stable (as partnership gets dissolved at death, retirement or insolvent);

- Minimum 2 partners and maximum 20 (10 in case of banking industry).

Merits of Partnership

- It has ease of formation and closure.

- It takes balanced decision.

- It has more funds.

- It allows sharing of risks.

- It helps maintain secrecy.

Limitations of Partnership

- It has unlimited liability.

- It has limited resources.

- It has a possibility of conflicts.

- There is a lack of continuity.

- There is a lack of public confidence.

Partnership Deed

It generally includes the following aspects:

- Name of the firm.

- Names of the partners.

- Location / Address of the firm.

- Duration of business.

- Investment made by each partner.

- Profit sharing ratio of the partners.

- Terms relating to salaries, drawing, interest on capital and interest in drawing of partners.

- Terms governing admission, retirement and expulsion of a partner.

- Duties and obligations of partners.

- Preparation of accounts and their auditing.

- Method of solving disputes.

Registration of Partnership

Registration is not compulsory, it is optional. But it is always beneficial to get the firm registered. The consequences of non-registration of a firm are as follows:

- A partner of an unregistered firm cannot file suit against the firm or other partner.

- The firm cannot file a suit against a third party.

- The firm cannot file a case against its partner.

COOPERATIVE SOCIETY

Cooperative society is a voluntary association of persons, who join together with the motive of the welfare of the members.

Features of Cooperative Society

- There is voluntary membership.

- There is a separate legal entity.

- There is limited liability.

- There is control of democratic pattern.

- It has service motive.

Merits of Cooperative Society

- There is equality in voting status.

- There is limited liability.

- It gives economy in operations.

- It has ease of formation.

- It gets support from government.

Limitations of Cooperative Society

- It has limited resources.

- There is inefficiency in management.

- There is lack of secrecy.

- There is government control.

- There is a difference of opinion.

Types of Cooperative Society

- Consumers Cooperative Society: It seeks to eliminate middleman by establishing a direct link with the producers. It purchases goods of daily consumption directly from manufacturer or wholesalers and sells them to the members at reasonable prices.

- Producers Cooperative Society: The main aim is to help small producers who cannot easily collect various items of production and face any problem in marketing. These societies purchase raw materials, tools, equipments and other items in large quantity and provide these things to their members at reasonable prices.

- Marketing Cooperative Society: It performs various marketing functions such as transportation, warehousing, packing, grading, marketing research, etc. for the benefit of its members. The production of different members is pooled together and sold by society at best price.

- Farmer's Cooperative Society: In such societies, small farmers join together and pool their resources for cultivating their land collectively. Such societies provide better quality seeds, fertilizers, machinery and other modern techniques for use in the cultivation of crops. It provides them opportunity of cultivating on a large scale.

- Credit Cooperative Society: Such societies protect the members from exploitation by money lenders. They provide loans, to their members at easy terms and reasonably low rates of interest.

- Cooperative Housing Society: The main aim is to provide houses to people with limited means / income at reasonable price.

Joint Stock Company

Joint Stock Company: A company is an association of persons formed for carrying out business activities and has a legal status independent of its members. It is governed by the Companies Act, 1956.

Features of Joint Stock Company

- There is limited liability.

- There is a transfer of interest.

- It has perpetual existence.

- There is scope of expansion.

- There is professional management.

Limitations of Joint Stock Company

- There is complexity information.

- There is lack of secrecy.

- There is an impersonal work environment.

- There are numerous regulations.

- There is delay in decision-making.

- It gives birth to oligarchic management.

- There is conflict in interests.

- One Person Company.

Formation of a Company

Formation of a company means bringing a company into existence and starting its business. The steps involved in the formation of a company are:

- Promotion;

- Incorporation;

- Capital Subscription;

- Commencement of Business: A private company has to undergo only first two steps, but a public company has to undergo all the four stages.

Promotion

Promotion means conceiving a business opportunity and taking an initiative to form a company,

1. Steps in the Promotion

- Identification of Business Opportunity: The first and foremost function of a promoter is to identify a business idea e.g. Produce a new product or service.

- Feasibility Studies: After identifying a business opportunity the promoters undertake detailed studies of technical, financial, economic feasibility of a business.

- Name Approval: After selecting the name of company, the promoters submit an application to the Registrar of Companies for its approval.

- Fixing up signatories to the Memorandum of Association: Promoters have to decide about the Director who will be signing the Memorandum of Association.

