Notes - Union Government

Category : UPSC

UNION GOVERNMENT

Introduction

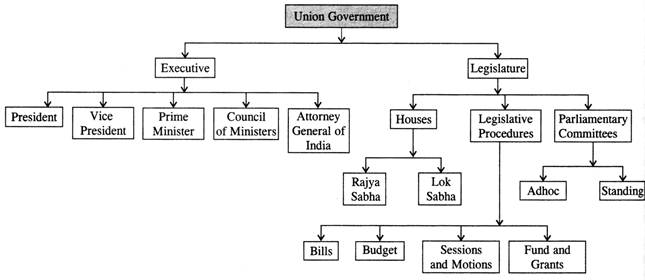

The Government of India or the Central or the Union Government is divided into three main sections, namely the executive, Legislature and the judiciary.

The union Government

PART V (ARTICLES 52 TO 151) deals with the Executive, Parliament (Legislature), Union Judiciary and the coptroller and Auditor General of India.

Union Executive: Articles 52 to 78 (Part V).

Union Executive in India consists, of the President, Vice-President, Prime minister and his/her Council of ministers and the Attorney General of India.

UNION EXECUTIVE

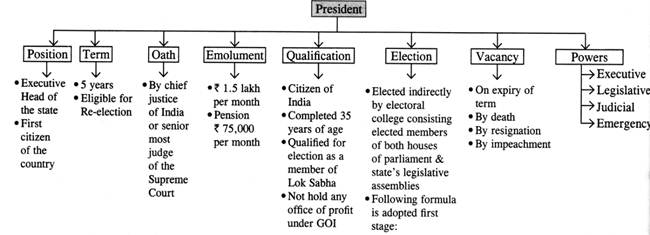

The President

Election of the President (Articles 54 & 55)

(a) Elected members of both houses of parliament.

(b) Elected members of the legislative assemblies of the states.

Members of legislative councils (in case of the bicameral legislature in state) do not participate in presidential election. Nominated members of both the Houses at the Centre and the States do not have voting rights in the election of the President.

Value of the cote of an MLA

\[=\frac{Total\,\,population\,\,of\,\,the\,\,state}{\begin{align}

& Elected\,\,members\,\,of\,\,the\,\,state \\

& legislative\,\,assembly\times 1000 \\

\end{align}}\]

Value of vote of an MP\[=\frac{MLAs\,\,of\,\,all\,\,states}{Total\,\,Nos.\,\,of\,\,elected\,\,MPs}\]

Population data used for these calculations are of 1971 census. 42nd amendment, 1976 froze the "last preceding census" to 1971, till the first census after 2000.

In 2000, the Union cabinet decided to extend the freeze on fresh delimitation of parliamentary and assembly constituencies up to 2026. The argument was that the states which had better population control thought that such a revision would reduce their seats in the parliament.

After calculating the value of vote of MLAs and MPs, a complex system of calculating the quota of individual candidates is used which is based on the order of preference of candidates.

Disputes on election of the President

Article 71 provides that all disputes arising out of the election of President or Vice-President shall be 'inquired' into and 'decided' by the Supreme Court whose decision shall be final.

If the election of President is declared void by the Supreme Court, the acts performed by President before the date of such decision of court remain valid.

Article 71(4) declares that the election of President or Vice-President cannot be challenged on the ground of any vacancy in the Electoral College which elects him.

Qualifications for the Office of President

(a) Citizen of India

(b) Completed 35 years

(c) Qualified for election as a member of the Lok Sabha, i.e. he must be registered as a voter in a parliamentary constituency.

(d) Not hold any office of profit under GOI, or any state government or under any local or other authority subject to the control of the government.

(a) By resignation in writing under addressed to Vice-President of India who shall communicates it to the speaker, Lok Sabha.

(b) By removal by Impeachment (Article 61). The only ground for impeachment specified in Article 61 (1) is 'Violation of the Constitution'.

Impeachment against the President

Impeachment is a quasi-judicial procedure mentioned in Article 61.

Impeachment charge against the President may be initiated by either houses of the parliament.

Impeachment Process

Charge must be in the form of a proposal/ resolution signed by not less than 1/4th of the total members of the house and moved after giving at least 14 day’s advance notice to the President.

\[\downarrow \]

This resolution must be passed by a Majority of not less than 2/3rd of the total membership of the initiating house.

\[\downarrow \]

Charge is then investigated by the other house. The President has right to appear and to be represented at the investigation.

\[\downarrow \]

If the other house, after investigations, passes a resolution by 2/3rd majority of the total membership declaring that the charge is proved, the President is removed from the office from the date on which the resolution passed.

In this context, two things should be noted:

(a) the nominated members of either House of Parliament can participate in the impeachment of the President though they do not participate in his election;

(b) the elected members of the legislative assemblies of states and the Union Territories of Delhi and Pondicherry do not participate in the impeachment of the President though they participate in his election.

No President has so far been impeached.

Vacancy in the office of President [Article 65(1)]

(a) On the expiry of the term (5 years)

(b) By his/her death

(c) By his/her resignation

(d) On his/her removal by impeachment

[Article 65(1)].

If the President is temporarily unable to discharge his/her duties due to an absence from India, illness or any other such cause, Vice-President hall discharge his functions until the President resumes his duties [Article 65(2)].

In case the office of Vice-President is vacant, the Chief Justice of India (or if his office is also vacant, the senior most judge of the Supreme Court available) acts as the President or discharges the functions of the President.

When any person, i.e Vice-President, Chief Justice of India, or the senior-most judge of the Supreme Court is acting as the President or discharging the functions of the President, he enjoys all the powers and immunities of the President and is entitled to such emoluments, allowances and privileges as are determined by the Parliament.

Privileges of the President (Article 361)

(a) He is Not answerable to any court for the exercise of powers and duties of his office. However during, investigations to the charges of impeachment, conduct of the President may be reviewed by any court, tribunal or body appointed by either house of Parliament.

(b) During his term of office, no criminal proceedings, no process for arrest or imprisonment can be undertaken.

(c) No civil proceeding until:-

(a) A notice in writing has been given to the President 2 months in advance.

(b) The notice states the nature of proceeding, cause of action, name, residence and description

of the party taking the proceedings and the relief claimed.

Value of vote of an MLA

\[=\frac{Total\,\,population\,\,of\,\,state}{Total\,\,no.of\,\,elected\,\,members\,\,in\,\,state\,\,legislative\,\,assembly}\times \frac{1}{1000}\]

Value of vote of an MP

\[=\frac{Total\,\,value\,\,of\,\,votes\,\,of\,\,all\,\,MLAs\,\,of\,\,all\,\,states}{Total\,\,no.elected\,\,MPs}\]

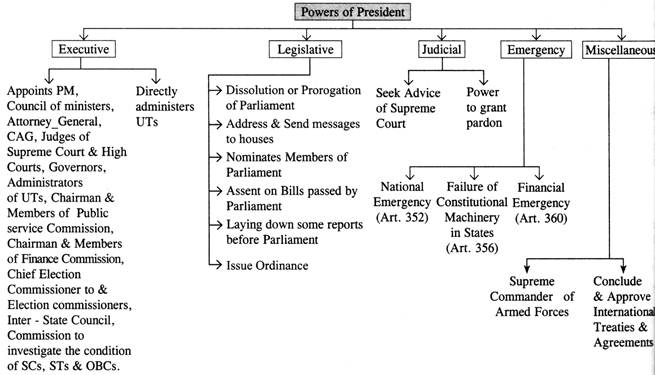

Powers and Duties of the President

Legislative Powers

(a) He may declare his assent to the bill.

