Digital Economy, GST & Economic Survey-2017

Category : UPSC

Digital Economy, GST & Economic Survey-2017

Introduction

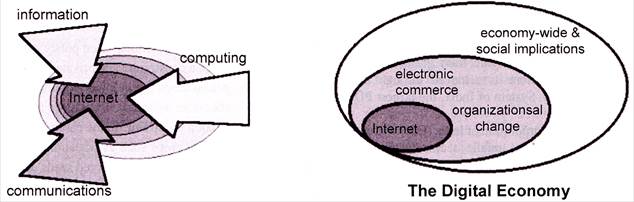

The digital economy refers to an economy that is based on digital technologies, although we increasingly perceive this as conducting business through markets based on the internet and the World Wide Web.

The term ?Digital Economy? was coined in Don Tapscott?s 1995 book The Digital Economy: Promise and Peril in the Age of Networked Intelligence. It was among the first books to consider how the Internet would change the way we did business.

According to Thomas Mesenbourg (2001), three main components of the 'Digital Economy' concept can be identified:

· e-business infrastructure (hardware, software, telecoms, networks, human capital, etc.),

· e-business (how business is conducted, any process that an organization conducts over computer-mediated networks),

· e-commerce (transfer of goods, for example when a book is sold online).

· Goods and Service Tax (GST) is a uniform indirect taxation system will be applicable uniformally throughout India. It will replace central and states indirect taxes.

Rapid advances in digital technology and applications has stimulated and enabled a dramatic growth in the global user population.

The digital economy is not limited to traditional business models. It encompasses every aspect of modern life; entertainment, health, education, business to banking, the ability of the citizen to engage with government and society to stimulate new ideas and help influence political and social change.

Modeling the Digital Economy

Digital economic activity results from billions of online connections among people, businesses, devices, data, and processes. The backbone of the digital economy is thus hyper-connectivity which creates interconnectedness of people, organisations, and machines that based on the Internet, mobile technology and the Internet of Things. The internet of things, which is known as the infrastructure of the information society connects physical devices, smart devices, buildings, and other items embedded with electronics, software, sensors etc. to engage in the exchange of data.

As social media, virtual reality and cloud services are expanding the boundary between the traditional economy and digital economy, is getting difficult to be identified. The OECD (Organisation for Economic Co-operation and Development) has included both information and Communication Technologies (ICT) goods and services under digital economy. This means that software services are also part of the digital economy. India is the second largest (after Ireland) exporter of ICT services (mostly

Software) according to the UNCTAD. In the case of ICT goods export, China is the unquestionable global leader with 32% share.

5 Key Attributes of the Digital Economy:

1. Digitize: In a digital economy... everything is digital and almost every move we make is tracked.

2. Connected: In a digital economy... we'll connect every device, system, service we use and every person/business we interact with.

3. Shared: In a digital economy... use only what we need; pay as we go.

4. Personalized: In a digital economy... we get better convenience, choice, and value.

5. Direct: In a digital economy... by-pass the middleman.

Impact of Digital Economy

Individual impact

i. Airbnb: It connects people and property to furnish unique accommodations to travellers, and helps owners monetize extra space.

ii. Amazon: It provides a seamless and simple interface for consumers to buy what they want, when they want from different vendors all in one interface.

iii. Wearable Tech: Wearable tech generates digital signals from analog objects... and allows us to measure, track, and analyze those signals for practical uses.

Societal Impact

i. Connected Cities: In Busan, South Korea, the government offers a Personal Life Assistant Services Platform allowing users to find and reserve the nearest workplace that provides features to meet their needs. It also enables users to access real-time transportation information and multimodal transportation routing services.

ii. Open Governments: The city of Boston built the Street Bump app, which lets residents report road condition data using their Smartphone's accelerometer to detect bumps and potholes, automatically sending information to the city.

iii. Mass Intelligence: By connecting drivers to one another, Waze app helps the community to work together to reduce travel time, expense, and frustration by reporting real time traffic and road conditions.

Business Impact

i. Amaze Customers/ Hyper- personalize Experiences:

Starbucks introduced a mobile feature called ?Mobile Order & Pay.? It means customers can order and pay for their drinks directly, skipping the checkout line completely.

ii. Unleash Human Potential/ Build the Workforce of the Future: SAP AR Warehouse Picker is a mobile augmented reality app that utilizes smart glasses to free warehouse workers from handheld scanners and other devices, improving situational awareness, workplace efficiency and security.

iii. Optimize Resources/ Maximize Outcomes: To treble container volume in 10 years, Port of Hamburg connects every truck, container, crane, and ship to a sophisticated scheduling application for a continually self-optimizing logistic chain.

How it impact Business

a. Activate: Digitize, connect and collect data on all your business assets.

b. Optimize: Gain insight from collected data 10 reduce waste, improve agility and predictability.

c. Transform: Reinvent processes in real time and dramatically simplify infrastructure to fully unleash human potential.

Digital Single Market

The Digital Single Market strategy aims to open up digital opportunities for people and business and enhance India's position as a world leader in the digital economy.

A Digital Single Market (DSM) is one in which the free movement of persons, services and capital is ensured and where the individuals and businesses can seamlessly access and exercise online activities under conditions of fair competition, and a high level of consumer and personal data protection, irrespective of their nationality or place of residence.

