Capital Market and Institution

Category : Banking

Capital Market and Institution

Financial Market

Financial market is a mechanism that allows people to easily buy and sell financial securities, commodities and other fungible items of value at low transaction costs at a predetermined or market determined price. Financial market can be divided into different types of market:

(a) Money market: which provides short term debt financing and investment.

(b) Capital Market: which facilitates comprises of stock markets and bond markets.

(c) Commodity Market: Which facilitates the trading of commodities.

(d) Foreign Market Exchange: Which facilitates the trading of foreign exchange.

(e) Future Markets: Which provide standardized forward contracts for trading products at some future date.

(f) Insurance Market: Which facilitate the redistribution of various risks.

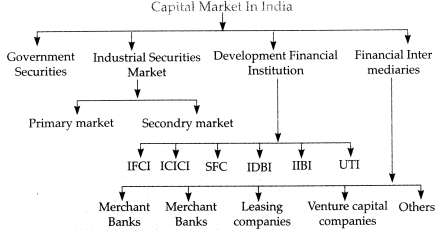

Capital market

Capital market is the market that helps the companies in raising long term investment credit. It is the market for long term funds. It refers to all the facilities and institutional arrangement for borrowing and lending term funds. It does not deal in capital goods but ifs concerned with raising of money capital for purpose of investment.

· Thus the capital market embraces the system through which the public takes up long term securities either directly or through which the public takes up long term securities either directly or through intermediaries.

· The structure of any capital market is composed of the sources of demand for long term capital and supply of, long term capital.

· The demand for capital comes from various categories of borrowers such as the central and state government local authorities and private industrial and manufacturing groups.

· In private sector, a large demand for long term capital comes from the joint-stock companies. These companies raise funds by the following Methods?

1. Issuing share

2. Selling debentures

3. Borrowing from specialized financial institutions called "Development Banks??.

4. Inviting fixed deposits from the general public.

· In supply of capital, there are many channels for the supply of funds to the capital market. A large part of the funds is obtained directly from individual investors through equity capital. There are specialized financial institutions such as the development banks, which also supply capital funds to industries.

· The Reserve Bank's policy operations can affect the structure of interest rates as follows:

1. By changing the Treasury bill rate

2. By changing the Bank rate

3. By fixing the minimum and maximum landing rates of banks.

4. By influencing fields on government securities through open market operations ? sales and purchase activities.

5. By fixing the maximum interest on time deposits with the Banks.

6. By affecting call money rates through changes in the reserve requirement ratios. Derivatives Market

Derivatives Markets

Derivatives markets are the financial market for derivatives. A derivative is an instrument whose value is derived from underlying assets or underlying index.

Functions of Derivatives

· Allow risk to be managed by hedging or risk transfer.

· Lower transaction costs lead to higher liquidity.

· Pricing is more accurate in derivatives than cash market.

· Less volatility in derivatives.

Options: Options are financial instruments that convey the right, but not the obligation to engage in a future transaction, on same underlying security. In other words, holders do not have to exercise this right.

Swaps: Swap is a derivative in which two counterparties agree to exchange one stream of cash flows against another stream. These streams are called the legs of swap.

· In swaps, cash flows are calculated over a notional principal amount, which is usually not exchanged between counterparties.

Commodity Markets: Commodity markets are the primary market where raw or primary products are exchanged. These commodities are traded on regulated commodities exchanges, in which they are bought and sold in standardized contracts.

Forward Contracts: A forward contract is among the oldest and simples of derivative contracts. It is simply a purchase or sale transaction in which the price and other terms have been agreed upon, but the delivery and payment are postponed to a later date.

E.g. - A stock market transaction in which delivery takes place after two or four weeks, hence the norm there is to settle within a couple of days.

Future Connected: Future contracts are the contracts that are exchange traded, standardized contracts in which the credit risk is handled by margins and daily mark to market. The delivery also occurs at a future date.

· It has the same general features as a forward contract but it is transacted through a future exchange.

Stock Market

A stock market is a public or private market for the trading of company stock and derivatives of company stock on agreed price. These are securities listed on a stock exchange.

BSE (Bombay stock exchange)

· BSE is the oldest stock exchange in Asia.

· It was established on 1875, and its head office is in Mumbai.

· BSE Index is known as SENSEX. SENSE measures on the basis of 30 top companies.

|

Share Price index of famous stock exchange of the World |

|

|

Mumbai (BSE, NSE) |

Dollex Sensex, S & P CNX Nifty, Fifty |

|

New York (NYSE, NASDAQ) |

Dow Jones, NASDAQ |

|

Tokyo |

Nikkei |

|

Frankfurt (Germany) |

DAX |

|

Hongkong |

Hangseng |

|

Singapore |

Simex, Straits Times |

|

London |

FTSE |

|

Paris |

CAC. |

NSE (National stock Exchange)

· National Stock Exchange was set up by leading institutions to provide a modern, fully automated screen based trading system with national research.

· NSE started trading in the equities segment on November 3 1994.

· NSE commenced operations in Derivatives segment in June 2000 with the launch of Index futures. The future contracts are based on the popular benchmark SNP CNX Nifty index and it measures on the basis of to 50 Companies.

· The exchange trading share in index Nifty.

· On June 15, 1995 National Stock Exchange launched two new reference rates for the loans Inter-Bank Call Money Market. These rates are-MIBOR (Mumbai Inter Bank Offer Rate), MIBID (Mumbai Inter Bank Bid rate).