(b) He may declare that he withholds his ascent to die bill.

(c) He may, in case of bills other than money bills, return the bill for reconsideration of the houses.

For Rajya Sabha, 12 members are nominated. These persons are having the special knowledge or practical experience of Literature, Science, Art and Social Service [Article 80(1)].

(i) Bill for formation of new states or alteration of boundaries of existing states (Article 3).

(ii) Money bill [Article 117(1)].

(iii) Bill involving expenditure from consolidated fund of India even though it may not be a money bill.

(iv) State bills restricting Freedom of Trade (Article 304).

The Veto power enjoyed by the executive in modern states can be classified into the following four types

It is the power to say no to a Bill passed by both Houses of Parliament. Such as Bill never becomes an act. The power cannot be overridden by the legislature. The Indian President has this power in relation in Bills except Money Bills.

The President exercises this veto, when he returns a Bill for reconsideration of the Parliament. However, if the Bill is passed again by the Parliament, with or without amendments and again presented to the President, it is obligatory for the President to give his assent to the Bill.

In this case, the President neither assents nor rejects nor returns the Bill, but simply keeps the Bill pending for an indefinite period. This power of the President not to take any action (either positive or negative) on the Bill is known as the Pocket Veto. Since, the Constitution of India does not specify a time limit for the President to give assent to a Bill, the Indian President can exercise Pocket veto.

It is the power of veto which can be overridden by the legislature by a higher majority. The American President may return a Bill within 10 days specifying his objections to the Bill. If both the houses pass the Bill again with 2/3rd majority (present and voting) the veto is overridden. If the requisite majority cannot be mustered, the veto stands. In India, there is no qualified veto.

Financial Powers

Executive Powers

Judicial Powers

Military Powers

President is the supreme commander of the armed forces of the country. The exercise of this power is regulated by law (Article 53). He appoints the chiefs of the Army, Navy and Air force. He can declare war or conclude peace subject to the approval of the parliament.

Diplomatic Powers

He represents India in international forums. He sends and receives ambassadors and diplomatic representatives. All treaties and international agreements are negotiated and concluded in his name though subject to approval of the Parliament.

National Emergency

State Emergency/President's Rule

(i) Failure of constitutional machinery in the states (article 356) or

(ii) Failure to comply with or to give effect to directions given by the union (article 365)

(i) Proclamation of national emergency should be in operation in the entire country, or in the whole or any part of the concerned state; and

(ii) The election commission must certify that the general elections to the concerned state cannot be held on account of difficulties.

(i) Assign to himself all or any of the functions of the state government and powers of the governor.

(ii) Declare that the powers of the state legislature

shall be exercisable by or under the authority of the parliament.

(iii) Authorize (when the Lok Sabha is not in session) expenditure from the consolidated fund of the state pending the sanction of such expenditure by the parliament.

(iv) Promulgate ordinances for the administration of the state when the parliament is not in session.

Financial Emergency

Miscellaneous Powers/Residuary Powers

Ordinance Making Power of the President (Article 123)

Position of Indian President

The position of the Indian President is somewhat difficult to categorise. Like the American president, he is elected for a fixed term, and like his American counterpart he is removable by the legislature through the process of impeachment. But the Indian Constitution makers preferred not to go completely the American way because absence of coordination between the legislature and the executive is a source of weakness of he American political system. Political analysts prefer to use the more dignified term of "Constitutional head" the president has thus been made a formal or constitutional head of the executive and the real executive powers are vested in the Ministers or the Cabinet.

List of President of India

|

Name |

Tenure |

Important Facts |

|

|

|

From |

To |

|

|

Dr. Rajendra Prasad |

26.01.1950 |

13.05.1962 |

First President and also had the Longest tenure (12 years). |

|

Dr. S. Radhakrishnan |

13.05.1962 |

13.05.1967 |

Was also the first Vice-President of India. |

|

Dr. Zakir Hussain |

13.05.1967 |

03.05.1969 |

Shortest tenure; First Muslim President to die in harness |

|

V.V. Giri |

03.05.1969 |

20.07.1969 |

First acting President of India. |

|

Justice M Hidayat-ul-lah |

20.07.1969 |

24.08.1969 |

Was also the Chief Justice of India. |

|

V.V. Giri |

24.08.1969 |

24.08.1974 |

--- |

|

F. Ali Ahmed |

24.08.1974 |

11.02.1977 |

Died in Office |

|

BD Jatti |

11.02.1977 |

25.07.1977 |

Acting President |

|

N Sanjeeva Reddy |

25.07.1977 |

25.07.1982 |

Youngest President (64 years) |

|

Giani Zail Singh |

25.07.1982 |

25.07.1987 |

First Sikh President |

|

R Vekataraman |

25.07.1987 |

25.07.1992 |

Oldest President (76 years) |

|

Dr SD Sharma |

25.07.1992 |

25.07.1997 |

--- |

|

KR Narayanan |

25.07.1997 |

25.07.2002 |

First Dalit President |

|

Dr APJ Abdul Kalam |

25.07.2002 |

25.07.2007 |

First Scientist to become President |

|

Mrs Pratibha Patil |

25.07.2007 |

25.07.2012 |

First Woman to become President |

|

Pranab Mukherjee |

25.07.2012 |

Till Date |

--- |

Vice-President

·

Functions of The Vice President

Vice-Presidents of India

|

Vice-Presidents |

Tenure |

|

Dr. Sarvapalli Radhakrishnan |

1952-1962 |

|

Dr. ZakirHussain 1962-1967 |

1962-1967 |

|

Varahagiri Venkatagiri |

1967-1969 |

|

Gopal Swarup Pathak |

1969-1974 |

|

B D Jatti |

1974-1979 |

|

Justice Mohammad Hidayat-ul-lah |

1979-1984 |

|

R Venkataraman |

1984-1987 |

|

Shanker Dayal Sharma |

1987-1992 |

|

K RNarayanan |

1992-1997 |

|

Krishan Kant (Died) |

1997-2002 |

|

Bhairon Singh Shekhawat |

2002-2007 |

|

Mohammad Hamid Ansari |

2007 till date |

The Prime Minister and Council of Ministers

Real Executive Authority

As the President of India is a constitutional executive head, the real executive authority of the Union is exercised by the Prune Minister and his Council of Ministers. The Indian PM has often been designated as primes inter pares (first among equals) & interstellar Lunar linares (moon among the stars).

The Prime Minister

The office of the Prime Minister has been created by the Constitution. The Prime Minister is appointed by the President (Article 75). Generally the President has no choice in the appointment of the Prime Minister and invites the leader of the majority political party in the Lok Sabha for this office. The Prime Minister theoretically holds office during the pleasure of the President. But the Prime Minister actually stays in office as long as he enjoys the confidence of the Parliament especially the Lok Sabha. The normal term is five years but it is automatically reduced if the Lok Sabha is dissolved earlier.

decisions.

