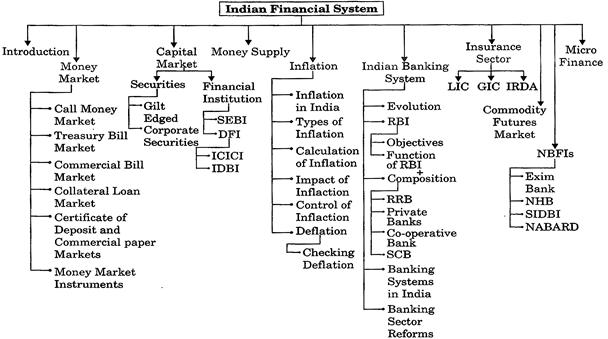

Money Supply and Indian Financial System

Category : UPSC

Money Supply and Indian Financial System

Introduction

A well-established financial system plays very important role in economic development of any country. A financial system consists of financial institutions, financial markets, financial instruments and financial services. This system provides a framework by which savings and surplus funds are mobilized in a productive manner. A financial system serves as a link between savers and investors. It promotes the capital formation by bringing together supply of savings and demand for funds.

This system provides detailed information about the players in the market such as individuals, corporate houses government agencies etc. It also provides a mechanism for controlling risks involved in managing savings and allocating funds. It covers the whole gamut of demand for and supply of funds for productive purposes. The financial system promotes economic development through mobilising savings and channelising these to investment avenues. The Indian financial system consists of both short term and long term finances. The organisation of the financial system comprises of three inter-related components, namely, financial intermediaries, financial markets and financial assets/instruments (securities).

MONEY MARKET

Money markets are those markets where borrowing and lending of short term funds (maturity 1 day to 1 year) takes place. Due to short maturity, the instruments of money market are liquid and can be converted to cash easily. Thus the money markets are able to address the need of the short term surplus fund of the lenders and short term borrowing requirements of the borrowers. The interest rates get determined in the money markets.

Therefore the money markets work as a mechanism whereby borrowers manage to obtain short term loan funds on the one hand, and lenders succeed in getting credit worthy borrowers for their money on the other. In this way, any institution or person who is willing to provide short-period monetary debt becomes a part of the money market.

Under Indian money market, the Reserve Bank of India occupies the central position because it regulates and controls the credit supply of the country.

The Indian money market is divided into two sectors:

1. The Unorganised sector.

2. The Organised sector.

Unorganised Sector

The Unorganised sector comprises of the unregulated non-bank financial intermediaries, indigenous bankers, and moneylenders.

Organised Sector

The organised sector includes the State Bank of India and

Its associated banks, 19 nationalised banks. Regional Rural Banks, Co-operative Banks, Non-governmental sectors and other banks.

Organised sector includes Reserve Bank of India, Private Banks, public sector banks, developmental banks and other non-banking financial companies (NBFCs) such as Life Insurance Corporation of India (LIC), Unit Trust of India (UTI), the International Finance Corporation, IDBI and the co-operative sector.

The organised money market in India is a conglomeration of markets of various instruments.

Money Market Instruments

1. Call Money Market

The most important component of organised money market is the call money market. It deals in call loans or call money granted for one day. Since the participants in the call money market are mostly banks, it is also called interbank call money market.

The banks with temporary deficit of funds form the demand side and the banks with temporary excess of funds form the supply side of the call money market.

The main features of Indian call money market are as follows:

(i) Call money market provides the institutional arrangement for making the temporary surplus of some banks available to other banks which are temporary in short of funds.

(ii) Mainly the banks participate in the call money market.

The State Bank of India is always on the lenders? side of the market.

(iii) The call money market operates through brokers who always keep in touch with banks and establish a link between the borrowing and lending banks.

(iv) The call money market is highly sensitive and competitive market. As such, it acts as the best indicator of the liquidity position of the organised money market.

(v) The rate of interest in the call money market is highly unstable. It quickly rises under the pressures of excess demand for funds and quickly falls under the pressures of excess supply of funds.

(vi) The call money market plays a vital role in removing the day-to-day fluctuations in the reserve position of the individual banks and improving the functioning of the banking system in the country.

2. Treasury Bill Market

The Treasury bill market deals in treasury bills which are the short-term (i.e. 91, 182 and 364 days) liability of the

Government of India. Theoretically, these bills are issued to meet the short-term financial requirements of the government. But, in reality, they have become a permanent source of funds to the government. Every year, a portion of treasury bills are converted into long-term bonds. Treasury bills are of two types:

(i) Ad hoc (ii) Regular

(i) Ad hoc: Ad hoc treasury bills are issued to the state governments, semi-government departments and foreign central banks. They are not sold to the banks and the general public, and are not marketable.

(ii) Regular: The regular treasury bills are sold to the banks and public and are freely marketable. Both types of adhos and regular treasury bills are sold by Reserve Bank of India on behalf of the Central Government.

The Treasury bill market in India is underdeveloped as compared to the Treasury bill markets in the U.S.A. and the U.K. In the U.S.A. and the U.K., the treasury bills are the most important money market instrument:

(a) Treasury bills provide a risk-free, profitable and highly

liquid investment outlet for short-term, investment of

surpluses of various financial institutions;

(b) Treasury bills from an important source of raising fund

for the government; and

(c) For the central bank the treasury bills are the main

instrument of open market operations.

On the contrary, the Indian Treasury bill market has no dealers except the Reserve Bank of India. Besides the Reserve Bank, some treasury bills are held by commercial banks, state government and semi-government bodies.

But, these treasury bills are not popular with the non-bank financial institutions, corporations, and individuals mainly because of absence of a developed Treasury bill market.

3. Commercial Bill Market

Commercial bill market deals in commercial bills issued by the firms engaged in business. These bills are generally of three months maturity. A commercial bill is a promise to pay specified amount in a specified period by the buyer of goods to the seller of the goods.

The seller, who has sold his goods on credit draws the bill and sends it to the buyer for acceptance. After the buyer or his bank writes the word ?accepte' on the bill, it becomes a markerable instrument and is sent to the seller.

The seller can now sell the bill (i.e. get it discounted) to his bank for cash. In times of financial crisis, the bank can sell the bills to other banks or get them rediscounted from the Reserve Bank.

In India, the bill market is undeveloped as compared to the same in advanced countries like the U.K. There is absence of specialised institutions like acceptance houses and discount houses, particularly dealing in acceptance and discounting business.

4, Collateral Loan Market

Collateral loan market deals with collateral loans i.e. loans backed by security. In the Indian collateral loan market, the commercial banks provide short- term loans against government securities, shares and debentures of the government, etc.

3. Certificate of Deposit and Commercial Paper Markets

With a view to further widening the range of money market instruments and giving investors greater flexibility in deployment of their short-term surplus funds. Certificates of Deposit (CDs) were introduced in India in 1989. CD is a negotiable money market instrument and issued in dematerialised form or as a Usance Promissory Note against funds deposited at a bank or other eligible financial institution for a specified time period commercial Paper (CP) was introduced in India in 1990 with a view to enabling highly rated corporate borrowers to diversity their sources of short-term borrowing and to provide an additional instrument to investors. It is an unsecured money market instrument issued in the form of a promissory note.

(* Source: Reserve Bank Of India).

6. Reforms

Chakravarthy Committee and Narasimhan Committee recommended certain money market instruments to reform Indian money market. Some of these are:

· 182 days treasury bills which are sold through fortnightly auctions. They carry attractive rates of interest and practically no risk and are therefore popular with commercial banks.