The DSM can create opportunities for new startups and allow existing companies in a market of over 500 min people.

Completing a Digital Single Market could contribute G 415 billion per year to Europe's economy, create jobs and transform our public services.

An inclusive DSM offers opportunities for citizens also, provided they are equipped with the right digital skills. Enhanced use of digital technologies can improve citizens' access to information and culture, improve their job opportunities. It can promote modern open government.

The Pillars

The Digital Single Market Strategy is built on three pillars:

1. Access: better access for consumers and businesses to digital goods and services across Europe;

2. Environment: creating the right conditions and a level playing field for digital networks and innovative services to flourish;

3. Economy & Society: maximising the growth potential of the digital economy.

Why need a Digital Single Market

Digital Single Market (DSM) is the need of the hour because,

i. It can help to better access for consumers and business to digital goods and services across India.

ii, It can help in shaping the right environment for digital networks and services to flourish.

iii. It will create an Indian Digital Economy and society with growth potential.

Progress in Digital Economy

1. The digital economy paves innovative ways for corporations on a global scale to improve the traditional business world. By providing easier B2B collaboration, communication, search, and strategy planning, the digital economy will change the way we do business altogether.

2. Communications Technology: Digital is increasingly becoming the leading form of communication, especially for businesses. Countries are recognizing that they need to invest in communications technologies, such as internet servers, telephone lines, and wireless signals, in order to boost their own economies. Latin America ![]() 302B, North America

302B, North America ![]() 1T Communications Technology Spending by Country (USD in billions)

1T Communications Technology Spending by Country (USD in billions)

3. Global Cloud Traffic: With the expanding development of cloud technology, businesses will be able to cut down on costs that initially stemmed from IT obstacles.

a. Additionally, businesses can consolidate their data using this technology, which will then improve cyber security and information security.

4. Social Media Users: Worldwide Social media goes beyond social sharing or reputation management. It's a way for businesses to engage with consumers. The global number of social network users is projected to be 2.4 billion in 2018, a 24% increase from 2015. The challenge for businesses now is to create original and unique social content that will stand out from me crowd.

Digital Economy and India

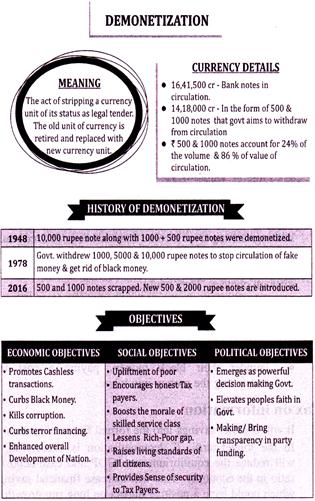

Digital India is one of the ambitious visions of GOI. It aims to empower citizens by creating best in class digital infrastructure in the country. Recently Digital India got heavy push when GOI withdrew 500 and 1000 rupees notes as legal tender.

This has two major impacts:

1. Opening of fresh bank accounts to deposit the money and

2. Increase in digital transactions using debit cards, UPI, Paytm etc.

It is also to be noted that present PM is emphasizing citizens to go cashless in their transactions. The government has constituted schemes like Digi Dhan Vyapar Yojana and Lucky Grahak Yojana to incentivize cashless transactions.

But the larger question is, Is India really ready to cashless.

Infrastructure Issue

In the backdrop of demonetisation, the Union Government is putting all efforts to move towards cashless economy. The government pushes towards cashless economy calls for greater digital infrastructure. Growth of the digital economy depends on building network capacity. The current push towards digital transactions leverages the high penetration of mobile phones, but these networks are suffering from various issues.

Issues

· The mobile phone will be the predominant mode of transitioning to the digital economy in India. But India?s inability to meet the rising demand for network capacity will place severe constraints on the move to and growth of the digital economy.

· The constraining factors are the lack of sufficient spectrum available to mobile use, which is must for transitioning to the digital economy through mobile phones.

· As per the Cellular Operators Association of India report, operators in India possess significantly smaller amounts of spectrum compared to international standards.

· Operators in India possess spectrum of approximately 13 MHz on average, which is very low compared to other Asian countries such as Bangladesh (37.4 MHz) and Malaysia (75 MHz).

· In India the problem is not scarcity of spectrum scarce, but also available spectrum is fragmented, overpriced and inflexible.

· The current push to digital transactions on account of demonetisation has meant increased congestion on a limited spectrum capacity.

· Government must allocate more spectrums at affordable price to deploy more spectrums for actual use by telecom subscribers, which in turn will push cashless economy goal.

· To realise the goals of cashless/digital economy there is need to build greater digital infrastructure, which is vital considering the current digital infrastructure of India.

A move towards cashless economy has multi-faceted benefits for any economy. But push towards digital economy calls for greater digital infrastructure. Hence government should address all the issues related to digital infrastructure to realise the benefits of digital economy.

Digital India

The Digital India Programme of the NDA Government is a repackaged and consolidated version of the hitherto called National e-governance plan with an equally nice sounding label. It seeks to deliver all government services electronically.

It not only envisages giving boost to information technology but also envisages achieving import-export balance in electronics.