Presidential Rule in the states on grounds of breakdown of constitutional machinery or imposition of an emergency due to financial instability.

List of Prime Ministers

|

Name |

Tenure |

Note |

Party (Alliance) |

|

|

|

From |

To |

|

|

|

Jawaharlal Nehru |

15.08.1947 |

27.05.1964 |

First Prime Minister of India, died in office; also had the longest tenure (17 years) |

INC |

|

Gulzari Lal Nanda |

27.05.1964 |

09.06.1964 |

First Acting Prime Minister |

INC |

|

Lal Bahadur Shastri |

09.06.1964 |

11.01.1966 |

Only Prime minister to die abroad during an official tour |

INC |

|

Gulzari Lal Nanda |

11.01.1966 |

24.01.1966 |

First to become Acting Prime Minister twice |

INC |

|

Indira Gandhi |

24.01.1966 |

24.03.1977 |

First woman Prime Minister of India; First Prime Minister to lose an election |

INC |

|

Morarji Desai |

24.03.1977 |

28.07.1979 |

Oldest Prime Minister (81 years) and the first to resign from office |

Janta Party |

|

Charan Singh |

28.07.1979 |

14.01.1980 |

Only Prime Minister who did not face the Parliament |

Janata Party (Sucular) with INC |

|

Indira Gandhi |

14.01.1980 |

31.10.1984 |

First Prime Minister to be assassinated |

INC |

|

Rajiv Gandhi |

|

|

Youngest Prime Minister (40 years) |

INC |

|

Vp Singh |

21.12.1989 |

10.11.1990 |

First Prime Minister to step down after vote of no-confidence |

Janata Dal (National Front) |

|

Chandra Shekhar |

10.01.1990 |

21.06.1991 |

--- |

Samajwadi Party with INC |

|

PV Narasimah Rao |

21.06.1991 |

16.05.1996 |

First Prime Minister from Southern India |

INC |

|

Atal Bihari Vajpayee |

16.05.1996 |

01.06.1996 |

Shortest tenure of a Prime Minister |

BJP |

|

HD Deva Gowada |

01.06.1996 |

20.04.1997 |

--- |

Janata Dal (United Front) |

|

IK Gujral |

21.04.1997 |

19.03.1998 |

--- |

Janata Dal |

|

Atal Bihari Vajpayee |

19.03.1998 |

13.10.1999 |

--- |

BJP (NDA) |

|

Atal Bihari Vajpayee |

13.10.1999 |

22.05.2004 |

--- |

BJP (NDA) |

|

Dr Manmohan Singh |

22.05.2004 |

26.05.2014 |

First Sikh Prime Minister, longest tenure after JL Nehru |

INC (UPA) |

|

Narendra Modi |

26.05.2014 |

Till date |

First PM born after Independence |

BJP (NDA) |

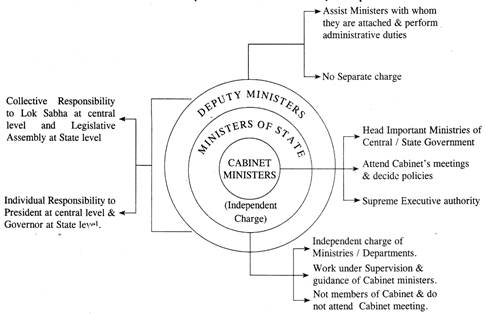

Council of Ministers

[Article 75(5)].

Powers

The Council of Ministers formulates and implements the policy of the country. It introduces most of the important bills and resolutions in the Parliament and steers them through.

It prepares and presents the budget to the Parliament for its approval; and generally it is passed in the form in which it is presented.

The foreign policy of the Government is determined by the Council of Ministers. It plays a vital role in recognition of new states and advises the President with regard to appointments of diplomats.

Collective Responsibility

Individual Responsibility

Legal Responsibility

The system of legal responsibility of a minister is not prescribed in the Indian Constitution. The Indian Constitution does not say the President can act only through Minister, it is left to the President to make rules as to how his orders are to be authenticated. Further the courts are barred from inquiring into the nature of advice rendered by the ministers. As such, if the President's act is authenticated by a secretary to the government of India no minister can be hold legally responsible for it even through he may have advised it.

Composition of Council of Ministers

There are 3 categories of Ministers:

Council of Ministers (As Centre and State level): Composition

Council of Ministers vs Cabinet

|

It is a wider body consisting of 60 to 70 ministers. |

It is a smaller body consisting of 15 to 20 Ministers. |

|

It includes all the three categories of ministers, Cabinet Ministers, Ministers of State and Deputy Ministers. |

It includes the cabinet i.e. Ministers only. Thus, it is a part of the Council of ministers. |

|

It does not meet, as a body, to transact government business, It has no collective functions.

|

It meets as a body frequently and usually once in a week, to deliberate and take decisions regarding the transaction of the government business. Thus, it has collective functions. |

|

It is vested with all powers. but in theory. |

It exercises, in practice, the power of the Council of Ministers and thus acts for the latter. |

|

Its functions are determined by the Cabinet.

|

It directs the Council of Ministers by taking policy decisions which are binding on all ministers. |

|

It implements the decisions taken by the Cabinet. |

It supervises the implementation of its decisions by the Council of Ministers. |

|

It is a constitutional body, dealt in detail by the Articles 74 and 75 of the Constitution, Its size is determined by the Prime Minister according to the exigencies of the time, and the requirements to the situation. Its classification now into a three-tier body, and is based on the conventions to the parliamentary form of government as developed in Britain. It has however, got a legislative sanction. Thus, the Salaries and Allowances Act of 1952 defines a 'Minister' as a "Member of the Council of Minister", by whatever name called and includes a Deputy Minister. |

The word 'cabinet' was inserted in the Article 352 of the Constitution in 1978 by the 44th Constitutional Amendment Act. Thus, it did ot find a place in the original text of the Constitution. Even, Article 352 defines the cabinet saying that, it is "the council consisting the Prime Minister and other Ministers of Cabinet rank appointed under Article 75? and does not describes its powers and functions. In other words, its role in our politico-administrative system is based on the conventions of the parliamentary form of government as developed in Britain. |

|

It is collectively responsible to the Lower House of the Parliament. |

It enforces the collective responsibility of the Council of Ministers to the Lower House of the Parliament. |

Attorney General of India

Attorney General is the highest legal officer of the Union Government and renders legal assistance to it. He is appointed by the President and holds office during his pleasure. To be eligible for appointment as Attorney General of India, a person must possess the qualifications prescribed for a judge of the Supreme Court. He is entitled to such salary and allowances as may be determined by the President. The Attorney General is entitled to audience in all courts in the country and can take part in the proceedings of the Parliament and its committees. However, he is not given the right to vote.

Functions

He is the chief legal adviser of the Government of India and gives it advice on all such legal matters which may be referred or assigned to him by the President. He also performs such other legal duties as are assigned to him by the President from time to time. The Attorney General appears before the Supreme Court and various High Courts in cases involving the Government of India.