· 364 days treasury bills were also introduced in 1992.

· Dated government securities with maturities up to 10 years have also been introduced primarily to develop a secondary market.

· Money market mutual funds have been permitted to be floated by commercial banks.

· Repurchase options (repos) and reverse repos have been introduced in order to even out sharp fluctuations in the money market. Repos provide an opportunity for RBI to repurchase government securities from commercial banks. Reverse repos are government securities sold through auction at fixed cut-off rate of interest.

· Liquidity Adjustment Facility (LAP) refers to RBI's policy of using Repos and Reverse Repos to adjust liquidity on a day-to-day basis.

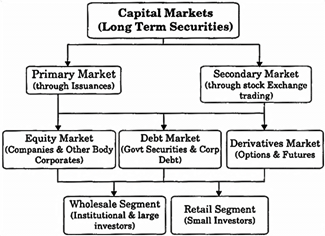

CAPITAL MARKET

The capital market is a place where people buy and sell securities. Securities in this sense is simply a bundle of rights sold to the public by companies, authorities or institutions on which people then trade in the capital market.

There are different types of securities or bundles of rights.

These include shares, debentures, bonds, etc.

There are two levels of the market

(1) Primary Market

(2) Secondary Market

In primary markets new stock and bond are issued and sold to investors. Secondary markets trade existing securities.

The primary market is the market where those wishing to raise funds from the stock market sell their securities to the public.

The secondary market is where those who bought the securities in the Initial Public Offer (IPO) can sell them anytime they wish.

The reason why people buy securities from the primary market is because they have the assurance that there is a secondary market where they can sell those shares possibly at a profit.

We can say, capital markets are markets for buying and selling equity and debt instruments. It channels savings and investment between suppliers of capital such as retail investors and institutional investors and users like businesses, government and individuals.

The difference between money market and capital market is not so much in the institutions so far as in the term of borrowing or lending. Long-term funds are raised either by borrowing from certain institutions or by issuing securities.

The main players in Indian capital markets are:

· Banks, indigenous and commercial.

· Insurance companies

· Development Finance Institutions (DPI),

· Non-Banking Finance Companies, (NBFCs)

· Non-Banking Financial Institutions.

Securities Market

The securities market is further divided into the gilt-edged market and the corporate securities market.

Gilt Edged Securities (G-sec)

Indian capital market consists of market for gilt-edged securities guaranteed by the government (Central or state). These securities are issued by local authorities (like city corporations, municipalities and port trusts) and autonomous government undertaking like the state electricity boards, development banks, etc. The RBI plays a dominant role in the gilt-edged market through its open market operations. Mostly financial institutions that have statutory obligations to keep a certain portion of their investments in government securities buy these. RBI trades in G-sec as part of its open market operations.

Corporate Securities

It refers to the stocks, shares, debentures, etc. of companies which are traded in stock market forming primary market. For inducing the public to invest their savings in new issues, services of specialised institutions (underwriters and stock brokers) are required. This kind of underwriting (guaranteeing purchase of a new issue at a fixed price) was non-existent in India until the establishment of the ICICI in 1955. Other institutions like the LIC, IDBI, UTI, IFCI and GIC, commercial banks, stock brokers and investment funds soon became the participants in the new issues market.

Secondary market, deals in securities already issued by companies. The main purpose of such a market is to provide liquidity (easy convertibility into cash) to such securities. After the reforms of 1991.

The Indian secondary market acquired a three tier form. This consists of:

Stock Exchange

A stock exchange is an organised market, i.e association of persons or firms to regulate and supervise all transactions, rules, regulations and standard practices to govern all market transactions, authorised stock brokers and an exchange floor where stock broker or their authorised agents meet during fixed business hours to buy and sell securities. The stock exchange is an institution for orderly buying and selling of listed securities. Listed securities are those that appear on the approved list of a stock exchange. (A particular security is listed or quoted when it is incorporated in the register of the stock exchange so that it can be bought / sold there.) There are 23 stock exchanges in the country out of which 20 (including Bombay Stock Exchange) are regional and two national.

NSE

The National Stock Exchange is the most modem and technology driven exchange. It was incorporated in 1992 and was recognized as a stock exchange in April 1993. It started operations in 1994 and grew rapidly to become India's biggest exchange. The NSE share index is known as Nifty. There is a 50 share index, S and P CNX 50 (Nifty fifty), S & P CNX 500 (500 share index). Nifty junior is the second-tier index of 50 stocks. The NSE became the first stock exchange in India to admit overseas shareholders.

NSE Launched electronic screen-based trading in 1994, derivatives trading and internet trading in 2000, which were the first of their kind in India.

BSE

Bombay Stock Exchange (BSE), India?s oldest stock exchange established in 1875 and was Asia's first Stock Exchange.

The BSE has four indices. Sensex or sensitive Index has 30 stocks. BSE-200 is a 200 stock share index (including the Sensex stocks). Dollex is its dollar version. BSE-500 is a 500-stock index which was developed in 1999 and represents several major industries, with special emphasis on IT sector. The National Index of 100 stocks quoted on a national level gives a wider representation of the stock market. It includes the Sensex stocks.

Over the Counter Exchange of India (OTCEI) was set up in 1989, but began to trade only in 1992. The OTCEI deals in securities that are not listed on a stock exchange. These unlisted securities are basically securities of small companies (with paid -up capital between 30 lakh and 25 crore) and have a limited market. Their prices are determined through direct negotiations between stock brokers and not by bidding as in stock exchanges. With the prevalence of screen-based trading, the relevance of regional stock exchanges has diminished.

ISE

Interconnected Stock Exchange of India (ISE) is a collaboration of India?s 15 regional stock exchanges (RSEs), and was set up in 1998. The RSEs were provided more power and reach through this. It is a web based exchange.

Indo Next is a new stock exchange, set up to promote liquidity to stocks of small and medium enterprises (SMEs) was launched in 2005 jointly by the BSE and FISE (Federation of Indian Stock Exchanges, representing 18 regional stock exchanges). It is better known as BSE Indo Next.

Approved Stock Exchanges in India

1. Bhvneshwar Stock Exchange, Bhuneshwar.

1. Calcutta Stock Exchange, Calcutta.

3. Cochin Stock Exchange, Cochin.

4. Delhi Stock Exchange, Delhi.

5. Guwahati Stock Exchange, Guwahati.

6. Hyderabad Stock Exchange, Hyderabad.

1. Jaipur Stock Exchange, Jaipur.

8. Canara Stock Exchange, Mangalore.

9. Ludhiana Stock Exchange, Ludhiana.

10. Chennai Stock Exchange, Chennai.

11. M. P. Stock Exchange, Indore.

12. Magadha Stock Exchange, Patna.

13. Pune Stock Exchange, Pime.

14. U.P. Stock Exchange, Kanpur.

15. Vadodara Stock Exchange, Vadodara.

16. Koyambtour Stock Exchange, Coimbatore.

17. Mer rut Stock Exchange, Meerut.

18. Mumbai Stock Exchange, Mumbai.

19. Over the Counter Exchange of India, Mumbai.

20. National Stock Exchange, Mumbai.

21. Ahmedabad Stock Exchange, Ahmedabad.

22. Bangalore Stock Exchange, Bangalore.

23. Capital Stock Exchange, Kerala Ltd., Thiruvananthapuram, Kerala

On July 9, 2007 SEBI has withdrawn its approval from Saurashtra Srock Exchange, Rajkot due to its passive working. Hence the number of approved stock exchanges has reduced to 23.

