Banking in India

Category : Banking

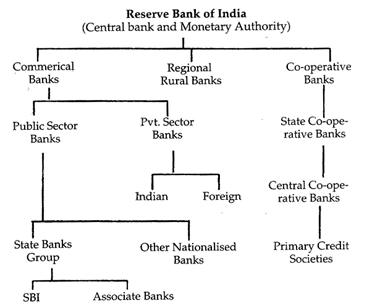

INDIAN BANKING SYSTEM

COMMERCIAL BANKS

Commercial bank is an institution that accepts deposits, makes business loans and offers related services to general public and businessmen. Commercial banks in India are largely Indian public sector and private sector with a few foreign banks. The public sector banks account for more than 80 percent of the entire banking business in India occupying a dominant position in the commercial banking. These are a profit making institution owned by government or private or both.

There are currently 27 public sector banks in India out of which 19 are nationalised banks and 6 are SBI and its associate banks, and rest two are IDBI Bank and Bharatiya Manila Bank, which are categorised as other public sector banks. There are total 93 commercial banks in India.

There are currently 27 public sector banks in India out of which 20 are nationalized banks and 6 are SBI and its associate banks, and last is Bharatiya Mahila Bank, which is categorised as other public sector bank. There are total 93 commercial banks in India.

The public sector accounts for 80 percent of total banking business in India and State Bank of India is the largest commercial bank in terms of volume of all commercial banks. b. Private sector banks:

Private sector banks are those whose equity is held by private shareholders. For example, ICICI, HDFC etc. Private sector banks play a major role in the development of Indian banking industry.

|

Differences between Private and Public Sector Banks Private sector banks introduced the concept of online banking in India. This was mostly because the private banks were technologically well equipped. · Private sector banks were using state-of-the-art technology and fully computerized systems since the time they entered the Indian market whereas the Public sector banks were not. · Despite the technological challenges, the public sector banks are still the preferred destinations for many as they are considered as safer options for money deposit. |

Foreign banks are those banks which have their head offices abroad. These banks have their registered head offices in a foreign country, while they operate their branches in India. They can operate in India either through wholly-owned subsidiaries or through branches. CITI bank, HSBC, Standard Chartered etc. are the examples of foreign banks in India.

REGIONAL RURAL BANK (RRB)

These are state sponsored regional rural oriented banks. They provide credit for agricultural and rural development. The main objective of RRB is to develop rural economy. Their borrowers include small and marginal farmers, agricultural labourers, artisans etc. NABARD holds the apex position in the agricultural and rural development.

After nationalization of banks in 1960, there were problems which made it difficult for commercial banks even under government ownership to lend to farmers. Government set up Narasimham Working Group in 1975. On the basis of this committee’s recommendations, a Regional Rural Banks Ordinance was promulgated in September

1975, which was replaced by the Regional Rural Banks Act 1976.

First RRB: Prathama Grameen Bank sponsored by Syndicate Bank established on 2nd October 1975 with its Head Office at Moradabad.

The RRBs were owned by three entities with their respective shares as follows:

Central Government-50%

State Government -15%

Sponsor bank-35%

Scheduled and Non-Scheduled banks

A bank is said to be a scheduled bank when it has a paid up capital and reserves as per the prescription of RBI and is included in the second schedule of RBI Act 1934.

Non-scheduled banks are those commercial banks which are not included in the second schedule of RBI Act 1934.

CO-OPERATIVE BANKS

Cooperative banks are so called because they are organised under the provisions of the Cooperative Credit Societies Act of the states. The major beneficiary of the Cooperative Banking is the agricultural sector in particular and the rural sector in general.

The cooperative credit institutions operating in the country are mainly of two kinds agricultural (dominant) and non-agricultural. There are two separate cooperative agencies for the provision of agricultural credit: one for short and medium-term credit, and the other for long-term credit. The former has three tier and federal structure. Three tier structures exist in the cooperative banking:

iii. Primary cooperative banks (PCB) at the base or local level.