· MIBOR will be the indicator of lending rate for loans.

· MIBID will be lending rate for receipts.

· The National Stock Exchange (NSE) has launched a new version of its online trading software called "National Exchange for Automatic Trading" (NEAT)

OTC Exchange of India

· The establishment of the over counter exchange of India or OTECI marked the drawn of a new era in the history of stock exchange in India.

· It was promoted in 1990 jointly by ICICI, IDBI, IFCI, SBI capital markets Ltd. UTI, GIC, LIC etc. These institutes are sponsor members of this stock exchange.

· OTECI introduced many novel concepts to the Indian capital markets such as screen based nationwide trading, sponsorship of companies market making and scruples trading.

Security and Exchange Board of India (SEBI)

· SEBI was established on 12 April, 1988 as a non-statutory body through a resolution of government.

· It was established for dealing with all matters relating to development and regulation of securities market and investor protection and to advise the Government on all these matters.

· SEBI was given statutory status and power on January 30, 1992.

· Its head office is situated in Mumbai.

Functions of SEBI

· To regulate the business of stock exchanges and other securities market.

· To encourage self-regulatory organizations.

· To check insider trading of securities.

· To regulate the working of Stock Brokers, Sub-brokers, Share Transfer Agents, Trustees, Merchant Bankers, Underwriters, Portfolio Manager etc. and also to make their registration.

· To safeguard the interests of investors and to regulate capital market with suitable measures.

Depository System in India

· Depository system is that system in which ownership of security is hanged by an electronic account entry and physical transaction of securities does not take place.

· On November 8, 1996, the first share depository in the country was established in Mumbai, named as National Securities Depository Limited. NSDL has been established by 3 main functional institutions in the country, i.e. UTI, IDBI and NSE.

· In February 1998, the second depository system "Central Depository Services India Ltd (CDSL) has been started. CDSL has been sponsored by BSE, Bank of India, Bank of Baroda, SBI and HDFC Bank.

· CDSL got registered with SEBI on August 19, 1998.

Depository:

A depository can be compared to a bank. Aback holds cash for customers and provides services related to transaction of cash for a customer opens an account in any of the branches of the bank. A depository holds securities for investors in e-form and provide services related to transaction of securities. A depository interacts with clients through Depository participants, which are organized affiliate.

FEMA (Foreign Exchange management Act.)

· Due to economic liberalization relating to foreign investments and foreign trade for closer interaction with the world economy FERA Act 1973, was reviewed a 1993 and several amendments were enacted.

· FEMA 1999 will make favorable development in foreign money market.

Financial Intermediaries

· Intermediaries mediate between savers and investors. They lend money as well as mobilize savings. Their liabilities are towards the ultimate savers while their assets are from the investors or borrowers.

Merchant Banks

· Merchant Banks are those which manage and under write new public issues floated by companies to raise funds from public. They advise corporate clients on mutual fund raising. They are also called investment banks. They deal only with corporates and not general public.

Venture Capital: Venture capital is money provided by financial institutions who invest alongside management in young, rapidly growing companies that have the potential to develop into significant economic contributors. Venture capital is an important source of equity/debt for star up companies.

Angel Investor: Individuals who invest in businesses looking for a higher return than possible from traditional investments. They invest their own money unlike a venture capitalist "who invests public money.

Mutual Funds

· Mutual Fund is a type of collective investment scheme that pools money from many investors and invests it in stocks, bonds short-term money market instruments and other securities.

· Mutual funds have a fund manager who invests the money on behalf of the investors by buying/selling stocks, bonds etc.

· Mutual fund has three tier structure. These are as follows:

Fig: Fund Structure

· Mutual fund is regulated by SEBI.

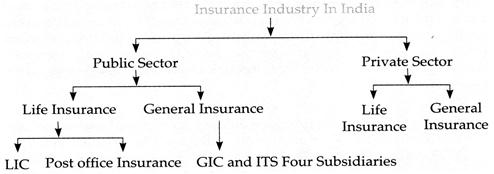

Insurance Sector

· Insurance sector constitutes an important segment of financial market in India and plays a predominant role in the formation of capital in the Country

· Insurance sector development can divide in the following phases:

|

Phase I |

Period |

|

Life insurance |

1818 to 1956 |

|

General insurance |

1850 to 1952 |

|

Phase II |

|

|

Life Insurance |

956 to 2000 Nationally and public |

|

General insurance |

1850 to 1952 Sector Entry |

|

Phase III |

|

|

Life insurance |

After 2000open for private and foreign entities |

· Life Insurance in India was started by the Bruisers. A British firm in 1818 established the Oriental Life Insurance Company at Calcutta.

· Till 1956, in India 245 Indian and foreign insurance companies were working in life insurance.

· On January 19, 1956 Central Government took over the charge of all these 245 Indian and foreign companies and on 1 September 1956 these companies were nationalized.

· 1 September 1956 Life Insurance Corporation of India was established with the capital of Rs. 5 core given by the government of India.

Insurance Regulatory and Development Authority (IRDA)

· IRDA was constituted on 19 April, 2000 to protect the interest of the holders of insurance policies and to regulate, promote and ensure orderly growth of the insurance industry.

· The authority consists of a chairperson, three whole-time members and four part-time members.

· For regulating the insurance sector, the authority has been issuing regulations covering almost the entire segment of insurance industry, namely, regulation on insurance agents, solvency margin, and reinsurance

Obligation of insurers to rural and social sector etc.