The Dl initiative was envisaged by the Department of Electronics and Information Technology (Deity), and will be implemented in phases that will culminate in 2018-19. The initiative is being implemented as an umbrella programme which shall include all departments and ministries within its scope. However, the implementation shall be monitored and overseen by a Digital India Advisory group that will be headed by the Ministry of Communications.

Objectives

The Digital India (DI) initiative aims to bring digital empowerment to India and aid in its transition to becoming a knowledge economy. The programme aims to do so through a combination of building digital infrastructure, providing digital services, implementing e-governance in an accessible manner and using technology as a driver of change and growth. Thus, the objectives are:

· Transform so far agrarian Indian economy to a knowledge- centric economy.

· Plug the widening digital divide in Indian society.

· Give India equal footing with the developed world in terms of development with the aid of latest technology.

Salient Features:

· Umbrella programme which includes the hitherto National

· Optical Fiber Network (NOFN) to connect 2, 50,000 gram Panchayats by providing internet connectivity to all citizens.

To be completed in phased manner by 2019.

· To be monitored by a Digital India Committee comprised of several ministers.

· Contemplates creation of massive infrastructure to provide high-speed internet at the gram level, e-availability of major government services like health, education, security, justice, financial inclusion, etc. thereby digitally empowering citizens.

· Will also ensure public answerability via. a unique ID, e-Pramaan based on standard government applications and fully online delivery of services.

· Has capacity to create huge number of jobs.

· If implemented well, will be a great boost for the electronics industry in India and expectedly will see a fall in imports of electronics.

Nature and Scope

DI aims to encourage the participation of individuals in digital activities through promotion of digital usage through mobile phones etc and also beefing up of infrastructure. High speed internet will be made available at the Gram Panchayat level.

Individuals will maintain a digital identity right from birth. A public cloud will be created with private space that could be shared. Emphasis will also be placed on making cyber space secure for Indians.

All departments and ministries will work together to provide single window access to all individuals. Government services can be availed either through mobile phones or through the internet. All processes will be simplified, making digital access easier. Citizen entitlements will be made available on the cloud.

Also, efforts will be undertaken to make financial transactions of a sizeable amount electronic and cashless.

Another major aim of the DI is to educate people and increase awareness about digital processes. To further this aim, the government will promote universal digital literacy and make all digital resources universally accessible to the people. Also, to make digital resources and services accessible to all people, it will be made available in all Indian languages.

Scope of DI

The DI programme covers a wide range of areas:

Broadband Services: It provides for incremental coverage of broadband services in gram panchayats over a span of three years at a cost of Rs. 32,000 crore under the guidance of Department of Telecommunications (DoT). It also provides for building up of a national information infrastructure with the guidance of Deity.

Mobile connectivity: Another important objective is to provide universal access to mobiles, improve mobile connectivity and increase mobile network penetration at a cost of 16,000 crores and under the DoT's purview.

Public Internet Access: DI also aims to establish service centres in rural areas through a National Rural Internet Mission and in post offices thus ensuring easy public access to internet and other digital services.

E-governance: The government aims to simplify procedures and reduce bureaucratic hurdles by using IT for a variety of purposes such as maintaining electronic databases, registering grievances against public officials, etc.

E-kranth: This provides for electronic delivery of services such as education, heakhcare, dispensing justice, educating farmers, forming plans, increasing financial inclusion etc. DI will continue in the footsteps of the National e-governanee Plan with respect to implementation of these.

Access to formation: Use technology to proactively engage with citizens through social media, emails, messages etc.

Also, build portals that provide people easy access to relevant information Manufacturing of electronics; DI aims to bring down India?s electronics imports to zero by 2020 through adopting a variety of measures aimed at boosting domestic manufacturing.

IT Jobs: Creation of skilled workforce in the area of IT.

Improve capacity-building and provide training so that a suitable work force is built. The DI programme envisages 1.7 crore direct and 8.5 crore indirect opportunities.

Early harvest programmes: Envisions converting all aovernment sreetinas into e-greetings. Development of an IT platform for mass messaging and biometric attendance for all government employees is also being developed.

National Knowledge Network (NKN): The scheme has been initiated for establishing the National Knowledge Network with multiple gigabit bandwidth to connect Knowledge Institutions across the country.

Also includes connecting citizens by social network called

My Goy, envisages as Net-Zero Electronics Import Target by 2020 and setting up of an Electronic development fund.

Thrust Areas in Digital India

\[\Rightarrow \]Broadband highways

\[\Rightarrow \]Total mobile connectivity

\[\Rightarrow \]Public Internet Access Programme

\[\Rightarrow \]E-Governance,

\[\Rightarrow \]E-Kranti

\[\Rightarrow \]Boost to electronics firms,

\[\Rightarrow \]Employment

\[\Rightarrow \]Early harvest programmes

\[\Rightarrow \]My Goy

\[\Rightarrow \]Net-Zero Electronics Import Target by 2020

\[\Rightarrow \]Electronic development fund

New Incentives Announced in the Budget 2016-17

Electronics Manufacturing

· Electronic manufacturing in India has got boost by further rationalization of duty structure.

· Tax benefits for IT units in SEZs has been extended from 2017 till 2020.

· This will enable technology units to set up and commence operations in SEZs and also significant move for skill development to services companies as well.

