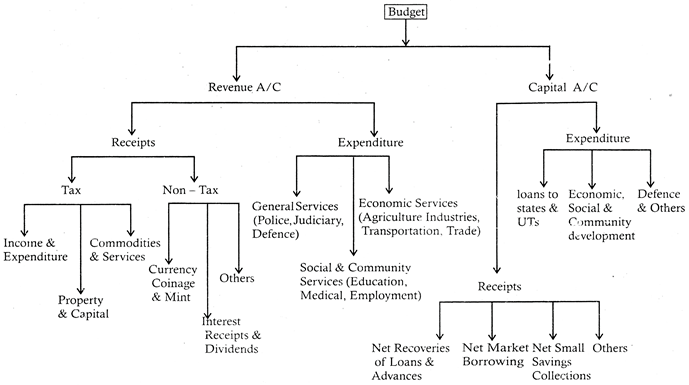

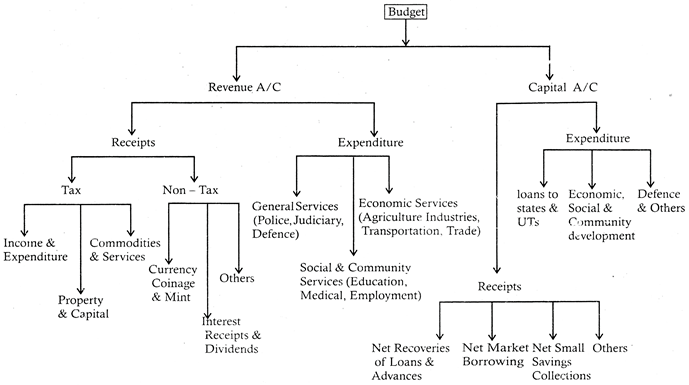

Budget

Budget is an annual financial statement. The Budget in India is divided into 2 parts-Revenue Account & Capital Acount.

Sustainable Development Goals (SDGs)

At the United Nations Sustainable Development Summit on 25 September 2015, World Leaders adopted the 2030 Agenda for sustainable Development, which includes a set of 17 sustainable Development Goals to end poverty, fight inequality and injustice and tackle climate change by 2030.

Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) is an investment in a business by an investor from another country for which the foreign investor has control over the company purchased. The Organization of Economic Co-operation and Development (OECD) defines control as owning 10% or more of the business. Businesses that make foreign direct investment are after called Multinational Corporations [MNCs] or Multinational Enterprises [MNEs).

- A MNE may create a new foreign enterprise by making a direct investment, which is called a greenfield investment.

- A MNE may make a direct investment by the acquisition of a foreign firm, which is called an acquisition or prownfield investment.

Advantages of foreign Direct Investment

- Economic Development Stimulation.

- Easy International Trade.

- Employment and Economic Boost.

- Development of human capital Resources.

- Tax incentives.

- Resource Transfer.

- Reduced disparity between revenues and costs.

- Increased productivity.

- Increment in income.

Disadvantages of Foreign Direct Investment

- Hindrances to domestic Investment

- Risk from political changes.

- Negative influence on exchange rates

- Higher costs.

- Economic non-viability.

- Modern-day Economic colonialism.

FDI, being a non-debt capital flow, is a leading source of external financing especially for the developing economies. Under the current policy regime, there are three broad entry options for foreign direct investors.

- In some sectors, FDI is not permitted (negative list);

- In another small category of sectors, foreign investment is permitted only till a specified level of foreign equity participation, and

- The third category, comprising all the other sectors, is where foreign investment up to 100 % of equity participation is allowed. The third category has two subsets -

- One consisting of sectors where automatic approval is granted for FDI (often foreign equity participation less than 100 %), and

- the other consisting of sectors where prior approval from the Foreign Investment Approval Board (FIPB) is required.

The following are some of the sector with 100% FDI

Advertising, agriculture, air transport services (domestic airlines), courier services, drugs and pharmaceutical, electricity, power, films and studios, hotel and tourism, housing and real estate, construction, mass rapid transport system, mining [gold and silver), NBFC, marketing, pipelines and' refining of petroleum products, tourism, transport infrastructure, townships, SEZs, railways, single brand retail (upto 49% automatic and from 49 to 100% has to be approved by F1PB), telecommunications (upto 49% automatic, 49-100% by FIPB), and asset reconstruction companies [upto 49% automatic, 49-100% by F1PB].

74% FDI

Airports, broadcasting, coal and lignite, credit information companies, direct to home (DTH), mining (diamonds & precious stones), satellites, and private sector banking are the sectors with FDI limit of 74%.

26-49% FDI

Airlines/aviation, defence, insurance and pension are the sectors which have 49% FDI limit. Sectors with 26% FDI limits print media [newspaper - 26%, scientific & periodicals - 100%) and FM radio. Public sector Banks have the lowest FDI limit of 20%.

Financial Inclusion

Financial Inclusion is an important priority of the Government. The objective of Financial Inclusion is to extend financial services to the large hitherto un-served population of the country to unlock its growth potential. Following are the important initiatives taken by the Government to achieve greater financial inclusion:

- Expansion of Bank Branch Network.

- Swabhimaan Scheme

- Direct Benefit Transfer

- PAHAL Scheme

- Pradhan Mantri Jan-Dhan Yojana (PM-JDY)

New Pension System

Pension Plans provide financial security & stability during old age when people don't have a regular source of income. To provide social security to more citizens the Government of India has started the National Pension System. Government of India established Pension Fund Regulatory & Development Authority (PFRDA) on 10th October 2013 to develop & regulate pension sector in the country. The National Pension System (NPS) was launched in 1st January, 2004 with the objective of providing retirement income to all the citizens. With effect from 1st may 2009, NPS has been provided for all citizens of the country including the unorganized sector workers on voluntary basis. Additionally, Central Government launched a co-contributory pension scheme, 'Swavalamban Scheme' in the Union Budget of 2010-11, under which the Government will contribute a sum of Rs. 1,000 to each eligible NPS subscriber who contributes a minimum of Rs.1,000 & maximum Rs. 12,000 per annum.