Securities and Exchange Board of India (SEBI)

The SEBI was set up in 1988 in place of the Controller of Capital Issue who was a functionary of the Ministry of Finance. It was made a statutory body in 1992. It is the main regulatory institution of the Indian capital market.

SEBI is managed by six members - one chairman (nominated by Central Government), two members (officers of central ministries) one member (from RBI) and remaining two members are nominated by Central Government. The office of SEBI is situated at Mumbai with its regional offices at Kolkata, Delhi and Chennai.

The SEBI is authorised to:

· oversee the working of stock exchanges?,

· regulate merchant banks and mutual funds;

· register and regulate intermediaries such as stock brokers;

· curb fraudulent and unfair trade practices including insider trading;

· promote the development of a healthy capital market.

Development Finance Institutions (DFIs)

The Industrial Finance Corporation of India (IFCI):

The IFCI was the first DPI to be established in 1948 under an Act of Parliament. It was originally a shareholders?

Corporation, but in 1993 it was converted into a company under the Companies Act. It grants loans and advances to industrial concerns, repayable normally within 25 years; guarantees loans raised by industrial units; subscribes to and underwrites the issue of stocks and shares by industrial concerns; and extends guarantees for deferred payments by importers. It was converted into a public limited company in 1993 to provide it more operational freedom.

Industrial Credit and Investment Corporation of India (ICICI):

The ICICI was established in 1955 for promoting and modernising industrial enterprises; encouraging private capital participation (both domestic and external) and help to develop capital markets. Its main aim was to give term loans in rupee and foreign exchange, underwrite issue of shares and debentures and directly subscribe to these issues. Among all the DFIs, ICICI had the most spectacular growth. In a ?reverse merger?, ICICI was merged with the ICICI Bank in March 2002 and became the first 'universal bank' in the country.

Industrial Development Bank of India (IDBI)

The IDBI was established under an Act of Parliament in

1964 for providing direct term finance to large industrial units and assisting small and medium units through banks and State Finance Corporations (SFCs). It was converted into a company by the 2003 Act and became a universal bank like ICICI through reverse merger with the IDBI Bank.

MONEY SUPPLY

The total stock of money in circulation among the public at particular point of time is called money supply. Money supply is die stock of liquid assets held by the public.

Which can he freely exchanged tor goods and services. The money supply includes notes and coins to bank deposit Ii includes ail economic units (households, firms and institutions) but excludes the producers or mono) (such as the government and the banking system as this is not in circulation). As it excludes tile money held by the government in its treasuries and the money with the banking system, money supply is bound to be smaller than the total stock of money in the country's economic system.

The four concepts of money used in calculating money supply are known as the money stock measures or measures of monetary aggregates. These are -

1. Ml \[\to \]Money with the Public (currency notes and coins) + Demand deposits of banks (on current and saving bank accounts) + other demand deposits with RBI. It is highly liquid and banks will not be able to run their lending programmers on this basis.

2. M2 \[\to \] Ml + saving bank deposits with Post-offices.

3. M3 \[\to \]Ml + Term deposits with the bank.

4. M4 \[\to \]M3 + All deposits of Post-offices.

\[{{M}_{1}}\]Measure represents the most liquid form of money among four money stock measures adopted by RBI. As we move from \[{{M}_{1}}\]to\[{{M}_{4}}\], the liquidity gets reduced. In other words, \[{{M}_{4}}\]possesses the lowest liquidity among all these measures.

The reduction in liquidity indicates the shifting from ?medium of exchange? to ?store of value?. All these four money stock measures are not of equal importance. Their relative importance varies from the point of view of monetary policy Generally, in developed countries, the bank deposits are the most important component in money supply, while due to less banking habits in under-developed countries people want to keep their money in the most liquid form i.e., currency.

M3 and M4 are generally termed as ?Broad money?. Ml and M2 are known as Narrow Money.

In economics, the money supply or money stock is the total amount of monetary assets available in an economy at a specific time. There are several ways to define ?money? but standard measures usually include currency in circulation and demand deposits.

Money supply data are usually recorded and published by the government or the central bank of the country. Public and private sector analyst have long monitored changes in money supply because of its possible effect on the price level inflation, exchange rate and the business cycle.

INFLATION

Inflation is an increase in price of goods. It can be seen as a devaluation of the worth of money. A crucial feature of inflation is that price rises are sustained. Once only increase in the rate of, say, value-added tax, will immediately put up prices, but this does not represent inflation, unless the indirect effects of the VAT rise have repercussions of prices in periods after the direct effects.

There are many causes of inflation. The most popular arguments are that it is caused by excess demand in the economy (demand- pull inflation), that it is caused by high costs (cost-push inflation) and that it results from excessive increases in the money supply (monetarism). Inflation affects all segments of the economy.

It hurts persons having fixed incomes, as they can purchase less number of goods in the same amount of money. It affects those like retired persons who depend on interest income on their savings. It upsets macro-economic decision making, as the uncertainty regarding future costs can affect projections.

It may appear that inflation benefits borrowers, as it leads to a fall in the real cost of capital. But this is only a temporary phase and the interest rate is bound to go up to compensate for the inflation.

Inflation in India

In India inflation is a structural as well as a monetary phenomenon. In the short term, localised demand-supply imbalances in wage goods, often due to seasonal variations in production- coupled with market rigidities and regulatory failures have supported inflation that have resulted in a more widespread impact on the consumers than the initial inflationary impulse. In the medium to long-term, the movement and outcome of monetary aggregates such as the money supply and interest rates of the financial systems have influenced aggregate demand and consequently changes in price levels in the economy. The latter considerations and the influence of global commodity prices on the domestic prices have become more important with the opening and growing integration of the Indian economy with the rest of the world.

Types of Inflation

1. Demand Pull Inflation occurs when excessive demand for commodities increases their prices. This is the conventional inflationary situation of ?too much money chasing too few goods?. The main demand-pull factors in India are:

(i) Mounting government expenditure

(ii) Deficit financing and increase in money supply

(iii) Role of black money

(iv) Rapid population growth.

2. Cost Push Inflation occurs when wages and other costs rise and the producers are successful in passing on the higher costs to the consumers in the shape of higher prices. The main cost -push factors in India are:

(i) Fluctuations in output and supply in both agriculture and industry sectors. Fluctuations in output of food grains have been a major factor responsible for rise in food-grain prices as well as general price. In the same way, the supply of manufactured goods also did not increase adequately in last few years. Power breakdowns, strikes and lock-outs and shortage of transport facilities have been the major constraints responsible for lowering production of manufactured goods. With ever-rising demand for manufactured goods, the producers are in a position to hike the prices of their products

(ii) Problem of hoarding by traders and black marketers.

(iii) Taxation which gives the traders an opportunity to raise the prices of goods, the proportion of which is often more than the levy of taxes.

(iv) Administered Prices.

(v) Hike in Oil Prices.

3. Stagflation is a situation when high rates of inflation coexist with high rate of unemployment (a combination or stagnation and inflation).

4. Hyperinflation refers to a situation of runaway inflation reaching even up to 100 percent per annum. It also refers to rapid inflation in which prices increase so fast that money loses its importance as a medium of exchange.