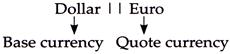

Foreign Exchange

A foreign exchange rate which is also called a forex rate or currency rate represents the value of a specific currency compared to that of another country. Currency rates are applicable only on currency pairs. The currency listed on the left is called the reference currency while the one listed on the right is quote currency.

Exchange rates are always written on quotations. A quotation reflects the number of quote currencies that can be bought by using a single unit of reference currency.

Ex- EURO (EUR) Great Britain Pound (GBP)

Australian Dollar (A![]() )

)

Types of exchange rate.

Spot Exchange Rate: This is the exchange rate that is currently applicable.

Term forward rate: This is the exchange rate that is currently quoted and used for trading.

Determining Currency Exchange Rates

(a) Fixed Rate This currency exchange rate is determined by a government agency or the Central Bank. This exchange rate is regularly monitored by the bank and maintained by the bank and maintained by using the country's own foreign exchange reserves.

(b) Floating Rate: In this flexible exchange rate regime the private market determines a currencies value. However the value fluctuates according to the demand/supply trends in the foreign exchange market.

Foreign Direct Investment (FDI)

· FDI means investment within a foreign country. Companies may Manu facture locally to capitalize on low cost labor, to avoid high import taxes. Investors invest in buying or establishing new operation in foreign countries.

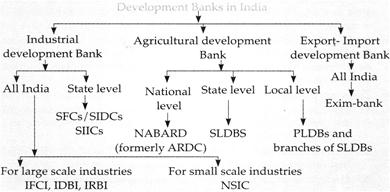

Development Bank:

A development bank is a financial institution concerned with providing all types of financial assistance (medium as well as long term) to business units in the form of loans, under writing, investment and guarantee operations and promotional activities economic development in genera and industrial development in particular

· At present there are five all India industrial development banks. These are ?

1. The industrial Finance corporation of India (IFCI)

2. The industrial development Bank of India (IDBI)

3. The industrial Reconstruction Bank of India (IRBI)

4. National small Industries Corporation (NSIC)

5. Industrial credit and Investment Corporation of India (ICICI)

· IFCI, IDBI, IRBI, NSIC are owned by the state, while last one is a private

Sector institution.

Industrial Finance Corporation of India: (IFCI):

· IFCI was the first development bank established in 1948 in the country for providing medium and long term credits to industrial concerns, particularly in such circumstances where normal banking accommodation is inappropriate or resource to capital issue method is impracticable.

· Major functions of IFCI are as follow:

1. To guarantee loan raised by industrial concerns.

2. To under write the issue of stocks, shares, bonds or debentures by industrial concerns.

3. To subscribe directly to the stock or shares of any industrial concern.

4. To grant loans and advances to or subscribe to the debentures of industrial concerns.

5. To extend guarantee in respect of deferred payments by importers.

Industrial development Bank of India (IDBI):

· The industrial development Bank of India (IDBI) was set up in Jul 1964 as a wholly owned subsidiary of the RBI. It was given complete autonomy in February 1976.

· IFCI and UTI are the subsidiaries of the IDBI. As an apex development bank the IDBI major role is to co-ordinate the activities of other development banks and term financing institutions in the capital market of the country.

· The main functions of IDBI are as follow?

1. Planning, promoting and developing industries with a view to fill the gaps in the industrial structure by conceiving, preparing and floating new projects.

2. Providing refinancing facilities to the IFCI, SFCs and other financial institutions approved by the government.

3. Undertaking market and investment research surveys and techno

4. Purchasing or under writing shares and debentures of industrial concerns.

5. Providing technical and administrative assistance for promotion, management and expansion of industry.

6. Guaranteeing deferred payments due from industrial concerns and for loans raised by them.

7. Co-coordinating the activities of financial institutions for the promotion and development of industries.

· IDBI is the loader, Co-coordinator and innovator in the field of industrial financing in our country. Its major activity is confined to financing, developmental. Co-ordination and promotional functions

Industrial Reconstruction Bank of India (IRBI):

· To provide financial assistance as well as to revive and revitalize sick industrial units in public/private sectors, an institution called the industrial reconstruction corporation of India (IRCI) was set up in 1971 with a share capital of Rs. 10 cores.

· In March 1985, it was converted into a statutory corporation called the industrial Reconstruction Bank of India (IRBI) with an authorize capital of Rs. 200 cores and a paid up capital of Rs. 50 cores.

· IRBI functions are as follows:

1. To provide financial assistance to sick industrial units

2. To provide managerial and technical assistance to sick industrial units.

3. To undertake leasing business

4. To provide consultancy services to the banks in the matter of sick units.

5. To provide merchant banking services for amalgamation, merger, reconstruction etc.

6. To secure the assistance of other financial institutions and government agencies for the revival and revitalization of sick industrial unit.

National small industries corporation (NSIC):

· NSIC was established in 1955 by the Government of India. Its main function is to assist small scale industrial units through promotional marketing and financial activities. NSIC procures machinery for small scale units on a hire purchase basis.

ICICI:

· ICICI was established in 1955 as a private sector development bank at the initiative of the World Bank. Its entire share capital was contributed by banks, insurance companies, foreign institutions and the World Bank.

· The ICICI provides long term and medium term loans in rupees and foreign currencies in various forms:

1. By equity participation

2. Contribution to preference shares and debentures

3. Guaranteeing loans from other private investment sources

4. Under writing new issues and securities

State Financial Corporations (SFCs):

· Under the provision of state financial corporation Act 1952 the SFCs are set up tin different states for providing term finance to medium and small scale industries. There are 18 SFCs operating in seventeen different states and Delhi.