· This will permit 30 % of additional wages paid to new workmen, deductible for 3 years. This will give a big boost to the BPO operations and generate new jobs (essential for India to reap it?s demographic dividend).

Encouragement to Digital Literacy & Digital Lockers

· Digital depository of school leaving certificates, college degrees and mark-sheets will be created.

· This would enhance the footprint of cloud technology in the Country.

· The IT department has already laid down the framework for cloud technology and will assist in the expansion.

· Cloud Technology is the delivery of on-demand computing resources?everything from applications to data centers over the Internet on a pay-for-use basis.

Extraordinary expansion to Digital Literacy in the country; imparting digital literacy to 6 crore households in next 3 years

· As of now, against the target of 52.5 lakhs, more than 40 lakhs have been trained.

Use of Aadhaar platform for delivery of services

· A legislation will be brought to give a statutory backing to Aadhaar, for delivery of services /subsidies / benefits, corning out of Consolidated Fund of India.

· This will prevent leakages by identifying the beneficiaries correctly and would encourage good governance.

· Greater stress on the use of digital platform across various departments.

· This will further encourage consolidation of seminal programmed of Digital India.

Reforms in Postal Department

· Effort is being made to leverage the vast network of India

· Post for implementing the mandate of financial inclusion.

· Today, India Post has not only installed more than 576 ATMs but has overtaken the SBI to become India?s largest Core Banking Network having 18,231 branches.

· By March, 2016 all the 25,000 Departmental Post Offices would offer Anywhere Banking facilities using Core Banking Solutions.

· Further, India Post has achieved new heights in tapping the potential of e-commerce.

· Its parcel revenues have witnessed a growth of 110% and it has collected more than Rs.1200 Crores from Cash on Delivery mode of payment for e-Commerce services.

Cashless Economy in India

An economy in which all transactions are carried through electronic channels such as credit and debit cards, electronic clearing etc. is called as cashless economy. The flow of cash in such economies is nonexistent or bare minimum.

Cashless Economy is when the flow of cash within an economy is non-existent and all transactions have to be through electronic channels such as direct debit, credit and debit cards, electronic clearing, and payment systems such as Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS) in India.

As of now. Cashless Economy has only academic importance.

The Indian Economy continues to be driven by the use of cash; less than 5% of all payments happen electronically. In India, the ratio of cash to gross domestic product is 12.42% in GDP, which is one of the highest in the world.

There are several reasons as to why Indians prefer Cash over electronic transactions. Firstly, lack of access to banking leaves no option other than cash for a large fraction of the population. Secondly, since, there are no extra transaction costs in Cash payments, it affects the consumer behavior.

Electronic payments had been so far unviable for small value transactions but things are changing fast. Thirdly, Cash provides flexibility and simplicity as a transaction needs only moving from one hand to another, there are no worries about crashing of computers and losing the transactions. Fourthly, India has a large unorganized sector with overwhelming majority of retailers, suppliers and service providers. They have neither the infrastructure to offer card-based transactions nor the inclination to encourage consumers to pay by credit cards or debit cards. Lastly, the lack of education / awareness among consumers regarding use of cards.

Current Situation in India

In India most of the transactions are done through cash.

According to various data released: less than 5% of all payments happen electronically. The ratio of cash to gross domestic product is one of the highest in the world?12.42% in 2014, compared with 9.47% in China or 4% in Brazil. The number of currency notes in circulation is also far higher than in other large economies; India had 76.47 billion currency notes in circulation in 2012-13 compared with 34.5 billion in the US.

Why Indians Prefer Cash over Electronic Transactions

Lack of banking access is one of the major hindrances in moving towards a cashless economy.

Consumer Behaviour: Consumers prefer using cash more than electronic mode for day to day purchasing, payments etc. A cash transaction is immediate, as simple as a banknote moving from one hand to another. When A.T. Kearney surveyed consumer behaviour at malls, it found that close to 90% transactions happened by cash.

Apart from illiteracy about electronic mode, consumer behaviour is also guided by the fact that use of cash is simple and easy away from the hassels of understanding the computer system.

Further new systems of electronic payments like digital wallet etc. do not attract the middle class consumer. For e.g. A thousand rupees loaded into Ola's digital wallet allows you to only buy taxi rides; the same thousand rupees as a banknote in your pocket can buy you anything under the sun.

Large Unorganized Sector: Most of the Indian work force works in unorganized sector. Accompanied by this majority of retailers, suppliers and service providers belong to the informal sector. They have neither the infrastructure to offer card-based transactions nor the inclination to encourage consumers to pay by credit cards or debit cards.

Lack of Awareness among Consumers: Non users of electronic mode of payment are not even aware of the benefits of credit or debit cards. Among debit card holders, who are the most obvious targets for conversion to cashless transactions, only 30% are aware that credit card usage offers a zero-interest credit for a maximum of 30 days. Just 55% perceive credit cards as providing hassle-free and fast payment; and only 22% know of the reward schemes. Further, nearly 75% debit card owners do not realise that with credit cards they can pay in equated monthly instalments (EMIs) without any paper work. Therefore consumer perception is also a barrier in moving towards cashless economy.