Payments Banks and Small Finance Banks

In order to expedite financial inclusion, RBI had created a framework for licensing Payments Banks / Small Banks and other differentiated banks. These local area banks, payment banks and Small Banks are expected to meet credit and remittance needs of small businesses, unorganized sector, low income households, farmers and migrant work force. Airtel was the first entity to launch India's first Payments Bank service in Rajasthan.

FINANCIAL INCLUSION GETS A LEG UP

|

SMALL BANKS |

PAYMENT BANKS |

WHAT PAYMENT BANKS CAN DO |

|

Initial capital requirement: ` 100 crore • Eligibility: Entities and individuals must have 10 years of experience in finance and banking. • Existing micro finance companies • NBFCs can convert into small banks • Large PSUs industrial houses and NBFCs floated by them cannot apply. |

• Initial capital requirement: ` 100 crore • Eligibility: Existing pre-paid payment instrument issuers/ individuals, professional, NBFCs, corporate business correspondents, telecom companies, super market chains, real estate sector cooperatives that arrowed and controlled by residents and public sector entities may apply.

|

• Issue ATM/debit cards. • Offer payments, remittance services and distribute financial products like MF and insurance, WHAT PAYMENT BANKS CANNOT DO • Issue credit cards. WHAT SMALL BANKS MUST DO • Must extend 75 per cent of its Adjusted Net Bank Credit (ANBC) to sectors eligible for classification as priority sector lending by RBI. |

|

• Promoter contribution: Initially must be 40%; to be brought down to 26% over 12 years. • Foreign holding: Up to 74% of paid-up capital, on a par with private banks. • Capital requirement: Minimum capital adequacy ratio 15% with minimum Tier-1 capital of 7.5%.

|

• Promoter contribution: Initially must be 40% for the first 5 years. • Foreign holding: Up to 74% of paid up capital, on a par with private banks. • Capital requirement: Must maintain CRR, minimum 75% of demand deposits in government bonds of up to one year and maximum 25% in current and fixed deposits with other scheduled commerical banks for operational purposes and Liquidity management. |

• At least 50% of loan portfolio should constitute loans and advances of up to ` 25 lakh DEADLINE Companies will have to apply by January 16, 2015, for licences in both categories: RBI may consider more applications later.

|

|

• Lending business: Restricted to small businesses, marginal farmers. Priority sector lending tar- get 75%, 50% of loan book must be of those up to ` 25 lakh. • Maximum exposure: For single borrower, limited to 10%: group exposure, limited to 15%. |

• Lending business: Cannot lend • Deposit per customer: Capped at ` 1,00,000. |

|

Banking Codes and Standards Board of India (BCSBI)

Under the recommendations from RBI constituted Committee on Procedures and Performance Audit of Public Services under the Chairmanship of Shri S.S. Tarapore, Banking Codes and Standards Board of India (BCSBI) was setup on February 18, 2006. The Independent banking industry watchdog is based in Mumbai/ Maharashtra. It functions as an independent and autonomous body.

BCSBI as Banking Industry Watchdog:

Banking Ombudsman

The Banking Ombudsman Scheme enables an expeditious and inexpensive forum to bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from 1995.

A Banking Ombudsman is a senior official appointed by the Reserve Bank of India.

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under the Scheme.

The Banking Ombudsman does not charge any fee for filing and resolving customers' complaints.

The amount, if any, to be paid by the bank to the complainant by way of compensation for any loss suffered by the complainant is limited to the amount arising directly out of the act or omission of the bank or `10 lakhs, whichever is lower.

If one is not satisfied with the decision passed by the Banking Ombudsman, one can approach the appellate authority against the Banking Ombudsmen's decision. Appellate Authority is vested with a Deputy Governor of the RBI.

Banks Board Bureau (BBB)

The main aim of Banks Board Bureau is to recommend appointment of directors in Public Sector Banks (PSBs) and advice on ways of raising funds and dealing with issues of stressed assets.

Besides this task, the BBB will also be a link between the government and banks and will be engaged with banks to evolve strategies for them.

Ratings of Banks in India

As per the recommendations of Padmanabhan Committee, the banks in India should be rated on a 5 point scale of A to E, based on international CAMELS rating model.