Calculation of Inflation

Changes in price level are measured by the following:

· Wholesale Price Index

· Consumer Price Index

· Gross Domestic Product (GDP) Deflator

The Wholesale Price Index (WPI) is a weighted average of indices covering 676 commodities, which are traded in primary, manufacturing and fuel and power-sectors. WPI is thus a measure of inflation on an economy-wide scale.

Services do not figure in this, as there is usually no wholesale price for services. The weightage for primary articles is only 20.12%. A revised WPI with 2004-05 as the base year has been adopted. Earlier WPI was released weekly with a lag of two weeks. However in 2012 the government discontinued the weekly release of WPI data. Now WPI data is released only on monthly basis. Earlier WPI was used for continuous monitoring of prices for policy making. But, in 2014 RBI adopted the new Consumer Price Index (CPI) (combined) as the key measure of inflation.

|

WPI: (676 :items) |

Weightage |

|

Total |

100 |

|

Primary Articles |

20.12

|

|

Food Articles |

14.34 |

|

Non-Food and Minerals |

5.78 |

|

Manufactured Products |

64.97 |

|

Food Products |

9.97 |

|

Non-Food and Products |

55 |

|

Fuel and Power |

14.91 |

Consumer Price Index (CPI) is the retail price average of a basket of goods and services directly consumed by the people.

It is computed separately for the following three groups:

(i) Industrial workers - 260 commodities.

(ii) Urban Non-Manual Employees-180 commodities.

(iii) Agricultural labourers - 60 commodities.

These indices, however, did not cover all the segments of the population and thus, did not reflect the correct picture of the price behavior of the whole country.

A result, there was a strong need for compiling a CPI for entire urban and rural population of the country to measure the inflation in Indian economy based on CPI. Thus, in 2012 Central Statistics Office (CSO) of the Ministry of Statistics and programmer Implementation started compiling a new series of CPI:

(a) CPI tor the entire urban population viz CPI (Urban); 437 commodities.

(b) CPI tor the entire rural population viz CPI (Rural) 450 commodities.

(c) Consolidated CPI for Urban + Rural will also be compiled based on above two CPIs

These reflect the changes in the price level of various goods and services consumed by the Urban and rural population.

These new indices are now compiled at State / UT and all

India levels.

The CPI inflation series is wider in scope than the one based on die wholesale price index (WPI), as it has both rural and urban figures, besides state-wise data. The new series, with 2010 as [he base year, also includes services, which is not the case with the WPI series.

In January 2015 the base year of the All India CPI was again changed from 2010: (100) to 2012: (100). The weights of the sub-components within the new CPI basket is based on the Consumer Expenditure Survery (CES) of 2011-12. Number of items has been increased from 437 to 448 in the rural basket and from 450 to 460 in the urban basket.

In January 2015 the base year of the All India CPI was again changed from 2010 (100) to 2012 (100), The weights of the sub-components within the new CPI basket is based on the Consumer Expenditure Survey (CES) of 2011-12. Number of items has been increased from 437 to 448 in the rural basket and from 450 to 460 in the urban basket.

A comparison of this new series with WPI is given below:

|

CPI : Sub Groups |

Weightage |

|

Food and Beverages |

54.18 |

|

Pan, Tobacco and Intoxicants |

3.26

|

|

Clothing and Footwear |

7.36 |

|

Fuel and Light |

7.94 |

|

Miscellaneous |

27.26 |

|

Total |

100 |

Currently the consumer price Indices released at national level are -

· CPI for Industrial worker (IW)

· CPI for Agricultural Labour (AL)/Rural Labour (RL)

· CPI (Rural/Urban/Combined)

First two are compiled and released by the Labour Bureau and the third by the CSO.

GDP deflator, which distinguishes between physical growth in output and price rise, and gives an accurate picture of the over-all price level.

The GDP Deflator is arrived at by dividing GDP at current prices by GDP at constant prices in terms of base year prices (2011-12 in India). This indicates as to how much of the growth in GDP in a year is due to price rise and how much due to increase in output. Earlier GDP Deflator was available only annually with a long lag of over one year and hence had very limited use for the conduct of policy. That has changed recently and the GDP Deflator is now available quarterly.

Theoretically, the growth in physical output in an economy has to be matched by a corresponding growth in monetary flows.

Any mismatch between the two gets reflected in the growth rate and price changes, monetary policy aims at managing the balance between growth in. real flows and growth in monetary flows.

Causes of Inflation

The inflation occurs due to two main factors:

(a) Increase in demand for goods and services.

(b) Decrease in the supply of goods & services.

(a) Factors causing an Increase in demand for goods & services:

(i) Increase in public expenditure

(ii) Increase in private expenditure

(iii) Increase in exports

(iv) Reduction in taxation

(v) Rapid growth of population

(vi) Black money

(vii) Deficit financing

(viii) Cheap money policy

(ix) Increase in consumer spending

(x) Department of Tax internal debts.

(b) Factors causing Decrease in supply of goods and services:

(i) Shortage of supplies of factors

(ii) Industrial disputes

(iii) Natural calamities

(iv) Loop-sided Production

(v) Hoarding by consumers

(vi) Hoarding by traders

(vii) Operation of Law of Diminishing Returns.

Impact of Inflation

1. Inflation is the most regressive form of situation as it affects the poor and vulnerable sections of the society the most. Such a situation leads to increasing income disparities.

2. Inflation dampens exports by making our products expensive and, conversely, makes imports attractive.

Such a situation may warrant formal or informal devaluation of the currency in order to make our exports competitive.

3. Inflation leads to recession, as people with fixed incomes set apart an increasing share of their income to meet the growing costs of essential commodities, leaving very little for expenditure on non-essential items. The roduction of such items has to be reduced, leading to shutdowns and recession.

Policy Measure to Control Inflation

The issue of inflation is addressed from both demand and supply sides. Demand management implies putting a check on the demand of the public for goods and services. Demand management is achieved by measures such as postponing public expenditure, reducing excess liquidity either through taxes or saving schemes and restrictions on ad hoc treasury bills. While such measures help contain the money supply, there is a danger that these will contract the economy and lead to an increase in unemployment. Rationalisation of excise and import duties of essential commodities leads to higher burden on poor.

RBI assists in controlling inflation through monetary measures such as quantitative and selective credit controls and by manipulating the Cash Reserve Ratio (CRR) and the Statutory Liquidity Ratio (SLR). These are the monetary policies adopted by government.

On the supply side, the mechanism of Public Distribution

System (PDS) ensures availability of essential commodities for the vulnerable sections of society. This helps maintain price levels. Fixation of maximum prices helps to eliminate the incentive for hoarding and speculative activity in food-grains. Control over private trade in food-grains and adoption of Open General Licence (OGL) to ease the imports of sugar, pulses, etc., in case of shortages are also some of the common measures undertaken. Coupled with this is the open market sale of rice and wheat resorted to by FCI from its buffer stock in times of price rise.

Inflation and Price Control in the Post-reform Period

One of the major achievements of economic reforms of 1991 was the removal of restrictions on production and prices. The direction was to move from a regulated to a market-related environment. Contrary to expectations, the removal of restrictions did not lead to a spurt in prices. However, inflationary pressure remained moderately high caused, paradoxically, by the very success of the reform process, which brought in large foreign investment leading an increase in money supply. Foreign inflows need to be ?sterillised? by the RBI by withdrawing from circulation an equivalent amount of rupee either through open market operation or through regulating bank credit. At the same time, it was important to maintain the correct exchange rate for the rupee so that its appreciation does not make our exports uncompetitive. Following are some of the fiscal policies adopted by government:

· Release of buffer stock of food grains to maintain the price level.