Benefits of Cashless Economy

The direct cost of running the economy is huge. For instance:

In the period 2010-11, the RBI spent nearly Rs 24 billion on printing money, and an additional Rs 455 million on distributing that money nationwide. Once the economy shifts to electronic transfers there will be efficiency gains as transaction costs across the economy will come down.

The benefits of a less-cash economy are for individuals, too.

No need for queues outside ATMs, no cashout during long holidays, no waiting for a deposited cheque to be credited, and no risk of carrying currency notes in the wallet. Cashless transactions with the enhanced security procedures address each of these problems.

Use of less cash will also keep a check on generation of black money, prevent money laundering, increase tax compliance.

This will ultimately help the consumers from side effects of above illegal activities.

In India huge amount of money is spent on welfare programmes.

However no significant results are achieved on ground level owing to corruption and lack of transparency. Once government switches over to electonic cash transfers there will be greater efficiency in welfare programmes as money is wired directly into the accounts of recipients making the entire process becomes transparent. Apart from direct benefits there are greater indirect benefits.

Most important of these being increase in the pace of circulation of money. Cash, being material, can be prevented from circulation. For example, cash that a tourist brings back unused from a foreign visit will lie idle till her next trip.

Cards and electronic channels act to alleviate this friction and increase circulation. Electronic transactions will also leave ample liquidity with the banks to lend to more sectors of the economy.

Steps Needs To Be Done

To Promote Cashless Economy: Enabling access to banking is a pre requisite to promote cashless economy. So the success of initiatives such as Jan Dhan accounts linked to Aadhaar data will be of prime importance. A robust payments mechanism to settle a digital transaction is also needed, though the National Electronic Funds, Transfer and Real Time, Gross Settlement services. The government has to come out with innovative ideas to promote cashless transactions. For eg; the government can offer 1 or 2% rebates to merchants who report at least half of their transactions through online payment.

Further the government has to give incentives to private to make internet available to remotest corners of the country.

Without internet services with competitive pricing the aim of moving to cashless economy remain unfulfilled. Apart from this consumer needs to be awakened to the benefits of using debit and credit cards. Because without changing consumer perception any amount of efforts will go waste.

Scope of Cashless Economy

Currently India is witnessing a huge demographic dividend and by 2030 or so it will highest number of youth population. So the analysts expect the Smartphone market to exhibit a growth of four times over the next five years. This will also bring a marked shift among the consumers behaviour to switch to mobile banking. Moreover we can estimate the upside potential from the fact that India has less than 40 million mobile banking users while each of the top three Chinese banks have in excess of 100 million. Also the telecom industry is expected to boost the digital shift. Various innovative tools have been launched by the telecom companies to entice the customers. For eg: Prepaid cards are extensively used by telecom operators and also offer mobile users the benefit of lower liability in case of loss or fraud in the online space. Such a mechanism will help to accelerate the movement away from cash while mimicking the benefits of currency. If there was a prepaid payment card option available which consumers could preload with small amounts for use at grocer's and neighbourhood retail stores with the benefit of receiving phone alerts for every transaction, it would perhaps be one of the effective ways of transitioning consumers from cash to cashless in a safe and easy manner.

The government is also giving incentives for electronic transactions. For eg: service tax waiver when credit cards or other forms of digital settlements are used. Therefore apart from the need of the economy there is also a lot of potential to bring this change.

Steps taken by RBI and Government to discourage use of cash

Licensing of Payment banks

· Government is also promoting mobile wallets. Mobile wallet allows users to instantly send money, pay bills, recharge mobiles, book movie tickets, send physical and e-gifts both online and offline. Recently, the RBI had issued certain guidelines that allow the users to increase their limit to Rs. 1,00,000 based on a certain KYC verification

· Promotion of e-commerce by liberalizing the FDI norms for this sector.

· Government has also launched UPI which will make Electronic transaction much simpler and faster.

· Government has also withdrawn surcharge, service charge on cards and digital payments

Challenges in Moving to Digital Economy:

· Not enough smart phones in the country: While most digital transactions in India can only be undertaken through smartphones, only about 17% of Indians own a smartphone. This is the lowest among BRICS countries and way below global average of 43 %.

· Security issues: Recent security breach of 3.2 million debit cards is a stark reminder of our weak cyber security architecture. Mobile payments applications are not using hardware-level security which can make online transactions more secure.

· No regulatory system in place: The regulatory attitude is archaic, with a requirement to report security breaches on a quarterly basis, and limited attention on monitoring compliance with international security standards.

· Lack of awareness: User awareness about digital security is also negligible.

· Dormant accounts and associated issues: Close to 240 million bank accounts were opened in no time under PMJDY, but most of them remained dormant despite added incentives. Creative use of such accounts to launder unaccounted money is now being reported.

· Over the counter cash usage: Electronic wallets might be predominantly used to receive online payments, only to be immediately withdrawn and used over the counter.

Note that Kenya, despite being the epicentre of the digital payments revolution, is still struggling with high over- the-counter cash usage.

· No robust Digital infrastructure in place: Several externalities include successful authentication of user information, availability of mobile or Internet connectivity, existence of payment and acceptance infrastructure.

Success of digital economy is contingent on these as well.

While moving cashless per se looks fancier than the reality.

