Reserve Bank of India - Structure and Functions

Category : Banking

RESERVE BANK OF INDIA

RBI was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act/1934.

Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.

CONSTITUTION

The Reserve Bank's affairs are governed by a central board of directors. The board is appointed by the Government of India in keeping with the Reserve Bank of India Act.

Dr. Urjit R. Patel (24th Governor)

Shri BP Kanungo

Shri S. S. Mundra

Shri N. S. Vishwanathan

Dr. Viral V. Acharya

|

First Governor of RBI - Sir Osbome Smith First Indian Governor of RBI - C. D. Deshmukh

|

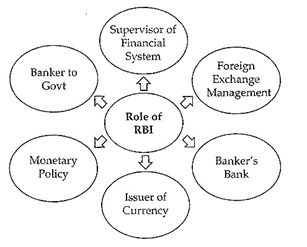

Functions of Reserve Bank of India

Monetary Authority:

Formulates, implements and monitors the monetary policy.

Objective: maintaining price stability and ensuring adequate flow of credit to productive sectors.

Regulator and supervisor of the financial system:

Prescribes broad parameters of banking operations within which the country's banking and financial system functions. Objective: maintain public confidence in the system, protect depositors' interest and provide cost-effective banking services to the public.

Manager of Foreign Exchange:

Manages the Foreign Exchange Management Act, 1999.

Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India.

Issuer of currency:

Issues and exchanges or destroys currency and coins not fit for circulation.

Objective: to give the public adequate quantity of supplies of currency notes and coins and in good quality.

Developmental role:

Performs a wide range of promotional functions to support national objectives.

Banker to the Government:

Performs merchant banking functions for the central and the state governments; also acts as their banker.

Banker to banks:

Maintains banking accounts of all scheduled banks.

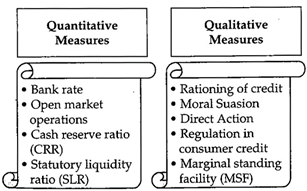

INSTRUMENTS OF MONETARY POLICY - QUANTITATIVE & QUALITATIVE TOOLS

The instruments of monetary policy are tools or devices which are used by the monetary authority in order to attain some predetermined objectives.

ELEMENTS OF MONETARY POLICY

REPO AND REVERSE REPO RATE

Repo is a transaction wherein securities are sold by the RBI and simultaneously repurchased at a fixed price. This fixed price is determined in context of an interest rate called the repo rate. The higher the repo rate, more costly are the funds for banks and hence, higher will be the rate that banks pass on to customers. A high rate signals that access to money is expensive for banks; lesser credit will flow into the system that helps bring down liquidity in the economy. The reverse is the reverse repo rate, which banks use to park excess money with RBI.

CASH RESERVE RATIO (CRR)

This is the percentage of a bank's total deposit that needs to be kept as cash with the RBI. The central bank can change the ratio to a limit. A high percentage means banks have less to lend, which curbs liquidity; a low CRR does the opposite. The RBI can reduce or raise CRR to tighten or ease liquidity as the situation demands.

OPEN MARKET OPERATIONS

This refers to buying and selling of government securities by RBI to regulate short-term money supply. If RBI wants to induce liquidity or more funds into the system, it will buy government securities and inject funds, and if it wants to curb the amount of money out there, it will sell these to banks, thereby reducing the amount of cash that banks have. RBI uses this tool actively even outside of its monetary policy review to manage liquidity on a regular basis.

STATUTORY LIQUIDITY RATIO

This is the percentage of banks' total deposits that they are needed to invest in government approved securities. The lesser the amount of SLR, the more banks have to lend outside. The SLR has been brought down from 22% to 21.5% in this policy and the endeavour will be to reduce it by 0.25% every quarter till 31 March 2017.

BANK RATE

This is the re-discounting rate that RBI extends to banks against securities such as bills of exchange, commercial papers and any other approved securities. In recent years, it has been the repo rather than the bank rate that has acted as a guideline for banks to set their interest rates. It is currently at 8.25%. Directionally, bank rate follows repo.

In addition to these measures, RBI also uses many qualitative tools to regulate credit flow and cost of credit to the economy and specific sectors within it.

Demonetisation and RBI

RBI under the Section 20 of the RBI Act 1934 has the obligation to undertake the receipts and payments of the Central Government and to carry out the exchange, remittance and other banking operations, including the management of the public debt of the Union.

State Government transactions are carried out by RBI in terms of the agreement entered into with the State Governments in terms of section 21 A of the Act. As of now, such agreements exist between RBI and all the State Governments except Government of Sikkim.

Fully Owned RBI Subsidiaries:

Offices

Has 19 regional offices, most of them in state capitals and 9 Sub-offices.