· The SFCs have similar functions to those of the IFCI. They are empowered to provide financial assistance in the form of loans and advances, subscription to shares and debentures, underwriting of new issues and guarantee of loans. But they have mostly concentrated on loans and advances only.

SIICs/SIDCs:

· In 1960, SIDCs & SIICs have been set up by state governments as counterparts of the NIDC presently, there are 28 such institution act in all.

· Besides financial assistance their main function is to promote industries. They arrange for land, put up industrial estates, construct roads, arrange for the supply of water and electric power, and arrange for licenses for industrial units and so on in order to promote industries especially in backward areas.

· Organizational deficiencies, insufficient and untrained staff, defaults in payment of dues are the major weaknesses of these institutions.

Export-Import Bank of India:

· Export-Import Bank of India was set up by the government of India on January 1, 1982, its main objects are ?

1. To ensure integrated and Co-ordinated approach in solving they allied problem encountered by exporters in India.

2. Export projection.

3. To pay attention to the exports of capital goods

4. To tap domestic and foreign markets for resource for under taking development and financial activities in the export sector.

5. To facilitate and encourage joint ventures and export of technical services and international and merchant banking.

6. To extend buyers credit and lines of credit.

Function of Exim-Bank;

1. Planning, promoting and developing exports and imports.

2. Providing technical, administrative and managerial assistance for promotion, management and expansion of exports.

3. Under taking market and investment surveys and techno economic studies related to development of exports of goods and services.

· In June 1986, Exim Bank introduced a new program called the Export Marketing Fund (EMI), under which finance is made available to Indian companies for under taking export marketing activities.

Industrial Finance Corporation of India (IFCI)

· IFCI Ltd. was established in 1948, and its head quarter is NEW DELHI.

· The IFCI is the first development financial institution in the country to cater to the needs of Indian industry.

· IFCI was established to provide long term low interest credit to corporate borrowers.

· In 1 July, 1993, IFCI was re-registerd as a commercial company under the Indian companies Act 1956, and renamed IFCI Ltd.

Industrial Investment Bank of India Ltd (IIBL):

· IIBL Ltd was established on March 20, 1985, head quarter in Kolkata.

· It is fully owned by Govt. of India.

· It will act as an autonomous finance institution like IDBI and IFCI.

Export - Import Bank India (Exim Bank)

· Exim Bank was established on January 1, 1982, and its head quarter is Mumbai.

· The main objective of Exim Bank is to provide financial assistance to exporters and importers with a view to promoting the country's international trade.

· It acts as the apex financial institution for financing foreign trade in India.

National Housing Bank

· NHB was established in 1987 and its head quarter is New Delhi.

· Wholly owned subsidiary of the RBI.

· It was established mainly to provide long term finance to individual households.

IFRS (International Financial Reporting Standards)

· IFRS are standards and interpretation adopted by the international Accounting Standards Board. Many of the standards forming part of IFRS are known by the older name of International Accounting Standards (IAS). In April 2001 the International Accounting Standards Board adopted all IAS and continued their development calling the new standard IFRS.

Foreign Currency Convertible Bond (FCCBs)

· They are a type of convertible bond issued in a currency different than the issuer's domestic currency. Money is raised as loan which is later converted into equity in the company.

ECBs (External Commercial Borrowings)

· External Commercial borrowings include Bank loans, supplier credits Fixed and floating rate bonds and borrowing from private sector windows of multilateral financial institutions such as IFC. In India External Commercial borrowings are permitted by the government for providing an additional source of funds to Indian Corporate and PSUs.

· ECBs can be used for any purpose except for investment in stock market and speculation in real estate.

CAPITAL MARKET GLOSSARY

Arbitrage: The business of taking advantage of difference in price of a security traded on two or more stock. Exchanges, by buying in one and selling in the other (or vice versa). Quite simply it means you try to buy something cheap in one place, to make a profit selling it somewhere else- Given the Speed at which the financial markets now operate, in practice the simultaneous purchase of Foreign exchange, securities, commodities or any other financial instrument in one market and the sale in another at a higher price.

Averaging: The process of gradually buying more and more securities in a declining market (or selling in a rising market) in order to level out the purchase (or sale) price

Bears: These stock market animals are pessimists; they expect share prices or any other type of Investment to fall. In a 'bear market' the general sentiment is that prices are going to go lower and majority of dealers will sell as quickly as possible for fear of holding shares which diminish in Value. Bears, like 'bulls' drive the market.

Bear Market: A prolonged period of falling securities prices in a stock market.

Badla: Carrying forward of transaction form one settlement period to the next without effecting delivery or payment. Badla involves carrying forward of a transaction from one settlement period to the next. The carry- forward is done at the making up price, which is usually the closing price of the Last day of settlement. A Badla transaction attracts the following payments charges: (a) 'Margin money' specified by the stock exchange board; and (b) Badla charges (interest charges) determined on the basis of demand and supply forces.

Blue Chips: Blue Chips are shares of large, well established and fi- manically sound companies with an Impressive records of earnings and dividends. Generally, Blue Chip shares provide low to moderate current yield and moderate to high capital gains yield. The price volatility of such shares is moderate.