As mentioned in the above points it comes with challenges and solutions. Right now the government should focus on ensuring the reliability of digital transactions without any glitches.

· Get Unabanked to banking system: Lot many people in our country still do not have bank accounts. While success of Jhan Dhan is apparent, efforts have to be made in creating awareness about moving to cashless transactions for people who already have Jhan Dhan accounts. And aggressive steps have to be taken to bring unbanked people in to banking system.

· Trust factor: Digital transaction is new to major part of our population in our country. There is always a fear/trust factor that influences majority population to adopt for conventional banking system. This can be overcome by having a best in class digital infrastructure and conducting mass programs about benefits about moving to digital transactions.

· Cyber security: Cyber security products and services need to be designed through a bottom-up approach, i.e. they should be able to deal with local problems and provide customized user-centric comprehensible solutions.

· Building digital infra and creating Awareness campaigns: Government needs to aggressively step up Building digital infrastructure and conducting mass awareness campaigns to masses.

· Strong regulatory system: There needs to have a strong regulatory system in place to deal with deal with external contingency situations and issues like cyber fraud.

· Accessibility: While it is no doubt that digital transactions will be most sought after options to conduct financial transactions in future. Accessibility to such digital platform has to be taken care of.

Recent Developments

· The Union Government has shifted the responsibility of promoting digital transactions in the country to the Union Ministry of IT and Electronics (MEITY) from NITI (National Institution for Transforming India) Aayog. In this regard. Government already has changed the business transaction rules to enable MEITY to promote digital transactions, including digital payments.

· The Union Cabinet has approved a draft ordinance to empower states and allow industries to pay workers? wages digitally, through a direct bank transfer to accounts or by cheque in a bid to encourage cashless transactions.

· The draft ordinance proposes changes to the Section 6 of the Payment of Wages Act, 1936 to encourage cashless transactions. It will need the President's assent to become law as per article 123 of the Constitution.

· The Union Government has launched Lucky Grahak Yojana to encourage consumers and Digi Dhan Vyapar Yojana to encourage merchants for transition to digital payments. These award based schemes were launched by the NITI (National Institution for Transforming India) Aayog, government's policy think-tank.

· The Union Ministry of Electronics and Information Technology (MeitY) has launched a TV channel named ?DigiShala? to promote cashless transactions. The channel was launched as part of the ?Digidhan? campaign which aims to spread awareness about digital transactions.

· Vittiya Saksharata Abhiyan (VISAKA) was launched by the Union Ministry for Human Resource Development (HRD) to make people aware about cashless economic system.

· The NITI Aayog has constituted a 13 member Committee on promotion of cashless society and digital economy.

· It will be headed by Andhra Pradesh Chief Minister Chandrababu Naidu. Chief Ministers of Odisha, Madhya Pradesh, Sikkim, Puducherry and Maharashtra representing different political parties are its members.

· The Union Cabinet has apprised of a Memorandum of Understanding (MoU) signed between India and Tunisia for strengthening bilateral cooperation in the field of Information and Communications Technology (ICT) and Digital Economy.

· Japan has officially recognized bitcoin and digital currencies as legal money along the lines of other fiat currencies with effect from April 1, 2017. The recognition comes after implementation of a new law amending Banking Act in Japan for legalizing these currencies.

It will help in integration of digital currency into legal banking system through regulatory scrutiny. Bitcoin is a form or digital currency or virtual currency created and held electronically. No one controls it that is not regulated by any central bank or government.

· The Union Government has launched Bharat a quick response (QR) code to enable digital payments without card swiping machines. It is world's first interoperable payment acceptance solution launched by Indian Government to move towards less-cash economy, QR code (Quick Response code) is a two-dimensional (matrix) machine-readable bar code made up of black and white square. This code can be read by the camera of a smartphone.

· Hailakandi district of Assam has become the first district to pay wages to tea garden workers through individual bank accounts.

· Akodara village in Sabarkantha district of Gujarat has earned the coveted tag of becoming India?s first digital village. The village with a total population of 1,191 people and 250 households uses a various cashless system for payments of goods and services. All transactions in the village are carried out through digital modes like SMS, net-banking or debit cards.

Goods and Service Tax (GST) 2017

The Good and Services tax is a proposed indirect tax that will replace India?s complex indirect tax system with a more simplified tax structure. Taxes such as excise duty, value added tax, Central sales tax, and octroi, among others, will all be wrapped up and replaced by a single tax- the GST.

The GST is paid by the end-consumer, which makes it difficult to evade and easy to administer. It's also a sledgehammer tax, levied on everyone, rich or poor (unlike an income tax), which usually results in a lot of money for governments. The tax also helps the Union government become more powerful ? using the council, it can now control tax rates in the state.