UNION LEGISLATURE

The Parliament

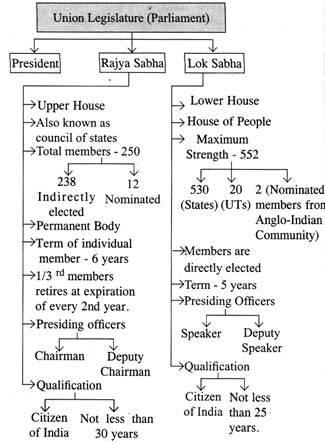

The Parliament is the Union Legislature of India. It consists of the President and two houses the Lok Sabha (house of people) and Rajya Sabha (council of states). Article 79 to 123 in Part-V deals with the provisions of the Parliament.

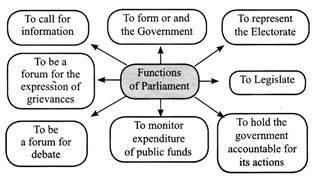

Functions of Parliament

Lok Sabha

Lower House of the Parliament and ateo blown as the first

Chamber.

Every citizen of India of 18 years and above and is not disqualified on the grounds of non- residence, unsoundness mind, crime or corrupt or illegal practices is entitled to vote (Art 326).

Territorial Constituencies for Lok Sabha

Offices of Speaker and Deputy Speaker of Lok Sabha

Pro Tem Speaker

As provided by the Constitution, the Speaker of the last Lok Sabha vacates his office immediately before the first meeting of the newly-elected Lok Sabha. Therefore, the President appoints a member of the Lok Sabha as the speaker Pro Tern. Usually, the senior most member is selected for this. The President himself administers oath to the speaker Pro Tern.

The speaker Pro Tern has all the powers of the speaker. He presides over the first sitting of the.newly-elected Lok Sabha. His main duty is to administer oath to the new members. He also enables the house to elect the new speaker.

When the new speaker is elected by the house, the office of the speaker Pro Tern ceases to exist. Hence, this office is a temporary office, existing for a few days.

Rajya Sabha

The Rajya Sabha is the second chamber or Upper House of the Parliament. It consists of representatives of the states. The maximum strength of the Rajya Sabha is 250. Of these, 238 represent the states and union territories and the rest are nominated by the President. The nominees are persons who have distinguished themselves in the field of literature, art, science, social service and so on. Representatives of the states are elected by members of state legislative assemblies on the basis of proportional representation through a single transferable vote. It is noteworthy that in the Rajya Sabha, the states have been provided representation on the basis of their population.

As regards qualifications for membership of the Rajya Sabha, the candidate must -

Chairman and Deputy Chairman of Rajya Sabha

Qualifications for the Membership of Parliament (Art 84)

Disqualification from Membership of Either House of Parliament

President has to obtain the opinion of the Election Commission before disqualifying a member, (Art 103).

Representation of people's act also provides additional grounds for disqualifications.

A member can also be disqualified on the grounds of defection.

If he has obtained membership of both houses of the Parliament, he needs to vacate one of the seats.

If elected to both to the Parliament and state legislature, he needs to resign from the state legislature.

If he is disqualified under Art. 102.

If he resigns in a voluntary manner.

If he remains absent from all meetings of the house for a period of 60 days without prior permission of the house.

Powers, Privileges and Immunities of Parliament and its Members

Individual privileges

Collective privileges of Lok Sabha and Rajya Sabha.

Individual Privileges

Collective Privileges of Each House

Joint Session of the House

Reject the bill altogether. .

Disagrees on it and returns it with some amendments which are not ultimately considered by the originating house.

Takes no action and more than 6 months time has passed.

The President in such a case may summon a joint sitting of both the houses.

Special Powers of Lok Sabha with respect to Rajya Sabha

Special power of Rajya Sabha with respect to Lok Sabha

As a federal chamber, it can initiate Central intervention in the State Legislative field. Article 249 of the Constitution provides that the Rajya Sabha may pass a resolution, by a majority of not less than two-thirds of the members present and voting, to the effect that it is necessary or expedient in the national interest that Parliament should make laws with respect to any matter enumerated in the State List. If such a resolution is adopted. Parliament will be authorised, to make laws on the subject specified in the resolution, for the whole or any part of the territory of India.

Such a resolution will remain in force for such period, not exceeding 1 year, as may be specified therein, but this period can be extended by 1 year at a time by passing further resolutions.

Sessions of the Parliament

Delimitation Commission

Pursuant to the enactment of the Constitution (Eighty- fourth Amendment) Act 2001, the Delimitation Act, 2002 was enacted. The Delimitation Commission was constituted on July 12, 2012 under the provisions of the Delimitation Act, 2002 with Justice Kuldip Singh, a retired judge of the Supreme Court as its chairperson and one of the election commissioners of India and the state. Election commissioners as its exofficio members. The main task of the Commission is to readjust the division of territorial constituencies of the seats in the House of the People allocated to each state and readjust the division of territorial constituencies of the total number of seats in the Legislative. Assembly of each estate. The Commission will also refix the seats reserved for the Scheduled Casts and the Scheduled Tribes. Earlier the .census figures of 1991 were to be the basis, but after the eighty seventh Amendment Act, the census figure of 2001 are to be the basis.

|

Control of the parliament Over the Executive |

|

|

Question hour |

· First hour of every parliamentary sitting. · Starred questions are answered orally and supplementary questions can follow. · Unstarred questions are answered in writing. · Short notice questions are asked giving less than 10 days notice. |

|

Zero hour |

· Starts immediately after the question hour. · Any matter can be discussed during the zero hour. |

|

Half-an-hour discussion |

· To clear fact on matters of public importance on which lot of debate has occurred. |

|

Short duration discussions |

· To discuss urgent matters. · Also known as two hour discussion. |

|

Calling attention motion |

· Moved to call the attention of a minister to matters of public importance. |

|

Adjournment motion |

· To draw attention of parliament to a matter of urgent public importance. · Motion needs the support of 50 members for admission. · Rajya Sabha cannot move this motion. |

|

No confidence motion |

· Moved to prove the confidence of Lok Sabha in the Council of Ministers. · If No Confidence motion is passed, council of Ministers has to resign. · No Confidence motion needs the support of 50 members to be admitted. · Can be moved only in Lok Sabha. |

|

Censure Motion |

· This motion seeks to censure the government for its lapses. · If the Censure Motion is passed against the government, it should pass a Confidence motion as soon as possible to regain the confidence of the house. |

|

|

· And government, does not need to resign immediately unlike in case of No-Confidence Motion. · It can be moved against an individual minister for specific policies or actions. This motion should state the reason for its adoption. It is in practice since 1954. |

Legislative Procedure in Parliament

Ordinary Bill

First Reading

At this stage the title of the bill is read and a brief speech regarding the aims and objective of the bill is made. Opponents of the bill also make a brief speech at this stage and after a formal vote, the bill is published in gazette.

Second Reading

At this stage the general principles of the bill as a whole are discussed and decision regarding reference of the bill to the appropriate committee is taken. No amendments are possible at this stage.

Cammittee Stage

After me second reading, the bill is referred to the appropriate committee where its provisions are thoroughly discussed. The committee can also make suitable suggestions for improvement of the bill and suggest necessary amendments.