Bonus: A free allotment of shares made in proportion to existing shares out of accumulated reserves. A bonus share does not constitute additional wealth to shareholders. It merely signifies recapitalization of reserves into equity capital. However, the expectation of bonus shares has a bullish impact on market sentiment and causes share prices to go up.

Book Closure: Dates between which a company keeps its register of members closed for updating prior to payment of dividends or issue of new shares or debentures.

Bull: A bull is one who expects a rise in price so that he can later sell at a higher price.

Bull Market: A rising market with abundance of buyers and few sellers.

Base Price: This is the price of a security at the beginning of the trading day which is used to determine the Day Minimum / Maximum and the Operational ranges for that day.

Buyer: The trading member who has placed the order for the purchase of the securities

Bid and offer Bid is the price at which the market maker buys from the investor and offer is the price at which he offers to sell the stock to the investor. The offer is higher than the bid.

Brokerage: Brokerage is the commission charged by the broker. The maximum brokerage chargeable is determined by SEBI.

Basket trading: is a facility by which investors are in a position to buy / sell all 30 scraps of Sensex in the proportion of current weights in the Sensex, in one go.

Beta: It is a standard measure of risk for an individual stock. It is the sensitivity of the movement of the past share price of a stock to the movement of the market as a whole. The beta of the market is taken as 1. A benchmark index (the Sensex, for instance) is taken as the proxy for the market. Stocks with betas greater than 1 tend to amplify the movement of the market. If a stock has a beta of 1.20, it means that if the market has moved by 1%, the stock price would have moved by an extra 1.2%.

Bid this is the highest price at which an investor is willing to buy a stock. Practically speaking, this is the available price at which an investor can sell shares.

Bad delivery: When physical share certificates along with transfer deeds are delivered in the market there are certain details to be filled in the transfer deed. Any improper execution of these details result in a bad delivery. A bad delivery may pertain to the transfer deed or the share certificate and maybe because of the transfer deed being torn, mutilated/ overwritten, defaced etc.

Buy limit order: An order of buying a security with a condition that order will not be executed above the specific mentioned price.

Buy on close: An order of buying a stock, but only at the end of the trading day. Security -will be bought in the closing price range.

Breakout: When the price of a stock surpasses its initial high (resistance level) or falls below the initial low (support level), it is termed as break out in technical analysis.

Book runner: Institution that arranges and manages the book building process for the new public issue.

Beneficial owner: the actual owner of the security, irrespective of who is holding the security.

Best ask: The lowest price at which a stock is quoted to be sold.

Best bid: The highest price quoted for a particular stock to be bought.

Bid/Ask spread: The difference between the ask price and bid price,

Bourse: The floor of a Stock Exchange.

Cash Settlement: Payment for transactions on the due date as distinct from carry forward (Badia) from one settlement period to the next.

Clearing Days or Settlement Days: Dates fixed in advance by the ex- change for the first and last business days of each clearance. The intervening period is called settlement period.

Clearing House: Each Exchange maintains a clearing house to act as the central agency for effecting delivery and settlement of contracts between all members. The days on which members pay or receive the amounts due to them are called pay-in or pay-out days respectively.

Correction: Temporary reversal of trend in share prices. This could be a reaction (a decrease following a consistent rise in prices) or a rally (an increase following a consistent fall in prices).

Closing Price: The trade price of a security at the end of a trading day Based on the closing price of the security, the base price at the beginning of the next trading day is calculated.

Counterparty: When a trading member enters an order, any other trading member with an order on the opposite side is referred to as the counterparty.

Carry forward trading. Trading where the settlement of trades is post-phoned on the stock exchange until a future settlement period involving payment of interest on the account. It refers to the trading in which the settlement is postponed to the next account period on payment of counting charges (known as 'vyaj badia') in which the buyer pays interest on borrowed funds or the backwardation charges (a.k.a 'unda badia') in which the short seller pays a charge for borrowing securities.

Clearing: Clearing refers to the process by which mutual indebted-ness among members is settled. The clearing corporation matches the final buyers and sellers through multilateral netting. The members of the clear- ing corporation also known as clearing members settle their dues with the clearing house that is operated by the clearing corporation. The clearing corporation is the legal counter-party to both legs of every trade. Company objection: An investor sends the certificate along with the transfer deed to the company for transfer. In certain cases the registration is rejected if the shares are fake, forged or stolen or if there is a signature difference etc.: In such cases the company returns the shares along with a letter which is termed as a company objection.

Call Option: This is the right, but not the obligation, to purchase shares at a specified price at a specified date in the future. See Options. For this privilege, the buyer pays a premium which would be a fraction of the price of the underlying security. You are gambling that the share price will rise above the option price. If this happens you can buy the shares and sell them immediately for a profit. If the share price does not rise above your option price, you do not exercise the option and it expires all you have lost is the initial payment made to purchase the option.

Call: The demand by a company or any other issuer of shares for payment. It may be the demand for full payment on the due date, such as, for example, with a rights issue. It may, alternatively, be the demand for a further payment when the total amount is payable by instalments. The calls are usually made several months apart by call letter and the shares are said to be paid-up when the final call has been paid. A call by a company should not be confused with a call option.

Capital Adequacy: The test of a securities business's ability to meet its financial obligation. Capital adequacy rules mean that a bank/financial institution has to have enough money to conduct its business.

Capitalization: The total value of the company in the stock market. This value is arrived at by multiplying the number of shares in issue by the company's share price. This market capitalization obviously Fluctuates as the share price moves up and down. It's an important figure - if your company is worth £2 billion, you'll have more credibility with bankers and other companies you want to take over than if you're a little minnow with hardly any value.