· Import of some essential commodities like edible oils.

· Strict fiscal and monetary discipline:

· Compensating farmers for the loss on account of withdreawal offertilizer subsidy, through upward revision of procurement prices.

· To maintain price stability, the Central Issue Price for rice and wheat has not been revised soncejuly 2002. There has been a continuous reduction in the import duty on edible oils.

Public Goods, Merit Goods and Subsidies

Subsidies are a major burden on the national budget. There are inevitable leakages in subsidies and much of it does not reach the intended beneficiaries. In many cases, the benefits are taken by the undeserving. Most of our agricultural and food subsidies suffer from this drawback. In order to assist proper targeting of subsidies, goods are classified into three categories:

(i) Public goods: It includes national defence, police, general administration, etc. These services are available to all and the enjoyment by one is not at the expense of another. No price can be put on these services.

(ii) Merit goods: It includes primary education, immunisation, public health programmer, etc. Not only individual beneficiary but society at large benefits by making these goods available.

Providing subsidy for these goods is essential.

(iii) Non-merit goods: In non-merit goods the benefit goes directly to the individual while the costs are borne by the society. Pollution caused by automobile emission is an example of non-merit goods.

Deflation

?Deflation is that state in which the value of money rises and the price of goods and services falls.?

The state of deflation may appear in the economy due to following reasons-

(i) When the Government withdraws money from

circulation.

(ii) When Government imposes heavy direct taxes or fakes heavy loans from the public (voluntary or compulsory or both).

(iii) When the Central Bank sells the securities in open market (which reduces the quantity of money in circulation).

(iv) When Central Bank controls the credit money and adopts various measures such as increase in CRR, credit rationing and direct action.

(v) When the Central Bank increases the Bank rate (which curtails the quantity of credit in the economy).

(vi) When state of over-production (excess supply over demand) takes place in the economy.

Measures of Checking Deflation

(i) Increasing money supply.

(ii) Promote credit creation by the banks.

(iii) Curtailment in taxes so as to increase the purchasing power of the people.

(iv) Increasing the public expenditure and the employment opportunities in the economy.

(v) Increasing the money supply in circulation by repayment of old public debts.

(vi) Providing of economic subsidy by the Government to the industrial sector of the economy.

INDIAN BANKING

Reserve Bank of India was nationalised on January 1,1949. For the co-ordinated regulation of Indian banking, the Indian Banking Act was passed in March 1949. By Act. The Reserve Bank of India was granted extended powers for the inspection of non-scheduled banks. For extending banking facilities in the rural areas the Imperial Bank of Indian was partially nationalised on July 1, 1955 and it was named as the State Bank of India. Along with SBI other 8 (at present 7) banks were converted as its associate banks which form what is named as the State Bank Group. They are as follows-

1. The State Bank of Bikaner and Jaipur (In the beginning the State Bank of Bikaner and the State Bank of Jaipur were separate. But they were merged and named as (lie State Bank of Bikaner and Jaipur).

2. The State Bank of Hyderabad

3. The State Bank of Indore

4. The State Bank of Mysore

5. The State Bank of Saurashtra

6. The State Bank of Patiala

7. The State Bank of Travancore

In order to have more control over the banks, 14 large commercial banks, whose reserves were more than 50 crores each were nationalised on 19th July, 1969. The nationalised hanks are as follows:

1. The Central Bank of India

2. Bank of India

3. Punjab National Bank

4. Canara Bank

5. United Commercial Bank

6. Syndicate Bank

7. Bank of Baroda

8. United Bank of India

9. Union Bank of India

10. Dena Bank

11. Allahabad Bank

12. Indian Bank

13. Indian Overseas Bank

14. Bank of Maharashtra

After one decade, on April 15, 1980, those 6 private sector banks whose reserves were more than 200 crores each were nationalised. These banks are as:

1. Andhra Bank

2. Punjab and Sindh Bank

3. New Bank of India

4. Vijaya Bank

5. Corporation Bank

6. Oriental Bank of Commerce

On 4th September, 1993 the Government merged the New Bank of India with Punjab National Bank and as a result of this the total number of nationalised bank got reduced from 20 to 19.

In 2008, state Bank of Saurashtra was merged with SBI. In 2010 State Bank of Indore was merged with SBI. In 2017 the process of merging of the rest of the five associate banks with SBI has been started. This merger is expected to be completed by the end of 2017-18.

With the change of the Indian economy to a higher growth trajectory, the provision of adequate and timely availability of bank credit to the productive sectors of the economy has acquired importance. As public sector banks still own about 71 % of the assets of the banking system, they continue to play an important role in responding to the changes in the economic environment. As the banking regulator and supervisor and as the monetary policy authority, the Reserve Bank of India (RBI) continues to guide the banking system, including foreign, private sector and public sector banks, to meet emerging economic challenges.

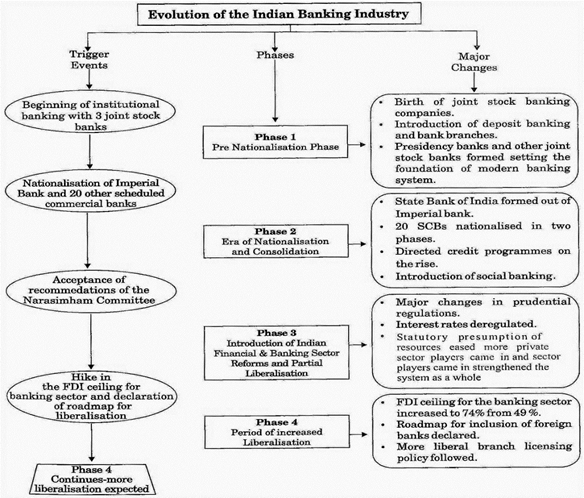

As certain rigidities and weaknesses were found to have developed in the banking system during the late eighties, the Government felt that these had to be addressed to enable the financial system to play its role in ushering in a more efficient and competitive economy. Accordingly, a high-level Committee under the Chairmanship of Shri M. Narasimham on the Financial System (CFS), was set up on August 14, 1991 to examine all aspects relating to the structure, organisation, functions and procedures of the financial systems. Based on the recommendations of the Committee a comprehensive reform of the banking system was introduced in 1992-93.

Another high-level Committee, under the Chairmanship of Shri M. Narasimham was constituted by the Government of India in December 1997 to review the record of implementation of financial system reforms recommended by the CFS in 1991 and chart the reforms necessary in the years ahead. The Committee submitted its report to the Government in April 1998.

Reserve Bank of India (RBI)

It is the Central Bank of the country. The Reserve Bank of India was established in 1935 with a capital of 5 crore.

This capital of 5 crore was divided into 5 lakh equity shares of 100 each. In the beginning the ownership of almost all the share capital was with the non-government shareholders.

In order to prevent the centralisation of the equity shares in the hands of a few people, the Reserve Bank of India was nationalised on January 1, 1949.

The general administration and direction of RBI is managed by a Central Board of Directors consisting of 20 members which includes 1 Governor, 4 Deputy Governors, 1 Government official appointed by the Union Government of India to give representation to important stratas in economic life of the country. Besides, 4 directors are nominated by the Union Government to represent local boards. Apart from the central board there are 4 local boards also and their head offices are situated in Mumbai, Chennai, Kolkata and New Delhi. 5 members of local boards are appointed by the Union Government for a period of 4 years. The local boards work according to the instructions and orders given by the Central Board of Directors, and from time to time they also tender useful advice on important matter. The head office of Reserve Bank of India is in Mumbai. At present, Dr. Urjit R. Patel is the Governor of Reserve Bank of India.