Governors of Reserve Bank of India

|

No. |

Name |

Term of office |

|

|

Began |

Ended |

||

|

1 |

Osborne Smith |

1 April 1935 |

30 June 1937 |

|

2 |

James Braid Taylor |

1 July 1937 |

17 February 1943 |

|

3 |

C. D. Deshmukh |

11 August 1943 |

30 June 1949 |

|

4 |

Benegal Rama Rau |

1 July 1949 |

14 January 1957 |

|

5 |

K. G. Ambegaonkar |

14 January 1957 |

28 February 1957 |

|

6 |

H. V. R. lyengar |

1 March 1957 |

28 February 1962 |

|

7 |

P. C. Bhattacharya |

1 March 1962 |

30 June 1967 |

|

8 |

L. K. Jha |

1 July 1967 |

3 May 1970 |

|

9 |

B. N. Adarkar |

4 May 1970 |

15 June 1970 |

|

10 |

S. Jagannathan |

16 June 1970 |

19 May 1975 |

|

11 |

N. C. Sen Gupta |

19 May 1975 |

19 August 1975 |

|

12 |

K. R. Puri |

20 August 1975 |

2 May 1977 |

|

13 |

M. Narasimham |

3 May 1977 |

30 November 1977 |

|

14 |

I. G. Patel |

1 December 1977 |

15 September 1982 |

|

15 |

Manmohan Singh |

16 September 1982 |

14 January 1985 |

|

16 |

Amitav Ghosh |

15 January 1985 |

4 February 1985 |

|

17 |

R. N. Malhotra |

4 February 1985 |

22 December 1990 |

|

18 |

S. Venkitaramanan |

22 December 1990 |

21 December 1992 |

|

19 |

C. Rangarajan |

22 December 1992 |

21 November 1997 |

|

20 |

Bimal Jalan |

22 November 1997 |

6 September 2003 |

|

21 |

Y. V. Reddy |

6 September 2003 |

5 September 2008 |

|

22 |

D. Subbarao |

5 September 2008 |

4 September 2013 |

|

23 |

Raghuram Rajan |

4 September 2013 |

4 September 2016 |

|

24 |

Urjit patel |

4 September 2016 |

Incumbent |

|

Reserve Bank of India - Brief History |

|

|

1926 |

Royal Commission on Indian Currency and Finance popularly known as the Hilton-Young Commission submitted its report and made recommendations to the British Government of India for creation of a central Bank. Objectives: • To separate the control of currency and credit from the government • To augment banking facilities throughout the country. |

|

1933 |

White Paper on Indian Constitutional Reforms recommended the creation of a Reserve Bank. A fresh bill was introduced in the Legislative Assembly. |

|

1934 |

The Bill was passed and received the Governor General's assent |

|

April 1, 1935 |

• Reserve Bank of India was established via the RBI Act of 1934 as the banker to the central government. • RBI launched its operations from April 1, 1935. • Its headquarters were in Kolkata in the beginning, but it was shifted to Shaheed Bhagat Singh Marg, Mumbai in 1937. • RBI started as a privately owned bank. It started with a Share Capital of ` 5 Crore, divided into shares of 100 each fully paid up. • In the beginning, this entire capital was owned by private shareholders. Out of this ` 5 Crore, the amount of ` 4,97,8000 was subscribed by the private shareholders while ` 2,20,000 was subscribed by central government. |

|

1942 |

Reserve Bank ceased to be the currency issuing authority of Burma (now Myanmar). |

|

1947 |

Reserve Bank stopped acting as banker to the Government of Burma. |

|

1948 |

Reserve Bank stopped rendering central banking services to Pakistan. |

|

1949 |

• Government of India nationalized the Reserve Bank under the Reserve Bank (Transfer of Public Ownership) Act, 1948. • Thus, the government passed Reserve Bank (Transfer to Public Ownership) Act, 1948 and took over RBI from private shareholders after paying appropriate compensation. Thus, nationalisation of RBI took place in 1949 and from January 1, 1949, RBI started working as a government owned central bank of India. • Banking Regulation Act was enacted. |

Acts administered by Reserve Bank of India

Other relevant Acts

|

Committee |

Date |

Headed by |

|

Mundra Committee-To Speed up the Process of Recalibration of ATMs |

November 2016 |

S.S. Mundra |

|

To study the regulatory issues relating to Financial Technology (Fintech) and Digital Banking in India |

June 2016 |

SudarshanSen |

|

PJ Nayak Committee-To Review Governance of Boards of Banks in India |

June 2016 |

P J Nayak |

|

To look at the various facets of household finance in India and to benchmark India's position |

August 2016 |

Dr. TarunRamadorai |

|

Working Group on Import Data Processing and Monitoring System |

April 2016 |

A. K. Pandey |

|

Working group on Interest Rate Options |

February 2016 |

P. G. Apte |

|

Advisory Committee on Ways and Means Advances to State Governments January 2016 Sumit Bose Committee on Medium term Path on Financial Inclusion |

December 2015 |

Deepak Mohanty |

|

Committee on Differential Premium System for Banks in India |

September 2015 |

Jasbir Singh |

|

Working Group on Compilation of Flow of Funds Accounts for Indian Economy August |

August 2015 |

D. K. Mohanty |

|

High Powered Committee on Urban Co-operative Banks (UCBs) |

June 2015 |

R. Gandhi |

|

Committee on Data Standardization |

March 2015 |

LP. Parthasarathi |

|

Internal Working Group (IWG) to Revisit the Existing Priority Sector Lending Guidelines |

March 2015 |

Lily Vadera |

|

Committee on Capacity Building in Banks and Non-Banks |

September 2014 |

G. Gopalakrishna |

|

Committee on Implementation of Countercyclical Capital Buffer |

July 2014 |

B. Mahapatra |

|

Committee on Data and Information Management in the Reserve Bank of India |

July 2014 |

D. K. Mohanty |

|

Committee on productivity growth for the Indian Economy |

June 2014 |

B. N. Goldar |

|

Committee to Review Governance of Boards of Banks in India |

May 2014 |

P. J. Nayak |

|

Working group on resolution Regime for Financial Institutions |

May 2014 |

Anand Sinha |

|

GIRO Advisory group - UmeshBellur group on enabling PKI in Payment System Applications |

April 2014 |

Anil Kumar Sharma |

|

Committee on licensing of new Urban Cooperative Banks |

September 2011 |

Malegam Committee |

|

Committee on issues and concerns in the NEFC Sector |

August 2011 |

Usha Throat |

You need to login to perform this action.

You will be redirected in

3 sec