- Appointment of Professionals: Promoters appoint merchant bankers, auditors, etc.

- Preparation of Necessary Documents: The promoters prepare certain legal documents as Memorandum of Association, Articles of Association which have to be submitted to the Registrar of the Companies.

Incorporation

Incorporation means Registration of the Company as a body corporate under the Companies Act 1956 and receiving Certificate of Incorporation. Steps for Incorporation are as follows:

- Application for incorporation: Promoters make an application for the incorporation of the company to the Register of Companies.

- Filing of necessary documents: Promoters filing the following documents:

Ø Memorandum of Association;

Ø Articles of Association;

Ø Statement of Authorised Capital;

Ø Consent of Proposed Directors;

Ø Agreement with Proposed Director;

Ø Statutory declaration.

- Payment fees: Along with the filing of the above documents, registration fees have to be deposited which depends on the amount of the authorised capital.

- Registration: The Registrar verifies all the documents submitted. If he is satisfied, then he enters the name of the company in this Register.

- Certificate of Incorporation: After entering the name of the company in the register, the Registrar issues a 'Certificate of Incorporation'. This is called the Birth Certificate of the Company.

Capital Subscription

A Public Company can raise funds from the public by issuing shares and debentures. For this, it has to issue prospectus and undergo various other formalities:

Commencement of Business

To commence business a Public Company has to obtain a Certificate of Commencement of Business. For this the following documents have to be filled with the Register of Companies.

- A declaration that 90% of the issued amount has been subscribed.

- A declaration that all directors have paid in cash in respect of allotment of shares made to them.

- A statutory declaration that the above requirements have been completed and must be signed by the director of the company.

Important Documents Used in the Formation of a Company

I. Memorandum of Association

Memorandum of Association is the important document of a company. No company can be registered without a Memorandum of Association. It is called life giving document.

II. Articles of Association

Articles of Association are subsidiary to Memorandum of Association. It contains rules and regulations for working of the company.

III. Prospectus

Prospectus means any document which invites the public to purchase shares and debentures of the company. It contains past history, present status and future prospects of the company.

Choice of Form of Business Organisation

- Selection of line of business.

- Size of the firm.

- Choice of form of ownership.

- Location of business enterprise.

- Financing the proposition.

- Physical facilities.

- Plant layout.

- Competent and committed workforce.

- Tax planning.

- Launching the enterprise.

Words that Matter

- Sole Proprietorship: Sole proprietorship refers to a form of business organization which is owned, managed and controlled by an individual who is the recipient of all profits and bearer of all risks.

- Hindu Undivided Family Business: It refers to a form of organization wherein the business is owned and carried by the members of the Hindu Undivided Family (HUF).

- Karta: The business is controlled by the head of the family who is the eldest member and is called Karta.

- Co - parceners: All members have equal ownership right over the property of an ancestor and they are known as co - parceners.

- Partnership: Partnership is the relation between persons who have agreed to share the profit and loss of the business carried on by all or any one of them acting for all.

- Partnership Deed: Partnership deed is the written agreement, which specifies the terms and conditions that govern the partnership.

- Registration of a Partnership firm: Registration of a partnership firm means the entering of the firm's name, along with the relevant prescribed particulars, in the register of firms kept with the Registrar of firms.

- Unlimited liability: When owners are liable to repay debts even from their personal resources in case the business assets are not sufficient to meet its debts, it is called unlimited liability.

- Cooperative Society: Cooperative Society is a voluntary association of persons, who join together with the motive of the welfare of the members.

- Joint Stock Company: A company is an association of persons formed for carrying out business activities and has a legal status independent of its members.

- One Person Company: The concept of One Person Company in India was introduced through the Companies Act, 2013 to support entrepreneurs who on their own are capable of starting a venture by allowing them to create a single person economic entity.

- Promoter: Promoter is a person who conceives the idea of starting a business, examines the feasibility of an idea, assemble various resources, prepare necessary documents and perform other activities needed to commence the business.

- Memorandum of Association: It is the principal document of the company. It has been described as the "charter of the company' as it contains the power and objectives of the company, defines the scope of its operations and relations with the investors and the outside world.

- Articles of Association: The Articles of Association is a document containing the rules and regulations fc r the internal management of the company.

- SEBI: Securities and Exchange Board of India is the regulatory authority in the securities market to protect the interest of investors.

- Prospectus: Prospectus is a document inviting deposits or offers from the public for the subscription or purchase of shares or debentures of the company.