Objectives of RBI

· The objectives of the RBI is to regulate the issue of bank notes and keeping of reserves with a view of securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.

· The formulation, framework and institutional architecture of monetary policy in India have evolved around these objectives - maintaining price stability, ensuring adequate flow of credit to sustain growth momentum and securing financial stability.

· The responsibility for ensuring financial stability has involved the vesting of extensive power in and operational objectives for the RBI for regulation and supervision of financial system and its constituents, the money, debt and foreign exchange segments of the financial markets in India and the payment and settlement system.

Functions of Reserve Bank

1. Issue of Notes

The Reserve Bank has the monopoly over issuing of notes in the country. It has the sole right to issue currency notes of various denominations except one rupee note. The Reserve Bank acts as the only source of legal tender of money because even the one rupee notes issued by Ministry? of Finance are circulated through it.

The Reserve Bank has adopted the Minimum Reserve System for the note issue. Since 1957, it maintains gold and foreign exchange reserves of 200 crores, of which at least 115 crores should be in gold.

2. Banker to the Government

The second important function of the Reserve Bank is to act as the Banker, Agent and Adviser to the Government.

It performs all the banking functions of the State and Central Government and it also tenders useful advice to the Government on matters related to economic and monetary policy. It also manages the public debt for the Government. The RBI also channelises bank credit in favors of priority sectors. RBI has thus developed institutions like IDBI, SIDBI, NABARD, NHB, etc.

The RBI also promotes cooperative banking and the bill market.

3. Banker's Bank

The Reserve Bank performs the same function for other banks as these banks ordinarily perform for their customer. It regulates, penalizes and helps banks as and when needed.

4. Controller of Credit

The Reserve Bank undertakes the responsibility of controlling credit created by the commercial banks.

To achieve this objective it makes extensive use of quantitative and qualitative techniques to control and regulate the credit effectively in the country.

5. Custodian of Foreign Reserves

For the purpose of keeping the foreign exchange rates stable, the Reserve Bank buys and sells foreign currencies and also protects the country's foreign exchange funds.

6. Other Functions

The bank performs a number of other developmental works. These works include the function of being a clearing house, arranging credit for agriculture (which has been transferred to NABARD), collecting and publishing the economic data, (weekly, monthly and annual reports are published by the RBI in the field of the country's currency and finance status), buying and selling of Government securities and trade bills, giving loans to the Government, buying and selling of valuable commodities, etc. It also acts as the representative of Government in I.M.F. and represents the membership of India.

As mentioned above, RBI also acts as Controller of Credit, and in this role makes extensive use of quantitative and qualitative techniques.

[See in detail in Chapter 3 under heading Indian Monetary Policy]

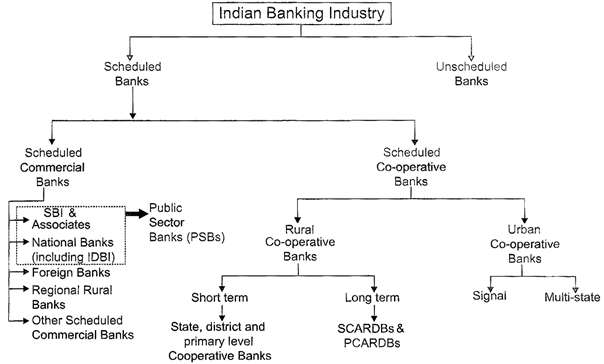

Composition of Banking System in India

The Indian banking system consists of commercial banks both in public and private sector. Regional Rural Banks (RRBs) and co-operative banks.

Regional Rural Banks (RRBs)

RRBs were set up with the objective of developing the rural economy by providing credit and encouraging other productive activities in the rural areas RRBs were first established in 1975.

Public sector banks sponsor RRBs, subscribing to the share capital. The RRBs meet the credit needs of the weaker sections-small and marginal farmers, artisans, small entrepreneurs, etc.

The RRBs accumulated huge losses and fared badly in their recovery of loans; the government allowed them to grant loans to non-priority sectors as well so as to improve their financial position.

Private Sector Banks

These banks in India are of two kinds- Indian and foreign.

The Indian private sector banks are those which have been incorporated in India and so have their head offices in India.

Foreign banks, on the other hand, have been incorporated in foreign countries and have their head offices outside India.

Co-operative Banks

These banks are so called because they have been organised under the provisions of the co-operative society?s law of the states.

State co-operative Banks (SCB): In terms of organisational set-up of the co-operative banking system, the state co- operative bank (SCB) in each state (co-operation being a state subject) are at the apex level; at the district level are the central co-operative banks (CCBs); and at the village level, there are primary agricultural credit societies (PACS).

Scheduled and Non-Scheduled Banks

The Reserve Bank of India has divided the banks as scheduled and non-scheduled banks. The scheduled banks are those which have a paid-up capital and reserves of an aggregate value of not less than Rs 5 lakh. All commercial banks-Indian and foreign, RRBs and state co-operative banks are scheduled banks. The non-scheduled banks are those which have not been included in the Second Schedule of the RBI Act, 1934. While in 1960-61, there were 256 non-scheduled banks, most have been now amalgamated with bigger banks.

Narsimhan Committee on Banking Sector Reforms:

The major recommendations of the committee are as follows:

· Banks should be free to open or close a branch, except in rural areas, where banking cannot depend on a bank?s choice. Also, there should be no further branch expansions.

· Nationalisation of banks should not take place any more.

· Private and foreign banks should be set up to promote competition.

? There should be a phased reduction of CRR and SLR Speedy computerization of banks.

? Setting up of special 'debt recovery tribunals'.

· Setting up of Asset Reconstruction of companies for non-performing assets (NPAs).

? A board for financial supervision should be set up.

· Banks should adopt provisioning norms to keep provisions against bad loans in their books.

· Banks should classify their assets into four categories, namely-standard, sub-standard, doubtful and loss.

· Banks should conform to BASEL norms and have a capital adequacy ratio (CAR) of 8% by 1998.

· Priority sector lending should be brought down from 40% to 10%.

· There should be a four-tier banking structure (international, national, regional and local).

Non-performing assets:

As per recommendations of the Narasimham Committee, it has been decided that credit facilities granted by banks will be classified into performing and non-performing assets (NPA).

NPA is a loan (whether term loan, cash credit, overdraft, or bills discounted), which is in default for more than six months.

In case of such assets, the income should be shown only

On receipt and not in the bank?s book on a due basis.

Urjit Patel Committee to Strengthen the Monetary Policy Framework

An expert committee headed by Urjit R. Patel, Deputy Governor of the RBI, was appointed on 12 September, 2013 to revise and strengthen the monetary policy framework. The main objective of the Committee was to recommend what needs to be done to revise and strengthen the current monetary policy framework with a view to making it transparent and predictable.

The group submitted its report in January, 2014 and inter-alia, made the following recommendations with regard to managing inflation in the country:

1. CPI (combined) should be used as the nominal anchor for a flexible inflation targeting (FIT) framework. The choice of CPI as nominal anchor was mainly on account of the fact that the CPI closely reflects cost of living and has larger influences on inflationary expectations than other anchors.

