| Explain the role of the following in correcting the inflationary gap in an economy: |

| (i) Legal reserves |

| (ii) Bank rate |

| Or |

| Explain the role of the following in correcting the deflationary gap in an economy: |

| (i) Open market operations |

| (ii) Margin requirements |

Answer:

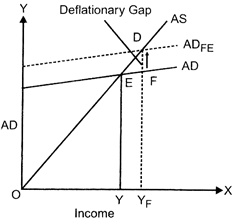

The situation of inflationary gap rises when equilibrium is established after the stage of full employment. The excess of aggregate demand over aggregate supply at the full employment level is inflationary gap. For bringing equality between AD and AS at the full employment level AD has to be reduced because AS cannot be increased since all the resources are fully employed. (i) Legal reserves: Legal reserves refers to a minimum percentage of deposits commercial banks have to keep as cash either with themselves or with the central bank. The central bank has the power to change it. When there is inflationary gap the central bank can raise the minimum limit of these reserves so that less funds are available to the banks for lending. This will reduce Aggregate Demand. (ii) Bank rate: Bank rate is the rate of interest which central bank charges from commercial banks for giving them loans. If banks rate is increased, the rate of interest for general public also goes up and this reduces the demand for credit by the public for investment and consumption. Therefore, for controlling the situation of inflationary gap, bank rate is increased. This ultimately will lead to the decline in the demand for credit. Decline in the volume of credit as a component of money supply will have controlling pressure on inflationary forces. Or The situation of deflationary gap arises when equilibrium is established before the stage of full employment. In this case, the full employment level, aggregate demand is less than aggregate supply. In Diagram, DF is the deflationary gap. For removing deflationary gap, the level of aggregate demand needs to be increased to match the aggregate supply. (i) Open market operations: This means the sale and purchase of securities by the central bank which are bought and sold by the commercial banks to correct deflationary gap. Credit as a component of money supply needs to be increased. For achieving this central bank buys securities from commercial banks in lieu of which cash flow or liquidity position of commercial banks improves and their lending capacity is raised. People can borrow more. This will raise AD.

(ii) Margin requirements: Commercial banks never advance loans to its customers equal to the full value of collateral or securities. They always keep a margin with them, such as keeping a margin of 20% and advancing loans equal to 80% of the value of security. In dealing with deflationary gap, this margin is reduced so that more credit may be made available against the security. This increases borrowing capacity of borrowers and thus will raise AD.

You need to login to perform this action.

You will be redirected in

3 sec