Report Stage

The committee submits its report to the House, where it is

Thoroughly discussed. The members of the House hold a

Clause – by - clause discussion and vote thereon. At this stage, they can also propose fresh amendments, which are accepted by majority vote.

Third Reading

A general discussion on the bill takes place and formal voting for the acceptance or rejection of the bill is held. No

amendments can be proposed at this stage. After a bill has been passed by one house it is transmitted to the other house, where it goes through all these stages once again.

After the bill has been passed by the other house, it is sent to the President for assent. However, if the other house proposes certain amendments which are not acceptable to the originating house, it may lead to a deadlock. The deadlock is resolved by ravening a joint-sitting of the two houses where the decision is taken by majority vote.

The President can either accord his assent or return the bill

for reconsideration of the Parliament. But if the Parliament

repasses the bill, the President has to accord assent to it.

Money Bill (Article 110)

Financial Bills

Financial Bills 2017

Arun Jaitley’s Finance Bill, 2017 'has been passed in Lok

Sabha on 22nd March 2017. It is marked as "money bill", so it will not be sent to Rajya Sabha for discussion, but only for which can be rejected by Lok Sabha, and then will be sent to the President of India for his ascent.

A bulk bill of 40 amendments to different laws. Finance Bill, 2017 has a string legislations that will impact a variety of existing taxation (and other) laws involving:

Finance Bill, 2017 has made a major amendment to how

private companies provide donations to political parties, which are not under Right Information Act and need not disclose the source of contributions under Rs 20,000.

As of now, a company can donate up to 7.5% of the average of its net profits in the last three consecutive financial years to disclosure of the donations against the names of the political parties who have been the beneficiaries must be displayed in the company balance sheet.

Once the amendments made in Finance Bill, 2017 come into effect, the cap of 7.5% of the average of its net profits in the last three consecutive financial years will be removed.

Additionally, companies will not be required to name the beneficiary political party.

Though companies can contribute via cheque, bank draft or e-transfer, electoral bonds, which might be introduced as means to food political parties to “maintain donor anonymity” would become the main route through which money goes into me coffers of political parties.

Aadhaar is now mandatory for filing income tax returns and PAN.

In addition to being linked to a number of public services and subsidies, as per Finance Bill, 2017, Aadhaar will now be compulsory from July 1, 2017 to file one's income tax returns and to obtain and retain PAN, or permanent account number. Without possessing, or at least enrolling for Aadhaar, it won't be possible to pay taxes, and that would mean ordinary citizens without Aadhaar will end up committing a crime, that of tax evasion and non-compliance of Income Tax Act, 2016.

Under Finance Bill, 2017, cash transactions above three lakh rupees will not be permitted:

(i) to a single person in one day,

(ii) for a single transaction (irrespective of number of payments), and

(iii) for any transactions relating to a single event.

(iv) Amendments to the Finance Bill, 2017 propose to lower this limit from three lakh rupees to two lakh

A number of tribunals, which oversee disputes related to

taxation and company balance sheets, as well as company wars over items such as telecom spectrum, etc. will be replaced and taken over by existing tribunals under other Acts. There is no clear rationale behind this replacement and to be rather arbitrary.

Members of invalidated tribunals, or those merged, after the premature termination of their will go back to their parent ministry and department.

Terms of service

Currently, respective Acts specify the qualification remuneration package and other terms of services. However, Finance Bill 2017 will empower the Central Government decide the terms of services, making up roles on the go. This will directly impact the independence of the tribunals as the executive will have enonormas and undue influence in deciding the outcomes of these tribunals and appellate tribunals.

|

Tribunals Proposed to be merged by amendments to the Finance Bill, 2017 |

||

|

Act |

Tribunal being replaced |

Tribunal to take over Functions |

|

Competition Act 2002 |

Competition Appellate Tribunal |

National Company Law Appellate, Tribunal (under Companies Act, 2013) |

|

Airports Economic Regulatory Authority of India Act, 2008 |

Airports Economics Regulatory Authority Appellate Tribunal

|

Telecom Disputes Settiement.and Appellate Tribuaal (under the TRAI Act, 1997) |

|

Information Technology Act, 2000 |

Cyber Appellate Tribunal |

|

|

Control of National Highways (Land and Traffic) Act, 2002 |

National Highways Tribunal |

Airport Appellate Tribunal (under the Airport Authority of India Act, 1994) |

|

Employees Provident Funds and Miscelaneous Provisions Act, 1952 |

Employees Provident Fund Appellate Tribunal |

Industrial Tribunal (under the Industrial Disputes Act, 1947) |

|

Copyright Act, 1957 |

Copyright Board |

Intellectual Property Appellate Board (under the Trade Marks Act. 1999) |

|

Railways Act, 1989 |

Railways Rates Tribunal |

Railway Claims Tribunal (under the Railways Claims Tribunal Act, 1987) |

|

Foreign Exchange Management Act, 1999 |

Appellate Tribunal for Foreign Exchange |

Appellate Tribunal (under the Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976) |

This effectively puts enormous powers in the hands of IT officers and can bring about a new “Inspector Raj” and reign of "tax terror". A possible fallout could be raids on dissenters, journalists, whistleblowers, activists, human rights lawyers, among others who ritually call out the government on incompetence, authoritarian streaks and governmental overreach bordering on police state.

Penalty overdrive

As per Finance Bill, 2017, the adjudicating officer will continue to retain power under amended Securities Contracts (Regulation) Act and Depositories Act, 2004, to impose penalties on those failing to furnish information, documents or returns vis – a - vis their incomes. Essentially, this will lead to a penalty overdrive and a Zeitgeist bureaucracy targeting anyone an the, wrong side of the ruling regime at will.

Constitutional Amendment Bill (Article 368)

Certain provisions of the Constitution can be amended by the Parliament by simple majority. These include provisions relating to the creation of new states, reconstitution of existing states, creation or abolition of upper chambers in the state legislature, etc.

Some provisions can be amended by Parliament by a two-third majority and also require the approval of the legislatures of not less than one-half of the states, (There is no time limit within which the states should give their consent to the bill). Provisions that can be amended this way include election of the President, powers of the Union and state executive. Union judiciary. High Courts, representation of states in Parliament, amendment procedure, etc. .

But a major portion of the Constitution can be amended

by a two-third majority in Parliament. This must also be the clear-cut majority of the total membership of each house. The provisions which can be amended in this ways

are F . R . , D.P.S.P, etc.

It may be noted that provisions which affect the federal character of the Constitution can be amended only with the approval of the states.

A notable feature of the amendment procedure in India is that the initiative rests with the Centre and the states cannot initiate any amendments.