Capitalization Issues: Money from a company's reserves is converted into issued capital, which is then distributed to shareholders in place of am cash dividend. This is also known as a Scrip Issue.

Call Risk: The risk that bonds will be redeemed (or "called"', before maturity. This possibility increases during periods of falling interest rates.

Capital Appreciation; An increase in the value of an investment, mea- soured by the increase in a fund unit's value from the time of purchase to the time of redemption.

Capital Gain: The amount by which an investment's selling price ex-cedes its purchase price.

Capital Market: A market where debt or equity securities are traded.

Commercial Paper: Paper; Debt instruments issued by corporations to meet their short-term financing needs. Such instruments are unsecured and have maturities ranging from 15 to 365 days.

Commission: A fee charged by a broker or distributor for his/her service in facilitating a transaction.

Coupon; Interest rate on a debt security that the issuer promises to pay to the holder until maturity. Usually expressed as a percentage of the face value

Consideration: Consideration is the total purchase or sale amount as- associated with a transaction. The amount you 'pay' or 'receive'. It may also be the basis for working out the commission, taxes and any other charges you are asked to pay.

Contract: On any securities market this is the agreement between a buyer and a seller buy or sell securities. The written agreement between the seller and the buyer to transfer ownership of the property from the former to the latter. It is a legally binding agreement for sale. In two identical parts, one signed by seller and one by purchaser. When the two parts are exchanged (exchange of contracts) both parties are committed to the transaction.

Convertible: Any security is described as convertible when it carries the right or option for the holder to at some stage convert it in for another form of security at a fixed price. Convertibles are often bonds or loan stock (but sometimes preference shares) which carry the right to be converted into ordinary shares at some date in the future at a previously specified price.

Corporate Bonds: A corporate bond is an IOU (Promissory Note) issued by a public company, such as HLL, ITC, TELCO etc. When you invest in a corporate bond, you are lending money to the company. In return you will receive interest at a fixed rate and the promise that your capital will be repaid at a certain date in the future. The guarantee that our capital will be returned is only as good as the company you are lending money to. While

HLL, ITC, TELCO are considered 'good risks' by investment pundits because they are blue chip companies, other smaller companies are likely to be a less good risk.

Correction: A correction is a term to describe a downward movement in share prices. In other words, a shake out or even a crash or mini-cash. Stockbrokers and fund managers like the term correction, perhaps because they believe if they use the term crash or 'heavy fall', it'll cause panic. What- ever you decide to call a downward jolt in share prices, if you lose money, it may be described as a correction, but you'll feel pretty sick all the same!

Clearing: Clearing refers to the process by which all transactions between members is settled through multilateral netting.

Cum- bonus: The share is described as cum-bonus when a potential purchaser is entitled to receive the current bonus.

Cum-right: The share is described as cum-rights when a potential purchaser is entitled to receive the current rights

Carry Over Margin: The amount to be paid by operators to the stock exchange to carry over their transactions from one settlement period to another.

Cash Settlement: Payment for transactions on the due date as distinct from carry -forward (badla) from one settlement period to the next

Capital loss: The negative difference between the selling price of the stock and purchase price of the stock.

Cash markets: The markets where securities (assets) have to be delivered immediately.

Capital Asset Pricing Model (CAPM): A model describing the relationship between risk and expected return, and serves as a model for the pricing of risky securities. CAPM says that the expected return of a security or a portfolio equals the rate on a risk-free security plus a risk premium. If this expected return does not meet or beat required return then the investment should not be undertaken.

Circuit breaker: When a stock price increases or decreases by a certain percentage in a single day it hits the circuit breaker. Once the stock hits the circuit breaker, trading in the stock above (or below) that price is not allowed for that particular day.

Custodial fees: The fees charged by the custodian for keeping the securities.

Cumulative preference share: Preference shares whose dividends will get accumulated, if the issuer does not make timely dividend payments.

Convertible preference shares: Preference shares that can be converted into equity shares at the option of the holder.

Commercial Paper (CP): CPs are negotiable, short-term, unsecured, promissory notes with fixed maturities, issued by well rated companies generally sold on discount basis.

Counter-party risk: It is the risk that the other party to a contract may not fulfill the terms of a contract.

Dividend: This is the income you receive as a shareholder from company. When you buy an ordinary share in a company, you become shareholder (an owner of the business) and to that extent you will have certain entitlements including the right to receive dividend payments as set by the board of directors and approved by the shareholders (sometimes called members) dividend is a cut of the profits earned by the business for the year. This pay-out is not guaranteed and where it exists at all, the amount you'll receive will vary from company to company and year to year.

Dividends from Mutual Funds: Mutual Fund dividends are paid on the face value of the units (usually Rs. 10 per unit). Unlike a dividend from an equity share, mutual fund dividends are not necessarily paid out of the profits of the scheme. As such, after the payout of the dividend, the Net Asset Value (NAV) of the scheme falls to the extent of the payout

Day Trading: Day trading is the buying and selling of stocks during the trading day by individuals known as day traders on their own account. The aim is to make a profit on the day and have no open positions at the close of the trading session, the day.

Debenture: A loan raised by a company, paying a fixed rate of interest and which is secured on the assets of the company. Debentures are fixed interest securities in return for long-term loans, they tend to be dated for redemption between ten and forty years ahead of the date of issue. They may be secured by a floating charge on the company's assets or they may be tie to specific, named assets. Debenture interest has to be paid by a company whether it makes a profit or not - if the debenture holders do not get paid they can legally force the company into liquidation to realize their claims on the company's assets.