Goods & Service Tax (GST) 2017

|

Why do we need GST? |

|

Evolution of businesses has led to blurred Taxation lines between Centre & State, leading to double taxation Cascading effect due to multiplicity of taxes & their non- creditable nature Extreme disparities in the rate of taxes levied by states Amendments in state VAT laws, leading to multiple compliance requirements Tax System needs to be destination based, rather than origin based |

|

GST-Council |

|

|

GST-TAXES |

||

|

Tax structure : 5%, 12%, 18%, & 28% |

||

|

Cess surcharge beyond 28% are: |

||

|

(i) |

Luxury cars |

15% |

|

(ii) |

Aerated drinks/water |

15% |

|

(iii) |

Panmasala |

135% |

|

(iv) |

Tobacco & cigarettes |

290% |

|

(v) |

Coal & lignite |

Rs. 400 / tonnes |

|

Features |

|

|

GST Replaces |

|

|

States Taxes |

Central Taxes |

|

|

|

Impact |

|

|

Price Impact |

General Impact |

|

|

|

Exclusion |

||

|

Alcohol |

Petroleum |

Real Estate |

|

Remains as states monopoly |

Out for 2 years with states |

? Stamp duty with States ? Service tax with GST |

|

Implementation Drive |

|

|

Hardware/Manpower |

Software/GST-Network |

|

|

Problem with our current Indirect Tax system

Multiple Duties / Taxes

There are multiple taxes levied on goods and services. Excise duty on manufacture, customs duty on imports and exports, service tax on services are levied by the Central Government.

On the other hand, VAT, Entry Tax, Purchase Tax, Octroi and duty on liquor are levied by the State governments.

Besides, there are other taxes /levies such as entertainment tax, luxury tax, stamp duty, cesses, surcharges, and road tax.

Such multiplicity of taxes distorts the tax structure and brings in complexities

Lack of Uniformity across States

Present structures of VAT across states lacks uniformity.

The differences are there with respect to definition of goods, capital goods, threshold limits, classification, exemptions, and procedures. This leads to increased complexities for corporate having operations in multiple States.

Confusion between Goods and Services

A problem under the State VAT is to determine whether a particular transaction constitutes a sale of goods or supply of services. This problem is most acute in the case of software products and intangibles such as the right to distribute/exhibit movies or time slots for broadcasting advertisements. In this context it is important to note that sales of goods are governed by the State Vat and the sale of services are governed by Centre Government.

Exclusion of States from the Preview Of Service Tax

The States are precluded from taxing services. This arrangement has posed difficulties in taxation of goods supplied as part of a composite works contract involving a supply of both goods and services, and under leasing contracts, which entail a transfer of the right to use goods without any transfer of their ownership.

Multitude of Exemptions Distort the Tax Base

The starting base for the CENVAT is narrow, and is being further eroded by a variety of area-specific, and conditional and unconditional exemptions. There have been attempts to rationalize the CENVAT rates by reducing their multiplicity but the government has not adhered to its own policy and has reintroduced concessions for several sectors/products.

Cascading Efeect

Although some success has been achieved in this context with the introduction of VAT, there are still certain shortcomings in the structure of VAT both at the Central and at the State level.

The most significant reason for cascading of tax is the partial coverage of Central and State taxes on account of various exemptions, for instance, Oil and gas production, mining, agriculture, wholesale and retail trade, real estate construction, and range of services remain outside the ambit of both the CENVAT and the Service tax levied by the Centre.

Lackluster Indigenous Production Due To

Cenvat

The CENVAT is levied on goods manufactured or produced in India. This gives rise to definitional issues as to what constitutes manufacturing, and valuation issues for determining the value on which the tax is to be levied. While these concepts have evolved through judicial rulings, it is recognized that limiting the tax to the point of manufacturing is a severe impediment to an efficient and neutral application of tax. Manufacturing itself forms a narrow base.

Background of GST

The idea of GST began to be discussed in India more than one and a half decade ago. The shortcomings of the existing system of indirect taxes has been universally accepted by the economists and the policy makers.

· After the Fiscal Responsibility and Budget Management Act was passed in 2003, the then F.M. Jaswant Singh?s Economic Adviser, Vijay Kelkar, suggested that meeting targets of lower fiscal deficit would entail increasing revenues, and not necessarily cutting spending in a growing economy with a severe infrastructure deficit.

· Kelkar's point was that India should use this opportunity to work on a modern tax law by shifting the focus from a tax on production to a tax on consumption, and by creating a single national market that would provide a huge boost to Indian manufacturing.

· There were other considerations too. India was signing regional tax treaties, which Kelkar recognised could hurt Indian industry and hobble the competitiveness of local firms. Kelkar, along with Arbind Modi, an IRS officer, and Ajay Shah, another adviser in the Ministry, started work on a report on the Task Force for the Implementation of the FRBM. That was the first report on a design for the GST - which suggested a single low rate: 7% for states and 5% for the Centre, and which detailed a plan for a grand bargain with states to get the proposed new taxation structure off the ground.

· After 2004, the next Finance Minister, P. Chidambaram, picked up the threads. He worked out the financial support to states and campaigned for the introduction of VAT.

· After overcoming resistance, by 2005, Chidambaram announced a national VA± or GST. covering both the Centre and the states, Budget 2006 signalled April 1, 2010, as the date for launching GST, By 2009, the first discussion paper on GST was unveiled by the Finance Ministry. The Finance Commission headed by Kelkar recommended several steps for the launch, including a substantial grant to the Empowered Committee to help reduce dependence on the Central Government to carry out research. In December. 2009 Task Force set up by the 13th Finance Commission presented its report.