Comparisons among different bills

|

Ordinary Bill |

Money Bill |

Financial Bill |

Constitution Amendment Bill |

|

Can be introduced in either house of parliament. |

Only in Lok Sabha. |

Only in Lok Sabha. |

In either house of Parliament. |

|

Passed by simple majority. |

Passed by simple majority. |

Passed by simple majority. |

Passed by simple or special majority (by both house sepratly) and or approval of legislatures of not less than one-half of the states. |

|

Equal Legislative jurisdiction of both houses of parliament. |

RS has only recommendatory power (14 days) |

Equal legislative jurisdiction of both houses of parliament. |

Equal legislative jurisdiction of both houses of parliament. |

|

Joint session can be held. |

Joint session cannot be held. |

Joint session can be held. |

Joint session cannot be held because if one house rejects the bill, it comes to an end. |

|

President has three options: Absolute veto, suspensive veto, pocket veto. |

President has choice of with holding or giving assent to the bill, but by convention he cannot with hold the assent. |

President has three options: Absolute veto pocket veto. |

President has to give assent to the bill. |

Public and Private Bills

Public Bills

Public and Private Bills

Public Bills

A public bill is introduced by minister in the Parliament or state legislature which reflects the policies of the rulling party or the government. A public bill generally has greater chance of approval by the Parliament unlike a private bill. The rejection of a public bill by the house amounts to the expression of want of parliamentary confidence in the government and may lead to its resignation. This bill is drafted by the concerned department in consultation with the law department and its introduction in the house requires seven days' notice.

Private Bill

A private bill is introduced by any member of Parliament other than a minister which reflects the stand of opposition party on public matter. A private bill is rejection by the house has no implication on the parliamentary confidence in the government or the resignation. The introduction of a private bill requires one month's notice and has lesser chance of parliamentary approval. A private bill's drafting is the responsibility of the rember concerned.

Youth Parliament

On the recommendation of the fourth all India whips conference a scheme of youth parliament was. started in 1960s with the objectives of

(a) acquainting the younger generation with parliamentary

practices and procedures;

(b) imbibing the spirit of discipline and tolerance in the minds of youth; and

(c) in calculating the basic values of democracy in the student community and enabling them to acquire a proper perspective on the functioning of democratic institutions. The youth parliament scheme was first introduced in the schools in Delhi in 1966-67.

Annual Financial Statement - Budget

(Article 112)

The Government of India has two budgets, namely, the Railway Budget and the General Budget. While the former consists of the estimates of receipts and expenditures of only the Ministry of Railways, the latter consists of the estimates of receipts and expenditure of all the ministries of the Government of India (except the railways).

|

Types of Budget |

||

|

Budget Type |

Given By |

Relates To |

|

Performance Budgeting |

First Hoover Commission, USA. Introduced in India in 1968 on recommendations of Administration Reforms Commission |

Emphasis on ?purpose? of expenditure |

|

Zero-Based Budgeting |

Phyrr, USA |

Every scheme crically reviewed & re-justified totally fom zero (or scratch) |

|

Line-Item Budgeting |

Developed in 18th century. Traditional system prevailed India. |

Emphasis on items of expenditure & not its purpose. Sole objective is control over expenditure. |

|

Line-Item Budgeting |

Developed in 18th century. Traditional system prevailed india. |

Emphasis on items of Expenditure & not its pupose. Sole objective is control over expenditure. |

Stages In Enactment of Budget

|

Presentation of budget |

|

\[\downarrow \] |

|

General discussion (on budget as a whole) |

|

\[\downarrow \] |

|

Voting on demands for grants (detailed discussions, various cut motions moved, many matters disposed off without discussions due to shortage of time- this is called Guillotine) |

|

\[\downarrow \] |

|

Passing of appropriation bill (authorizes Parliament to withdraw money from Consolidated Fund, includes grants voted by Lok Sabha and expenditure charged on Consolidated Fund, no amendment can be made to it) |

|

\[\downarrow \] |

|

Passing of finance bill (last stage of budget enactment, gives effect to financial proposals of government, amendments can be moved to it) |

Other Grants

|

Supplementary grant |

It is granted when the amount authorized by the Parliament through the appropriation act for a particular service for the current financial year is found to be insufficient of that year. |

|

Additional grant |

It is granted when a need has arisen during the current financial year for additional expenditure upon some new service not contemplated in the budget for that year. |

|

Excess grant |

It is granted when money has been spent on any service during a financial year in excess of the amount granted for that service in the budget for that year. It is voted by the lok sabha after the financial year. |

|

Vote of credit |

It is granted for meeting an unexpected demand for the service, the demands cannot be stated with the details in the budget. It is like a blank cheque given to the executive by the lok sabha. |

|

Exceptional grant |

It is granted for a special purpose and forms no part of the current service of any financial year. |

|

Token grant |

It is granted when funds to meet the proposed expenditure on the new service can be made available by re-appropriation. A demand for the grant of token sum of Re 1 is submitted to the vote of Lok Sabha and if assented, funds are made available. |

|

Various Cut Motions as Moved in Lok sabha |

|

|

Policy cut |

Disapproval of policy. It states that amount of demand be reduced to Rs. 1. |

|

Economy cut |

Demand be reduced by a specified amount |

|

Token cut |

Demand is reduced by Rs. 100. |

Parliamentary Terms

Summoning

The president from tune to time sumons each House of Parliament to meet. But, the maximum gap between two sessions of Parliament cannot be more than six months. In other words, the Parliament should meet at least twice a year.

Adjournment

A sitting of Parliament can be terminated by adjournment or adjournment sine die or prorogation or dissolution (in the case of the Lok Sabha). An adjournment suspends the work in a sitting for a specified time, which may be hours, day or weeks.

It is the period between the prorogation of the parliament and its re-assembly is a new session

Adjournment Sine Die

Adjournment sine die means terminating a sitting of Parliament for an indefinite period.

The power of adjournment as well as adjournment sine die lies with the presiding officer of the House. He can also call a sitting of the House before the date or time to which it has been adjourned or at any time after the House has been adjourned sine die.

Prorogation

The presiding officer (Speaker or Chairman) declares the House adjourned sine die, when the business of a session is completed. Within the next few days, the President issues a notification for prorogation of the session. However, the President can also prorogue the House while in session.

Dissolution

Rajya Sabha, being a permanent House, is not subject to dissolution. Only the Lok Sabha is subject to dissolution. Unlike a prorogation, a dissolution ends the very life of the

existing House, and a new House is constituted after general sections are held. The dissolution of the Lok Sabha may take place in either of two ways:

which he is authorised to do. Once the Lok Sabha is dissolved before the completion of its normal tenure, the dissolution is irrevocable.

When the Lok Sabha is dissolved, all business including bills, rations, resolutions, notices, petitions and so on pending before 1 or its committees lapse. They (to be pursued further) must be reintroduced in the newly-constituted Lok Sabha. However, some pending bills and all pending assurances that are to be examined by the Committee on Government Assurances do not lapse on the dissolution of the Lok Sabha. The position with respect to lapsing of bills is as follows:

Sabha lapses.

Lok Sabha does not lapse.

President does not lapse.

Quorum

Quorum is the minimum number of members required to be present in the House before it can transact any business. It is one tenth of the total number of members in each House including the presiding officer. It means that there must be at least 55 members present in the Lok Sabha and 25 members present in the Rajya Sabha, if any business is to be conducted. If there is no quorum during a meeting of the House, it is the duty of the presiding officer either to adjourn the House or to suspend the meeting until there is a quorum.

Funds

Indian Constitution provides three kinds of funds for Central Government

Consolidated Fund of India

Article 266 provides the Parliament to have a' Consolidated Fund of India'. It is a fund to which all receipts are credited and all payments are debited. In other words,

Public Account of India

All other public money received by Government of India on or on behalf of it, shall be credited to the Public Accounts of India. It includes departmental deposits, remittances, judicial deposits, provident fund deposits, etc. Payments from this account can be made by without parliamentary appropriation as these payments are mostly in the nature of banking transactions. It is covered in Article 266 (1).