The NPS is structured in 2 tiers. A Tier- 1 account is a basic retirement pension account available to all citizens from 1 May 2009. It does not permit withdrawal of funds before retirement. A Tier-2 account is a prospective payment system account that permits some withdrawal of pension prior to retirement under exceptional circumstances, usually related to the provision of health care.

Glossary

- Ante date: To give a date prior to that on which it is written, to any cheque. bill or any other document.

- Arbitration: A method for solving disputes, generally of an industrial nature, between the employer and his employees.

- Amortization: Amortization is the repayment of Principal and Interest components of a Loan, over a period of time. Certain categories of expenses or charges are also amortized over a period of time.

- Ad valorem tax- a tax based on the value of property.

- Assets: Property of any kind.

- Banker's cheque: a cheque by one bank on another.

- Balance of trade (or payment): The difference between the visible exports and visible imports of two countries in trade with each other is called balance of payment.

- Basis Point: A unit of measurement which is equal to 1/l00th of 1%. This is used to measure changes in interest rates, stock-market indices or yield on fixed income securities.

- Balance Sheet: It is a statement of accounts, generally of a business concern, prepared at the end of a year.

- Bank Rate: It is the rate of interest charged by the Reserve Bank of India for lending money to Commercial Banks.

- Bear: A speculator in the stock market who believes that prices will go down.

- Black Money: It means unaccounted money, concealed income and undisclosed wealth. The money which thus remains unaccounted for, is called the Black Money.

- Bond: A legal agreement to pay a certain sum of money (called principal) at some future date and carrying a fixed rate of interest.

- Bull: Speculators in the stock markets who buy goods, in some cases without money to pay with, anticipating that prices will go up.

- Budget: An estimate of expected revenue and expenditure for a given period, usually a year, item by item.

- Budget Deficit: when the expenditure of the government exceeds the revenue, the balance between the two is the budget deficit.

- Cartel: It is a combination of business, generally in the same trade formed with a view to controlling prices and enjoy monopoly.

- Call money: Loan marle for a very short period. It carries a very low rate of interest.

- Commercial Banks: Financial institutions that create credit, accept deposits, give loans and perform other financial functions.

- Credit Appraisal: This is the process for evaluating credit worthiness of any loan proposal. This helps establish the risks involved in the proposal and debt servicing capacity of the borrower.

- Custodial Account: An account created for the benefit of a minor with an adult as the custodian.

- Deferred Payment: Payments put off to a future date or extended over a period of time. Interest will usually still accumulates during deferment.

- Deflation: Deflation is a reduction in the level of national income and output, usually accompanied by a fall in the general price level.

- Depreciation: Reduction in the value of fixed assets due to wear and tear.

- Devaluation: Official reduction in the foreign value of domestic currency. It is done to encourage the country's exports and discourage imports.

- Dividend: Earning of stock paid to shareholders.

- Dumping: Sale of a commodity at different prices in different markets, lower price being charged in the market where demand is relatively elastic.

- Double Taxation: Corporate earnings taxed at both the corporate level and again as a stock holder dividend.

- Exchange Rate: The price of one currency stated in terms of another currency, when exchanged.

- Excise Duty Tax: Imposed on the manufacture, sale and consumption of various commodities, such as taxes on textiles, cloth, liquor, etc.

- Fiscal policy: Government's expenditure and tax policy.

- Free-trade Area: A form of economic integration ill which there exists free internal trade among member countries but each member is free to levy different external tariffs against non-member nations.

- Index of industrial Production: A quantity index that is designed to measure changes in the physical volume or production levels of industrial goods over time.

- MICR Code: A unique 9-digit code assigned to each Bank branch by Reserve Bank of India to facilitate sorting in clearing of instruments using the Magnetic Ink Character Recognition Technology.

- Money Laundering: This means acquiring, owning, possessing 01- transferring any proceeds (or money) of crime or knowingly entering into any transaction related to proceeds of the crime either directly or indirectly.

- Monopoly: Single seller selling single product.

- Multi-Fiber Arrangement (MFA): A set of non-tariff bilateral quotas established by developed countries on imports of cotton, wool, and synthetic textiles and clothing from individual LDCs.

- Non-performing Assets (NPA): Any loan account that has been classified by a bank or financial institution as sub-standard, doubtful or loss assets in terms of asset classification norms of RBI.

- Payee (Drawee): The person who receives a payment. This often applies to cheque.

- Payer (Drawer): The person who makes a payment. This often applies to cheque.

- Preference Shares: These are the shares entitled to a fixed dividend before any distribution of profits can be made amongst the holders of ordinary shares.

- Repo Rate: The rate at which banks borrow from RBI. It injects liquidity into the market.

- Reverse Repo Rate: The rate at which RBI borrows from banks for a short- term. It withdraws liquidity into the market.

- Statutory Liquidity Ratio (SLR): SLR is the portion that banks need to invest in the form of cash, gold or government approved securities.

- Tariff (ad Valorem): A fixed percentage tax on the value of an imported commodity, levied at the point of entry into the importing country.

- VAT (Value Added Tax): A form of indirect sales tax paid on products and services at each stage of production or distribution, based on the value added at that stage and included in the cost to the ultimate customer.

- Zero Based Budgeting: The practice of justifying the utility in cost benefit terms of each government expenditure on projects.