2. Target rate of inflation should be 4% with a tolerance band of 2% to be achieved in a two-year time frame.

3. The transition path to the target zone should be graduated to bring down inflation from the current level of around 10% to 8% over a period not exceeding 12 months and to 6% over a period not exceeding the next 24 months.

4. Administered prices and interest rates should be eliminated as they act as impediments to monetary policy transmission and achievement of price stability.

Payment Banks and Small Finance Banks

Payments Banks

The primary objective of payments banks, as stated by RBI before, will be to focus on domestic payments services.

According to the guidelines, payments banks can open small saving accounts and accept deposits of up to Rs.1 lakh per individual customer and provide remittance services. Hence, the balance at the close of business on any day should not exceed Rs.1 lakh per customer. RBI clarified again that payments banks can't accept fixed deposits (FDs), term deposits, recurring deposits (RDs) and any non-resident Indian deposits. However, this means that customers will now have more locker services options via payments banks.

The banks will have to provide normal banking services including accepting deposits repayable on demand or otherwise, and withdrawal by cheque, draft or order, except lending. This means, customers need to be given cheque book and passbooks.

Payments banks can issue debit cards with Visa, Master Card or Rupay, and are allowed to set up their own ATMs (automated teller machines). RBI stated that the current norms of free ATM transactions will be applicable to these banks as well.

Payments banks are eligible to become members of clearing houses and electronic clearing services, so that they can provide consumers the ease of transferring money. They will also be allowed to connect to the national unified unstructured supplementary service data platform of the National Payments Corporation of India. This simply means that customers of payments banks can avail mobile banking services.

Know-your-customer (KYC) norms will be as per the KYC guidelines applicable to other scheduled commercial banks.

These banks are allowed to appoint business correspondents who can facilitate activities such as loan sourcing for some other banks in addition to performing payment related activities for the payments banks. They can sell credit products, mutual fund schemes, insurance and trading products to customers on behalf of other banks and can recruit kirana stores across the country as business correspondent agents to promote their services.

The payments banks can undertake other non-risk sharing, simple financial services activities or non-risk government services- such as Aadhaar enrolment-that doesn't require and commitment of their own funds.

Small Finance Banks

Small finance banks will be allowed to take deposits as well as lend money, and their focus will be on small lending,

One of the concerns raised was that since the new banks will have to use the words -small finance banks' in its name it will be a major challenge with regards to brand awareness and brand equity compared with existing banks. It is a worry that it will take a long time for these banks to build a good level of retail deposits and depositors would assume that since these are ?small? banks, they might not be as safe as 'larger' banks. RBI, however, reiterated that the words 'small finance bank' has to be in the bank's name.

In terms of products, these banks can offer payment or remittance products as well as access to ATMs and point-of-sale terminals.

RBI also stated that the operations of the bank should be technology-driven right from the beginning, conforming to generally accepted standards and norms. The banks are being encouraged to have new approaches for data storage, security, ?real time data update and so on, A detailed technology plan for the same has to be given to RBI. Expect innovation with the help of technology from these banks.

INSURANCE SECTOR

Insurance

It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss.

Insurance policy

It is a financial contract between the insurer & the policy holder where the details of the policy is mentioned including [he benefits & the premium that policy holder has to pay.

Premium

It is the periodic payment made on an insurance policy.

Insurance premiums are collected in monthly or quarterly or half-yearly or yearly mode.

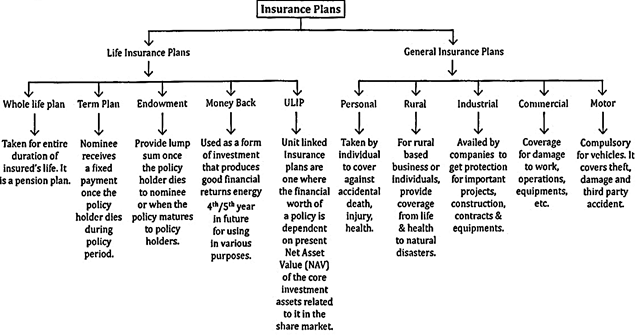

Major Types of Insurance:

(a) Life Insurance: Descendent?s family receives financial benefits.

(b) Automobile Insurance: Protects policy holder against financial loss in the event of an incident involving a vehicle they own.

(c) Health Insurance: Covers the expenditures associated to treatment & medical expenditures.

(d) Property Insurance: Provides protection from risks associated to theft, fire, floods, etc.

· Insurance Industry in India

The Indian Government passed an ordinance on January 19. 1956 whereby the life insurance sector was nationalized & the Life Insurance Corporation of India (LIC) came into existence. The Indian Parliament passed the General Insurance Business (Nationalisation) Act in 1972 & the general insurance sector was brought under governmental control from January 1, 1973.Life

Life Insurance Corporation of India (LIC)

The LIC was established on first of September 1956 after nationalising the existing private insurance companies. LIC has a strong social security scheme which is funded by me Social Security Fund (SSF) set up and administrated by it since 1989-90. The LIC runs three schemes supported by SSF - Janashree Binia Yojana, Krishi Shramik Samajik Suraksha Yojana and Sluksha Sahayog Yojana. These schemes benefit persons and families below the poverty line.

General Insurance Corporation of India (GIC)

The GIC was formed in November 1972 upon the nationalisation general insurance business. The 107 private companies operating in the field were grouped together into four:

(i) National Insurance Company

(ii) United India Insurance Company

(iii) Oriental Insurance Company

(iv) New India Assurance Company

With GIC as the holding company. These companies can compete among themselves for all types of general insurance except aviation insurance and crop insurance which are the monopoly of GIC.

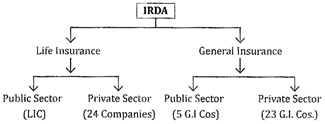

IRDA

Insurance Regulatory and Development Authority of India

(IRDAI) is an autonomous apex statutory body which regulates and develops the insurance industry in India. It was constituted by a Parliament of India act called Insurance Regulatory and Development Authority Act, 1999 and duly passed by the Government of India.

The agency operates from its headquarter at Hyderabad,

Telangana, shifted from Delhi in 2001.

The key objectives of the IRDA include promotion of competition so as to enhance customer satisfaction through increased consumer choice and lower premiums, while ensuring the financial security of the insurance market.

Some of the functions of the authority include:

· To protect the interest of and secure fair treatment to policy holders.

· To bring about speedy and orderly growth of the insurance industry.

· To ensure speedy settlement of genuine claims and to prevent frauds and malpractices.

· Promote fairness, transparency and orderly conduct in financial markets dealing with insurance.

COMMODITY FUTURES MARKET

India has a long history of commodity futures trading. A commodity includes all types of goods. Futures trading is Organised in such goods or commodities as is permitted by the government. A commodity exchange which is an association or a company or any corporate body organizing future trading in commodities

A future contract is a type of 'forward contract' which means a contract for the delivery of goods that is not a ready delivery contract. A ready delivery contract provides delivery of goods and payment of price either immediately or within a period not exceeding 11 days. The ready delivery contracts are known as 'spot' or 'cash' contracts.

All contracts in commodities providing delivery of goods and payment of price after 11 days are forward contracts which may be either 'specific delivery contracts' or 'futures contracts'.

There are four commodity exchanges working in the country.