Derivatives: Instruments derived from securities or physical markets. The most common types of derivatives that ordinary investors are likely to come across are futures, options, warrants and convertible bonds. Beyond this, the range of derivatives possible is only limited by the imagination of investment banks. In other words, new derivatives are being created at the time. It is likely nowadays that any person who has funds invested will unwittingly perhaps be indirectly exposed to derivatives.

Delivery: A transaction may be for "spot delivery" (delivery and payment on the same or next day) "hand delivery" (delivery and payment on the date stipulated by the exchange, normally within two weeks of the contract date) special delivery (delivery and payment beyond fourteen days limit subject to the exact date being specified at the time of contract and authorized by the exchange) or "clearing" (clearance and settlement through the clearing house).

Day Minimum/Maximum range: The minimum/maximum price range for a security on a trading day. Buy orders outside the Maximum of the range and sell orders outside the Minimum of the range are not allowed to be entered into the system. It is calculated as a percentage of the Base price.

Day order: A day order, as the name suggests, is an order which is valid for the day on which it is entered. If the order is not matched during the day, at the end of the trading day the order gets cancelled automatically

Dealer: A user belonging to a Trading Member. Dealers can participate in the market on behalf of the Trading Member.

Disclosed Quantity (DQ): A dealer can enter such an order in the system wherein only a fraction of the order quantity is disclosed to the market. If an order has an undisclosed quantity, then it trades in quantities of the disclosed quantity.

Demat trading: Demat trading is trading of shares that are in the electronic form or dematerialised shares. Dematerialisation is the process by which shares in the physical form are cancelled and credit in the form of electronic balances are maintained on highly secure systems at the depository

Date of payment: Date on which dividend cheese are mailed.

Deferred taxes: Amount allocated during an accounting period to cover tax liabilities that have not yet been paid and also may not have accrued. For instance, a heavy advertisement expenditure capitalized may give significant tax break.

Delivery price: The price fixed by the clearing house at which deliveries on futures are to take place. In practice, at this price contracts are settled by payment or receipt of the difference

Delivery date: The date on which forward or futures contract for sale falls due. Dividend yield Annual dividend paid on a share of a company divided by current share price of that company.

Diversification: Investing in a basket of shares with different risk-reward profile and correlation so as to minimize unsystematic risk.

Discounted payback period; Period in which future discounted cash in- flows equal the initial outflow. Discount factor. Expected rate of return by which, future cash flows are deflated. The discount rate is annual rate and deflating future cash flow takes place in a compounded manner.

Downgrade: Refers to lowering of ratings for a share by analysts, intermediaries or investors.

Ex-bonus: The share is described as ex-bonus when a potential purchaser is not entitled to receive the current bonus, the right to which remains with the seller.

Ex-rights: The share is described as ex-rights when a potential purchaser is not entitled to receive the current rights, the right of which remains with the seller.

Earnings per Share (EPS): It is the most important measure of how well (or otherwise) the board of directors are doing for the shareholders. This measure expresses how much the company is earning for every share held. The calculation is 'pre-tax profit dividend by the number of shares in issue'. Earnings per share is more important than the overall reported profit figure the reason is that EPS provides a more pure measure of profitability.

Eurobond: A Eurobond is a medium or long-term interest-bearing bond created in the international capital markets. A Eurobond is denominated in a currency other than that of the place where it is being issued. Eurobonds are only issued by major borrowers, such as governments, other public bodies or large multinational companies.

Ex-Dividend: This is a share sold without the right to receive the declared dividend payment that is marked as due to those shareholders where on the share register at a pre-announced date. The stock market authorities usually specify the date on which a share will begin trading ex div. The share price invariably drops when the share goes ex dividend, taking the known income of the dividend out of the share price.

EX-coupon: A stock or bond sold without the right of receipt of the next due interest payment.

ESOP: Employee Stock Option Plan is a trust established by a company to allot some of its paid-up equity capital to its employees over a period of time. They are used to reward employees.

Exercise price: The pre-determined price at which the underlying future or options contract may be bought or sold

Exercise the option: The act of buying or selling the underlying asset via the option contract.

Efficient capital market: - A market in which all the players have all the material information at their disposal at the same time.

Fundamental. Analysis: Analysis of a security which takes into consideration balance sheet analysis, profit and loss fundamentals, management, the nature of business and other such items.

Feature: A term used to designate all contracts covering the purchase and sale of financial instruments or physical commodities for future deliver on a commodity futures exchange.

Gearing: Using borrowed funds as well as, or instead of the investor's own equity to purchase an asset. See also Leverage, Negative gearing.

Hedge Fund: A type of investment fund, usually used by wealthy individuals and institutions, for which the fund manager is authorized to use a number of aggressive investment techniques, including using derivatives, short selling and leverage.

Hedging: An investment made in order to protect against loss in another security, by taking an offsetting position in a related security, such as an option. Hedges reduce potential losses and also tend to reduce potential profits.

Initial Public Offering (IFCN: The first sale of stock of a company to the public.

Inside Day: A day where the price range of a security is within the previous day's price range; ie a higher low and a lower high

Insider Trading: Illegally trading on information not available to the general public

Insolvency: Being unable to meet debt obligations as they fall due, owing to an excess of liabilities over assets.