Contingency Fund of India

The Constitution authorised the Parliament to establish a 'Contingency Fund of India' (Under Article 267), into which amounts determined by law are paid from time-to- time. Accordingly, the Parliament enacted the Contingency Fund of India Act in 1950.

This fund is placed at the disposal of the President and he can make advances out of it to meet unforeseen expenditure pending its authorisation by the Parliament. In 2005, the amount of money in the Contingency Fund of India was increased from Rs. 50 crore to Rs. 500 crore.

Charged Expenditure

The budget consists of two types of expenditure – the expenditure 'charged' upon the Consolidated Fund of India and the expenditure 'made* from the Consolidated Fund of India. The charged expenditure is non-votable by the "Parliament, that is, it can only be discussed by the Parliament, which the other type has to be voted by the Parliament. The listof the charged expenditure is as follows:

Parliamentary Commitees

Parliamentary Committees are of two kinds - Adhoc Committees and the Standing Committees. Adhoc Committees are appointed for a specific purpose and they cease to exist when they finish the task assigned to them and submit a report. The principal Adhoc Committees are the Select and Joint Committees on Bills. Apart from he Adhoc Committees, each House of Parliament has Standing Committees like the Business Advisory Committee, the Committee on Petitions, the Committee of

Privileges and the Rules Committee.

An other class of committees which act as Parliament's Watch Dogs over the executive is of special importance. These are the Committee on Subordinate Legislation, the Committee on Government Assurances, the Committee on Estimates, the Committee on Public Accounts and the Committee on Public Undertakings and the Departmentally Related Standing Committees (DRSCs). They play an important role in exercising a check over Governmental Expenditure and Policy Formulation.

Estimates Committee

The Principles of Proportional Representation by means of a Single Transferable Vote is used in election of the members. The Chairman of this Committee is appointed by the Speaker from amongst its members and he is invariably from the ruling party.

Committee on Public Undertakings

This committee was created in 1964 on the recommendation of the Krishna Menon Committee. The Committee on Public Undertakings consists of 15 members elected by the Lok Sabha; 7 members of the Rajya Sabha are also associated with it. A minister is not eligible for election to this committee. The term of the committee is 1 year. The functions of the Committee on Public Undertakings are as follows:

To examine the reports and accounts of Public Undertakings;

To examine me reports, if any, of the Comptroller and Auditor General on the Public Undertakings.

To examine, in the context of the autonomy and efficiency of the Public Undertakings, whether the affairs of the Public Undertakings are being managed in accordance with sound business principles and prudent commercial practices.

The Chairman of the Committee is appointed by the Speaker, from amongst its members who are darwn from the Lock Sabha only.

Committee on Public Accounts

This committee was first set-up in 1921 under the provisions of the Government of India Act, 1919. This committee consists of 22 members (15 from Lok Sabha and 7 form Rajya Sabha). A minister is not eligible for election to this committee. The term of the committee is 1 year. The main duty of the committee is to ascertain whether the money granted by Parliament has been spent by government 'within the Scope of the Demand.'

Rules Committee

It considers matters of procedure and conduct of business in the house and recommends any amendments or additions to the Rules of Procedure and Conduct of Business in Lok Sabha that are considered necessary.

Presentation of States & Union territories in ?Lok Sabha? and Rajya Sabha?

|

States |

Lok Sabha (No. of Seats) |

Rajya Sabha (No. of Seats) |

|

Andhra Pradesh |

25 |

11 |

|

Assam |

14 |

7 |

|

Goa |

2 |

1 |

|

Haryana |

10 |

5 |

|

Jammu & Kashmir |

6 |

4 |

|

Kerala |

20 |

9 |

|

Maharashtra |

48 |

19 |

|

Meghalaya |

2 |

1 |

|

Odisha |

21 |

10 |

|

Rajasthan |

25 |

10 |

|

Tamil Nadu |

39 |

18 |

|

West Bengal |

42 |

16 |

|

Mijoram |

1 |

1 |

|

Jharkhand |

14 |

6 |

|

Uttar Pradesh |

80 |

31 |

|

Bihar |

40 |

16 |

|

Gujrat |

26 |

11 |

|

Himachal Pradesh |

4 |

3 |

|

Karnatak |

28 |

12 |

|

Madhya Pradesh |

29 |

11 |

|

Manipur |

2 |

1 |

|

Nagaland |

1 |

1 |

|

Punjab |

13 |

7 |

|

Sikkim |

1 |

1 |

|

Tripura |

2 |

1 |

|

Arunachal Pradesh |

2 |

1 |

|

Uttarakhand |

5 |

3 |

|

Chattisgarh |

11 |

5 |

|

Telangana |

17 |

7 |

|

Union Territories |

Lok Sabha (No. of Seats) |

Rajya Sabha (No. of Seats) |

|

Delhi |

7 |

3 |

|

Chandigarh |

1 |

Nil |

|

Dadra and Nagar Haveli |

1 |

Nil |

|

Daman and Diu |

1 |

Nil |

|

Andaman and Nicobar |

1 |

Nil |

|

Puducherry |

1 |

1 |

|

Lakshadweep |

1 |

Nil |

NATIONAL SCEMES/PROGRAMMES 2014-17

|

Schemes/ Programs |

Launched Date |

Symbol |

Objectives |

|

Pradhan Mantri Jan Dhan Yojana (PMJDY) |

Ausust 28, 2014 |

|

Financial inclusion and access to financial services for all households in the country. |

|

Pradhan Mantri Sukanya Samriddhi Yojana (PMSSY) |

January 22, 2015 |

|

To secure the future of girl child and it is linked to ?Beti Bachao- Beti Padhao? |

|

Pradhan Mantri Mudra Yojana (PMMY) |

April 8, 2015 |

|

Financial support for growth of micro enterprises sector. |

|

Pradhan Mantri Jyoti Yojana (PMJJY) |

May 9, 2015 |

|

Provide life insurance cover to all Indian citizens. |

|

Prahan Mantri Suraksha Bima Yojana (PMSBY) |

May 9, 2015 |

|

Provide accidental cover to all Indian citizens |

|

Atal Pension Yojana (APY) |

May 9, 2015 |

|

Increase the number of people covered under any kind of pension scheme. |

|

Kisan Vikas Patra (KVP) |

March 3, 2015 (Re-launched) |

|

To provide safe and secure investment avenues to the small investors. |

|

Gold Monetization Scheme (GMS) |

November 4, 2015 |

|

To secure the reliance on gold imports over time. |

|

Pradhan Mantri Fasal Bima Yojana (PMFBY) |

October 11, 2014 |

|

Provide insurance cover to rabi and kharif crops and financial support to farmers in case of damage of crops. |

|

Pradhan Mantri Gram Sinchai Yojna (PMGSY) |

July 1, 2015 |

|

Irrigating the field of every farmer and improving water use efficiency to provide "Per Drop More Crop". |