Upon these guidelines, RBI has evolved the model for rating banks based on CAMELS. Each of the 6 components would be weighed on a scale of 1 to 1 (H) and would contain several parameters with individual weightage.

|

CAMELS Rating for Domestic Banks |

Rating parameters for foreign banks |

Rating Scale in India |

|||

|

C |

Capital adequacy ratio |

C |

Capital adequacy ratio |

A |

Sound in every respect |

|

A |

Asset quality |

A |

Asset quality |

B |

Fundamentally sound, but with moderate weaknesses |

|

M |

Management Effectiveness |

L |

Liquidity |

C |

Financial, operational and/or compliance weaknesses that give cause for supervisory concern |

|

E |

Earning |

C |

Compliance |

D |

Serious or moderate financial, operational and/or managerial weaknesses that could impair future viability |

|

L |

Liquidity (asset- liability) |

S |

System and controls |

E |

Critical financial weaknesses that render the possibility of failure in the near term |

|

S |

System and controls |

|

|

|

|

VARIOUS TYPES OF BANKING

Investment Banks

Investment banking is a special segment of banking operations that help individuals, corporations, and governments raise financial capital by underwriting or acting as the client's agent in the issuance of securities.

Universal Banking

A universal bank participates in both investment banking with commercial banking under one roof and reaping synergies.

Retail Banking

Retail banking or Consumer Banking refers to the division of a bank that directly deals with individual consumers, rather than with companies, corporations or other banks. Services offered include savings and transactional accounts, mortgages, personal loans, debit cards, and credit cards.

Wholesale Banking

These banks provide banking solutions to corporate and institutional and other financial institutions such as large corporations and other banks, whereas retail banking focuses more on the individual or small business.

Islamic or Sharia banking

Islamic or Sharia banking is a finance system based on the principles of not charging interest, which is prohibited in Islam. Islamic Banks are providing sharia compliant finance. The Reserve Bank of India has proposed opening of "Islamic window" in conventional banks for "gradual" introduction of Sharia- compliant or interest-free banking in the country.

BASEL ACCORDS

The Basel Accords refer to the banking supervision Accords (recommendations on banking regulations) issued by the Basel Committee on Banking Supervision (BCBS). They are called the Basel Accords as the BCBS maintains its secretariat at the Bank for International Settlements (BIS) in Basel/ Switzerland and the committee normally meets there. The Basel Accords is a set of recommendations for regulations in the banking industry. Up to now, three accords have been published.

BASEL I

Basel I norms were published in 1988 which asked to set a minimum capital requirements for banks. It denned capital requirement and structure of risk weights for banks. The goal was to minimize credit risk i.e. the defaults on a credit or loan when the borrower is unable to pay back to the bank.

The 1988 Accord called for a minimum capital ratio of capital to risk-weighted assets to be implemented by the end of 1992. Ultimately, this framework, was introduced not only in member countries but also in virtually all other countries with active international banks.

BASEL II

After Basel I, Basel II norms were published in 2004. Unlike the goal of Basel I norms, Basel II focused on how much of their credit risks the banks have to reduce. So in case if a bank is exposed to a greater risk/ it guards against the risks. Basel II was to be implemented in early 2008.

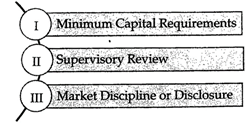

The revised framework comprised three Pillars namely:

Minimum capital requirements- to develop and expand the standardized rules set out in the 1988 Accord;

Supervisory review - of an institution's capital adequacy and internal assessment process; Effective use of disclosure- as a lever to strengthen market discipline and encourage sound banking practices.

BASEL III

These measures aim to:

Basel III was to be implemented until 31 March 2018 which is extended to 31 March 2019.