Institutional. Investor: An entity with large amounts of its own assets, or assets held in trust by it for others, to invest. Examples are superannuation funds, life companies and banks. Institutional investors account for a large portion of market volume and exert an increasing amount of influence on the market.

Interest Rate Futures: These are futures contracts and transferable agreements whose underlying security is a debt obligation. Interest rate futures contracts offered on the Sydney Futures Exchange are 3 year and 10 year Government bonds, and bank bills.

Management Buy-in (MB): The purchase of a controlling interest in a business by an outside management team.

Management Buy-out (MBO): The purchase of all outstanding shares in a business by its management team.

Margin: A good faith deposit required by an exchange or clearing house as collateral for an investment in securities purchased on credit.

Margin Call: Unfavorable movements in securities purchased on credit will result in a demand by a broker to an investor to put up money due to this decline in value. The exchange or clearing house calculates margins daily and requires prompt lodgment of sufficient collateral to maintain the required margin level and cover potential losses.

Market Capitalization; The market price of a company, calculated by multiplying the share price by the number of shares outstanding. The market Capitalization of the share market is the sum of the value of listed shares.

Market Maker: An exchange member who provides market liquidity making a market by buying and selling for his own account at publicly quoted prices.

Money Supply: The total supply of money in circulation, held by members of the public and in bank deposits.

Naked Option: The writing of an option without ownership of the underlying asset.

Offer: The lowest price that an investor or dealer is prepared to sell a given security.

The same as Ask.

Off Market: Refers to a transaction which takes place outside the formal market, such as the transfer of shares between parties without going through a broker. Such transactions are conducted through negotiation and executed with an "Australian Standard Transfer Form".

Open Interest: The net total number of futures or option contracts that have not yet been exercised, expired, or delivered.

Open Order: An order to buy or sell securities that has not been executed and which remains effective until it is executed, cancelled or changed to a different price.

Open Outcry: The method of public auction where all bids and offers are made verbally in trading rings or pits.

Option Buyer/Taker: The party who pays a premium to obtain the right to exercise a put or the call option. The party -who sells them that right is the Option Writer.

Option Premium: The dollar amount per share that is paid by the option buyer to the seller (writer) for an option. The premium is determined by supply and demand, time left till expiry of the contract and volatility of the underlying share price.

Option Writer: The party who sells an option contract to another investor and receives premium income for doing so.

Option Clearing House (OCH): This is the overseer of the options market. Its duties include matching option buyers and sellers and reviewing the financial situation of contract holders.

Ordinary Shares: The most commonly-traded security, which grants ownership in a company. Ordinary shareholders may receive payments in cash, called dividends, and capital appreciation if the company trades profitably the ordinary shareholders have no preferential rights in the liquidation process if a company is wound up.

Out of the money: A call option whose strike price is higher than the current market price of the underlying security, or a put option whose strike price is below the current price of the underlying security.

Overbought: Market condition where prices have risen too steeply and too quickly and are in danger of reversing.

Oversold: Market condition where prices have declined too steeply and too quickly and are in danger of reversing.

Oversubscribed: Term used to describe a situation in which the buyer for a new share issue want more shares than the amount to be allocated.

Over the counter Optics (OTC Option): An option which is 'tailor made' for a client by a financial institution. OTC options are bought and sold through negotiation and are not traded on a listed exchange.

Pooled Investments: Funds which are collected from a number of individual investors, pooled together and managed by professionals. Diversification and professional money management are the main benefits.

Portfolio Investment holdings of an individual investor or organization usually composed of a mix of different asset classes of securities, such as shares, fixed interest and property. A share portfolio would include a mix of different sectors and stocks.

Portfolio Insurance: A strategy designed to protect a portfolio of stocks against market risk by selling index futures short or buying stock index put Options for downside protection.

Preference Share: Shares which provide a specific dividend that is paid before any dividends are paid to ordinary shareholders and which rank ahead of common shares in the event of a liquidation.

Premium: Describes any asset that is valued at more than the normal market price. The opposite of Discount. Also the price an investor pays the writer of an option.

Price/Earnings Ratio (P/E Ratio): The market price of a company's shares divided by its earnings per share to determine its attractiveness and how expensive in relation to other companies.

Price Range: An index or share highest price and lowest price reached during any specific day, week or year.

Put Call Ratio: The ratio of put trading volume divided by the call trading volume over a specific period of time.

Put Option: A contract which gives the purchaser the right, but not the obligation, to sell a certain quantity of an underlying security to the writer of the option, at a specific price within specified period of time/s highest price and lowest price reached during any specific day, week or year.

Warrant: A security similar to an option but usually with a longer term till expiry. A stock warrant allows a trader to purchase shares at a fixed price for a certain period of time.

Wasting: Asset: An asset, such as an option, this declines in value over time because its time value will decay until expiry.

Weighting: Specification measuring the relative importance of item when combined, such as the percentage of a portfolio or index that a given share represents.

White Knight: A friendly party in a takeover who acquires the company to avoid a hostile takeover by an undesirable black knight.

Yield: The annual rate of return on an investment expressed as a percentage.

Yield Curve: A curve that shows the relationship between fixed interest investments at a given point in time. A normal yield curve would show higher interest rates for long-term investment, while a negative or inverted curve indicates higher short-term rates.

Yield to Maturity: The yield that would be realized on a fixed income security provided it is held to its maturity date, including interest payments and capital gains or losses.

You need to login to perform this action.

You will be redirected in

3 sec