|

Sansad Adarsh Gram Yojana (SAGY) |

October 11, 2014 |

|

Social, cultural, economic infrastructure development in the villages. |

|

Soil Health Card Scheme (SHCS) |

February 17, 2015 |

|

To help farmers to improve productivity by using fertilizers. |

|

Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) |

July25, 2015 |

|

Electric supply feeder separation and distribution infrastructure including metering at all levels in rural areas. |

|

Shyama Prasad Mukherji Rurban Mission (SPMRM) |

February 21, 2016 |

|

To create 300 clusters across the country and strengthen financial, job, and lifestyle facilities in rural area. |

|

Rashtriya Gram Swaraj Abhiyan (RGSA) |

------- |

--------- |

To strengthen the panchayati raj system across the country. |

|

Rashtriya Gokul Mission (RGM) |

December 16, 2014 |

|

To conserve and develop indigenous bovine breeds. |

|

Gram Uday se bharat Uday Abhiyan (GUSBUA) |

14th to 24th April |

|

This scheme strengthens panchayati raj villages and ensures social harmony in villages. |

|

Pradhan Mantri Awas Yojana (PMAY) |

June 25, 2015 |

|

Achieve housing for all by the year 2022, 2 crore in urban and 3 crore in homes in rural areas. |

|

Pradhan Mantri Awas yojana- Gramin |

------- |

|

Government to construct 1 crore permanent house for the rural poor in the next three years. |

|

Atal Mission for Rejuvenation and Urban Transformation |

June 24, 2015 |

|

To provide basic services (water supply, sewerage, urban transport) to households and build amenities in cities. |

|

National heritage City Development and Augumentation |

January 21, 2015 |

|

Bringing together urban planning, economic growth and heritage conservation. |

|

Smart City Mission |

June 25, 2015 |

|

To develop 100 cities all over the country, making them citizen friendly and sustainable. |

|

PMAY-G Home Loan Scheme 2017 |

November 30, 2016 |

-------- |

The beneficiaries will be provided interest subvention of 3% on home loan of up to 2 lakhs taken in 2017. |

|

Smart Ganga city Scheme (SGCS) |

August 13, 2016 |

|

Union minister for water resources, river development and Ganges Rejuvenation. |

|

Digital India |

July 1, 2015 |

|

To deliver government services to citizens electronically by improving online infrastructures and by increasing internet connectivity. |

|

Skill India |

July 16, 2016 |

|

Train over 40 crore people in India in different skills by 2022. |

|

Deen Dyala Upadhaya Grameen kaushalya Yojana (DDU-GKY) |

July 25, 2016 |

|

To achieve inclusive growth, by developing skills and productive capacity of the rural youth from poor families. |

|

Udaan Scheme |

November 14, 2014 |

|

Encouraging girls for higher technical education. |

|

Unnat bharat Abhiyan |

-------- |

|

Aims to connect institutions of higher education including IITs, NITs and IISERs. |

|

Pradhan Mantri Kaushal Vikas yojana |

January 8, 2017 |

|

Aims to train Indian youth for overseas employment. |

|

National Apprenticeshep Promotion Scheme (NAPS) |

August 19, 2016 |

|

Providing apprenticeship training to over 50 lakh youngsters in order to create more jobs. |

|

Vidhyanjali Scheme |

------ |

|

To boost community participation in government schools eg: cultural and social program |

|

SWAYAM Prabha |

July 18, 2016 |

|

Operationalsing 32 direct to home television channels for providing high quality educational content to all. |

|

Pradhan Mantri Yuva Yojana ( PMYY) |

------- |

|

To scale up an ecosystem of entrepreneurship for youngsters. |

|

Make in India |

September 25, 2014 |

|

To encourage multinational and domestic companies to manufacture their products in India and create jobs and skill |

|

Startup India, Standup India |

January 16, 2016 |

|

enhancement in 25sectors |

|

Pradhan Mantri Garib kalyan Yojana (PMGKY) |

April, 2015 |

|

To provide support to all startup businesses in all aspects of doing business in India. |

|

Swachh Bharat Abhiyaan (SBA) |

October 2, 2014 |

|

Implement the pro-poor welfare schemes in more effective way and reaches out to more poor population across the country. |

|

Namami Gange Project (NGP) |

July 10, 2014 |

|

To fulfill Mahatma Gandhi's dream of clean and hygienic India. |

|

Mission Indradhanush |

December 25, 2014 |

|

To integrate the efforts to clean and protect the Ganga river in a comprehensive manner. |

|

National Bal Swachhta Mission |

November 14, 2014 |

----------- |

To immunize all children as well as pregnant women against diseases by 2020. |

|

Pradhan Mantri Jan Aushadhi Yojana (PMJAY) |

March, 2016 (expected) |

|

To provide hygienic and clean environment, food, drinking water, toilets, schools and other surroundings to the children. Provides drugs/ medicines at affordable cost across the country. |

|

Pradhan Mantri Surakshit Matritva Abhiyan |

-------- |

|

Aims at boosting the health care facilities for the pregnant women, especially the poor. |

|

Integrated Power Development Scheme (IPDS) |

September 18, 2015 |

|

To ensure 24*7 power for all. |

|

Prakash path- Way to Light- the National LED Programme |

January 5, 2015 |

|

To distribute LED bulbs and decrease the power consumption. |

|

UJWAL Discom Assurance Yojana (UDAY) |

November 20, 2015 |

|

To obtain operational and financial turnaround of state owned power distribution companies (DISCOMs) |

|

Pradhan Mantri Ujwal Yojana |

May 1, 2016 |

|

To distribute free LPG connections to the women belonging to 5 crore BPL families across the country. |

|

Swadesh Darshan Yojana (SDY) |

March 9, 2015 |

|

To develop world class tourism infrastructure |

|

PRASAD (Pilgrimage Rejuvenation and Spritual Augmentation Drive) |

March 9, 2015 |

|

To develop world class tourism infrastructure across India. |

|

Beti Bacchao, Beti Padhao Yojana (BBBPY) |

January 22, 2015 |

|

To generate awareness and improving the efficiency of welfare services meant for women. |

|

Pandit Deendhayal Upadhaya Shramev Jayate Yojana (PDUSJY) |

October 16, 2014 |

|

To consolidate information of labor inspection and its enforcement through a unified web portal. |

|

Sagarmala Project |

July 31, 2015 |

|

To transform the existing ports into modem world class ports. It's to promote transport of goods. |

|

Vikalp Scheme |

November 1, 2015 |

|

For confirmed accommodation in next alternative train for the waitlisted passengers. |

|

National Sports Talent Search Scheme (NSTSS) |

February 20, 2015 |

|

To identify sporting talent amongs students in the age group of 8-12 years |

|

PAHAL- Direct Benefits Transfer for LPG (DBTL) Consumers Scheme |

January 1, 2015 |

|

To send the subsidy money of LPG cylinders directly into the bank accounts of the consumers. |

|

Pradhan Mantri Khanij Kshetra Kalyan Yojana |

September 17, 2015 |

|

To safeguard health, environment and economic conditions of the tribals. |

|

Setu Bhratam Project |

March 3, 2016 |

|

To free all national highways from railway level crossings and renovate the old bridges on national highways by 2019. |

You need to login to perform this action.

You will be redirected in

3 sec