Basel III is not to be succeeded by Basel II, rather Basel III will work alongside Basel I and Basel II

Comparison of Capital Requirements

Under Basel II and Basel III:

|

Requirements |

Under Basel II |

Under Basel III |

|

Minimum Ratio of Total Capital To RWAs |

8% |

11.50% |

|

Minimum Ration of Common Equity to RWAs |

2% |

4.50% to 7.00% |

|

Tier I capital to RWAs |

4% |

6.00% |

|

Core Tier I capital to RWAs |

2% |

5.00% |

|

Capital Conservation Buffers to RWAs |

None |

2.50% |

|

Leverage Ratio |

None |

3.00% |

|

Countercyclical Buffer |

None |

0% to 2.50% |

|

Minimum Liquidity Coverage Ratio |

None |

TBD(2015) |

|

Minimum Net Stable Funding Ratio |

None |

TBD(2018) |

Risk management in Indian banks

Indian Banks have been making great advancements in terms of technology, quality/ as well as stability 'such that they have started to expand and diversify at a rapid rate. However/ such expansion brings these banks into the context of risk especially at the onset of increasing Globalization and Liberalization. In banks and other financial institutions, risk plays a major part in the earnings of a bank. The higher the risk/ the higher the return, hence, it is essential to maintain a parity between risk and return.

Various Types of Risks associated with the Banks

Credit risk

A credit risk is the risk of default on a debt that may arise from a borrower failing to make required payments.

Market risk

Risk arises due to fluctuations in market price of marketable securities. Bank generally invests in equity shares/ loss arises to bank due to fluctuations in equity market is known as market risk.

Interest rate risk

IRR arises due to fluctuation in the interest rate. If a bank had a lot of fixed deposits, fall in interest rate will cause loss to bank. Similarly, if a bank had a large amount of fixed interest rate loans, increase in interest rate will cause losses.

Foreign exchange risk

Banks may have large foreign exchange assets due to mismatch of the maturity date. Fluctuations in exchange rate cause loss to the bank.

Operational risk

Risks arise due to the failure of day to day activities, system or people. It includes both internal and external frauds like failures related to policies, laws, regulations, documentation or any technological risks.

Liquidity risk

Risks arise due to the inability of bank to meet its obligations and it refers to a situation when any asset may not be realized in cash. Also, we can say that it is a mismatch of assets and liabilities. It is a more important than any other risk because it has to be kept within limits, otherwise banks dependence on money market would increase.

List of Public Sector and Private Sector Banks, their Head offices, chairmen and Slogans:

|

S.NO |

Bank Name |

Head Office |

Chairman |

Slogan |

|

1. |

Allahabad Bank |

Kolkata |

Rakesh Sethi |

A tradition of trust |

|

2. |

Andhra Bank |

Hyderabad |

C.V.R Rajendran |

Much more to do. With YOU in focus |

|

3. |

Bank of Baroda |

Vadodara |

Mr. Ravi Venkatesan |

India's International Bank |

|

4. |

Bank of India |

Mumbai |

V. R. Iyer |

Relationships beyond Banking |

|

5. |

BankofMaha- rashtra |

Pune |

Sushil Muhnot |

One Family One Bank |

|

6. |

Canara Bank |

Bangalore |

R. K. Dubey |

It's easy to change for those who you love, Together we Can |

|

7. |

Central Bank of India |

Mumbai |

Rajeev Rishi |

Build A Better Life Around Us, Central to you since 1911. |

|

8. |

Corporation Bank |

Mangalore |

Sadhu Ram Bansal |

Prosperity for all |

|

9. |

Dena Bank |

Mumbai |

Aswini Kumar |

Trusted Family Bank |

|

10. |

Indian Bank |

Chennai |

T. M. Bhasin |

Taking Banking Technology to Common Man, Your Tech-friendly bank |

|

11. |

Indian Overseas Bank |

Chennai |

M. Narendra |

Good people to grow with. |

|

12. |

Oriental Bank of Commerce |

New Delhi |

S. L. Bansal |

Where every individual is committed |

|

13. |

Punjab National Bank |

New Delhi |

K. R. Kamath |

The Name you can Bank Upon |

|

14. |

Punjab & Sind Bank |

New Delhi |

Jatinder Bir Singh |

Where series is a way of life |

|

15. |

Syndicate Bank |

Manipal |

Sudhir Kumar Jain |

Your Faithful And Friendly Financial Partner |

|

16. |

Union Bank of India |

Mumbai |

Arun Tiwari |

Good people to bank with |

|

17. |

United Bank of India |

Kolkata |

Vacant |

The Bank that begins with "U" |

|

18. |

UCO Bank |

Kolkata |

Arunkaul |

Honours Your Trust |

|

19. |

Vijaya Bank |

Bangalore |

V. Kannan |

A friend You can Bank Upon |

|

20. |

IDBI Bank Ltd |

Mumbai |

M.S. Raghavan |

Banking for all; " Aao Sochein Bada" |

|

21. |

BharatiyaMa- hila Bank |

New Delhi |

Usha Ananthasu- bramanyan |

Empowering women. Empowering India |

State Bank Group

|

1 |

State Bank of India |

Mumbai |

Arundhati Bhattacharya |

The Nation banks on us; Pure Banking Nothing Else; With you all the way |

|

2 |

State Bank of Bikaner & Jaipur |

Rajasthan |

Arundhati Bhattacharya |

|

|

3 |

State Bank of Patiala |

Punjab |

Arundhati Bhattacharya |

Blending Modernity with Tradition |

|

4 |

State Bank of Hy- derabad |

Hyderabad |

Arundhati Bhattacharya |

You can always bank on us |

|

5 |

State Bank of Mysore |

Bangalore |

Arundhati Bhattacharya |

Working for a better tomorrow |

|

6 |

State Bank of Travan- core |

Thiruvanan- thapuram |

Arundhati Bhattacharya |

A Long Tradition of Trust |

Private Sector Bank

|

S. No |

Bank Name |

Chairman |

Slogan |

|

1 |

AXIS Bank Ltd. |

Shika Sharma |

Everything is the same except the name. |

|

2 |

Bandhan Bank |

Chandra Shekhar Ghosh |

Aapka Bhala/ Sabki Bhalai |

|

3 |

Citi Union Bank Ltd. |

N Kamakodi |

Trust and Excellence since 1904 |

|

4 |

Coastal Local Area Bank Ltd. |

D Jagapathi Raju |

|

|

5 |

DCB Bank Limited |

Nasser Munjee |

|

|

6 |

Dhanlaxmi Bank Ltd |

G N Bajpal |

Tann. Mann. Dhan |

|

7 |

ICICI Bank Ltd |

Chanda Kochhar |

Hum Ham na!! |

|

8 |

Indusind Bank Ltd. |

RomeshSobti |

We make you feel richer |

|

9 |

ING Vysya Bank Ltd. |

Shailendra Bhandari |

Jiyo easy |

|

10 |

Kamataka Bank Ltd. |

P Jayaram Bhat |

Your family bank across India |

|

11 |

Kotak Mahindra Bank Ltd. |

Uday Kotak |

Let's make money simple |

|

12 |

IDFC Bank (Infrastructure Development Finance Company) Founded - 2015 |

Dr. Rajiv B. Lall |

Banking Hat ke |

|

13 |

RBL Bank. |

S G Kutte |

|

|

14 |

Tamilnadu Mercantile Bank Ltd. |

H S U Kamath |

|

|

15 |

The Catholic Syrian Bank Ltd. |

Rakesh Bhatia |

Support all the way. |

|

16 |

The Federal Bank Ltd. |

Shyam Srinivasan |

Your perfect banking partner |

|

17 |

The HDFC Bank Ltd. |

Aditya puri |

We understand your world. |

|

18 |

The Jammu & Kaslunir Bank Ltd. |

Parvez Ahmad |

Serving to Empower |

|

19 |

The Karur Vysya Bank Ltd. |

K Venkataraman |

Smart way to bank |

|

20 |

The Lakshmi Vilas Bank Ltd. |

Rakesh Sharma |

The Changing Face of pros- perity |

|

21 |

Standard Chartered |

Zarin Daruwala |

Here for good |

|

22 |

The South Indian Bank Ltd. |

V. G. Mathew |

Experience Next Generation Banking |

|

23 |

Yes Bank Ltd. |

Rana Kapoor |

Experience our expertise |

You need to login to perform this action.

You will be redirected in

3 sec