They are NMCE (National Multi Commodity Exchange) - the oldest commodity exchange in the country which became operational in 2002, MCX (Multi Commodity Exchange), NCDEX (National commodity and Derivatives Exchange) and ICEX (Indian Commodity Exchange). ICEX is the latest commodity exchange which becomes operational since November 27, 2009. India bulls of private sector and MMT of the public sector are the main promoter companies of this exchange.

The MCX recorded the highest turnover in terms of value of trade during 2009, followed by National Commodity and Derivatives Exchange Ltd. (NCDEX) and National Multi-Commodity Exchange of India Ltd. (NMCE) respectively.

Forwards Market Commission (FMC)

FMC is a statutory body set up by the Forwards Contracts

(Regulation) Act, 1952. It functions under the administrative control of Department of Consumer Affairs, Ministry of Consumer Affairs, Food and Public Distribution. The Commission is a Regulatory body set up to ensure financial integrity, market integrity and protection and promotion of the interest of consumers.

Foreign Portfolio Investments

The government has allowed Foreign Institutional Investors (FIIs) to invest in Indian stock markets since September 1992.

These FIIs are foreign pension funds, mutual funds, investment trusts, asset management companies (AMCs) and portfolio managers. FIIs have generally been actively participating in the Portfolio Investment Scheme, although there are charges that they have brought greater volatility to the Indian stock market. Net FII inflow at end of 2012 stood at US ![]() 31.01 billion (as per the economic Survey 2012-13). 1759 FIIs are currently registered with SEBI.

31.01 billion (as per the economic Survey 2012-13). 1759 FIIs are currently registered with SEBI.

NON-BANKING FINANCIAL INSTITUTIONS (NBFIS)

NBFIs work in similar ways as banks, but there are certain differences

According to the Economic Survey, there are four Institutions namely:

(i) Export Import Bank of India (EXIM Bank),

(ii) National Bank for Agriculture and Rural Development (NABARD),

(iii) National Housing Bank (NHB) and

(iv) Small Industries Development Bank of India (SIDBI).

These institutions are regulated by the RBI as all-India FIs. The outstanding of total resources mobilized at any point of time by an FI, including funds mobilized under the ?umbrella limit-as prescribed by the RBI, should not exceed 10 times its new owned funds as per its latest audited balance sheet. However, in view of the difficulties expressed by the NHB and EXI Bank, their aggregate borrowing limit has been enhanced to times of their net owned funds (NOF) for one year (for NHB up to 30 September, 2012 and for EXIM Bank up 10 31 March, 2012, subject to review.)

Export-Import Bank of India (EXIM Bank)

EXIM bank in India was established on January 1, 1982 for financing facilitating and promoting foreign trade in India.

Besides, EXIM Bank also discharges duties of coordinating the activities of various financial institutions, providing finances for export and imports of goods and services. Besides India, this bank also manages finances to third world countries for export and import of goods and services. The Government India wholly owns EXIM Bank of India.

National Housing Bank (NHB)

National Housing Bank was established in July 1988 as wholly owned subsidiary of RBI. In 2012, as per the recommendation of the Narasimhan Committee, the RBI's stake in NHB was transferred to the Government. NHB is the apex banking institution providing finances for houses. The statutory mandate of NHB covers promotional, developmental and regulatory aspects of housing finance with focus on developing a sound housing finance system. NHB amended its Act called NHB (Amendment) Act, 2000 which came into force on June 12. 2000. NHB has made a number of efforts to promote the supply of real resources like land and building material.

NIIB has been permitted to mobilise resources by issuing bonds and debentures. NHB can obtains short term loan for 18 months period from RBI and obtain long-term loan from National Housing Credit Fund constituted by RBI. It can also obtain loans from various financial institutions of India and abroad. It can also obtain loans in foreign currencies. Besides, N11R can accept long term deposits from Central Government and other institutions.

A major activity of NHB includes extending financial assistance to eligible institutions in the housing sector by way of refinance and direct finance. The NHB is the regulator and supervisor of Housing Finance Companies (HFCs) in the country.

In 2007 NHB launched RESIDEX to provide an index of residential prices in India across cities and over time.

RUSIDEX is updated on a quarterly basis with 2007 as base year. Currently RESIDEX tracks residential property prices in 26 JNNURM cities.

Small Industries Development Bank of India (SIDBI)

Small Industries Development Bank of India (SIDBI) was established as wholly owned subsidiary of IDBI under the

Small Industries Development Bank of India Act, 1989 as the principal financial institution for promotion, financing and envelopment of industries in the small scale sector. SIDBI started its operations from April 2, 1990. It oversees the activity of agencies which provide finances to small enterprises. It?s headquarter is situated at Lucknow. 5 Regional and 21 Branch offices have also been started in different parts of the country.

All duties related to small enterprises which were performed by IDBI, have been shifted to SIDBI. SIDBI provides assistance to the small scale industrial sector in the country through other institutions like State Financial Corporations (SFC), Commercial Banks, and State Industrial Development Corporations, etc. Besides share capital, SIDBI can increase its resources by taking loans from the Government of India and RBI. SIDBI can also obtain loans from Indian Capital market.

It is also free to obtain loans in foreign currencies from foreign institutions. SIDBI will provide loans (both in Indian and Foreign Currencies) under its ?Single Window Service?.

While IDBI continues to be the single largest shareholder of SIDBI, the State Bank of India and LIC follow as the next two large shareholders in that order,

National Bank for Agriculture and Rural Development (NABARD)

It is an apex depeviomental bank in India. Setting up of NABARAD was recommended by the committee to review arrangements for institutional credit for agriculture and rural development, set up by the RBI, under the chairmanship of Shri B.Sivaraman. It was established in 1982 and its main focus has been on the upliftment of rural India by increasing credit flow into agriculture and rural non-farm sector. It has been entrusted with matters concerning policy, planning and operations in the field of credit for agriculture and other economic activities in rural areas in India. NABARAD is active in developing financial inclusion policy and is a member of the Alliance for Financial Inclusion.

SEWA Bank

In 1972, the Self Employed Women's Association

(SEWA) was registered as a trade union in Gujarat, with the main objective of "strengthening its members bargaining power to improve income, employment and access to social security.

In 1973, to address their lack of access to financial services, the members of SEWA decided to found "a bank

of their own". Four thousand women contributed share capital to establish the Mahila SEWA Co-operative Bank.

Since then it has been providing banking services to poor, illiterate, self-employed women and has become a viable financial venture with today around 30,000 active clients.

Micro Finance

A microfinance institution is an organization that provides financial services to the poor. Financial Inclusion is the delivery of financial services at an affordable cost to vast sections of the disadvantaged and low income groups.

It is crucial to innovate and provide means to include the financially disadvantaged by ensuring access to financial services, and timely and adequate credit. Financial inclusion can be described as the provision of affordable financial services, like access to payments and remittance facilities, savings, loans and insurance services by the formal financial system to those who are excluded.

The Self-Help Group (SHG)-bank linkage programmer continued to be the main micro-finance model by which the formal banking system reaches micro-entrepreneurs (including farmers). Launched in 1992 as a pilot project, it has since proved its efficacy as a mainstream programmer for banking by the poor who mainly comprise the marginal farmers, landless labourers, artisans and craftsmen and others engaged in small businesses like hawking and vending in the rural areas. The main advantages of the programme are timely repayment of loans to banks, reduction in transaction costs both to the poor and the banks, doorstep "saving and credit? facility for poor and exploitation of the untapped business potential of the rural areas.

You need to login to perform this action.

You will be redirected in

3 sec