· In 2011, Finance Minister Pranab Mukherjee introduced a Bill to provide the enabling framework for GST. That went to the Parliamentary Committee on Finance led by Yashwant Sinha, which suggested changes. During that period, resistance to the proposed GST was led by Madhya Pradesh and Gujarat. The resistance was strong enough for Sinha to examine these arguments before Kelkar twice in the proceedings of the Committee. Some of the states opposing the new structure also raised the issue of their autonomy being impacted.

· 'Report on the 115th Constitution Amendment (GST) Bill, 2011' by Parliamentary Standing Committee on Finance in August, 2013.

· After the present government came to power, efforts were renewed, and the legislation was approved in the Lok Sabhain2015.

· The 122nd Constitution Amendment Bill intoduced by the government in December, 2014, since the earlier bill had lapsed. The bill was passed by the Lok Sabha in 2015.

· But the government's lack of numbers in the Upper House led to a long standoff with the Opposition in 2016.

· Back channel talks were initiated, and Finance Minister Arun Jaitley led negotiations with several stakeholders?mainly state governments?and gradually got them on board.

· GST Bill was eventually passed by the Rajya Sabha on 3rd August 2016.

· The passage of key bills in the last week of March 2017 has now paved the way for the launch of GST on July 1, 2017,

Salient feature of proposed Indian GST System

· GST will be levied on ?supply? of goods and services and hence the present prevalent concepts of levy of excise on manufacture, VAT/CST on sales, entry tax on entry of goods in local area will no longer be relevant. The ambit of 'supply' is quite wide and covers supply of goods and services without consideration from one taxable person to another.

· There would be dual GST i.e. both the Centre and the States would concurrently levy GST across the entire goods and services supply chain on a common base.

· Centre will levy Central GST (CGST) and States will levy State GST (SGST) on every supply of goods and services within a State. Integrated GST (IGST) will be levied on all inter-state supplies by the Centre and then transferred to the Destination State. Unlike in the present scenario, IGST will have to be paid on all inter-state supplies.

· Present Central Taxes like Central Excise, Service Tax, CVD, SAD, CST and State Taxes like VAT, CST, Entry Tax, Luxury Tax will be subsumed under GST. Customs is outside GST and hence Basic Customs Duty would continue on imports.

· GST is a destination based consumption tax, which essentially implies that the revenue will accrue to the State where the consumer resides. This is unlike the present origin based levy where the revenue accrues to the origin state from where the movement originates.

· Seamless flow of credit would be there under GST whereby CGST would be allowed to be set-off against CGST and IGST, SGST against SGST and IGST and IGST against IGST, CGST and SGST in that order. However, CGST credit will not be allowed to be set-off against SGST and vice versa. Thus, under GST, the present cost of 2% CST on inter-state sale will not be there as IGST would be totally fungible in the Destination State.

· However, credit fungibility is state-centric as credit accumulated in one State cannot be used against tax payouts in another State.

· Liability for payment of GST would arise at the time of supply of goods and service. In terms of model law, receipt of advance payments for supply of goods and/or services would be considered as 'time of supply' and tax liability would arise on such advance receipt. However, receipt of goods and services is one of the pre-conditions for allowing input tax credit under GST and hence, even if GST is paid on advance payments, credit for the same would be available only on receipt of goods and services.

· Registration threshold has been presently kept at Rs.10 Lakhs (Rs. 5 lakhs in case of North East States and Sikkim) in the draft model law. Existing registered assesses would be migrated into GST, first provisionally and then finally subject to furnishing of requite information. Assesses have the option to take business segment-wise registration.

· Option of composition levy is also prescribed, if aggregate turnover of a tax payer is Rs.50 lakhs. Persons adopting composition levy would be neither entitled to charge GST from its customers nor to avail credit of input tax.

However, composition levy is not allowable to assesses who affects inter-State supplies.

· Under GST, every assessee would have to upload invoice level outward supply details for B2B transactions. Details of inward supplies and tax credit would be auto-populated based on sales details uploaded by the vendor. Hence, a robust IT infrastructure at the end of both supplier and recipient is critical for hassle free tax credits and avoid denial of credits due to mismatch issues.

· Provisions relating to payment of tax under reverse charge, tax deductions at source are expected to continue under GST regime for specified persons/transactions.

· Thus, additional compliances would continue on the part of recipients, so far as tax payments under reverse charge and deduction at source are concerned.

|

Present tax collection system. Example |

GST Collection system. Example |

|

Stage 1: |

Stage 1: |

|

In the process of creating jeans, the manufacturer buys raw materials for Rs.100 & adds value to the materials he Started out with. Let us take this value or/margin/profit added by him to be Rs.30 The gross value of his good world, be Rs.130 (100+30). At a tax rate of 10% , the tax on output will be Rs.13. Here good sold to wholesaler for Rs.143+20) |

Under GST, Manufacturer can set off this tax (Rs.13) against the tax he has already paid on raw material/inputs (Rs.10) Therefore, the effective GST on the Manufacture will be only Rs.3 (13-10). He will sell good to wholesaler for Rs.133 (100+30+3). |

|

Stage 2: |

Stage 2: |

|

The wholesaler purchases it for Rs.143, and adds on value (his ?margin?) of, say Rs.20 The gross value of jeans he sell would then be Rs.163 (Rs.143+20) A 10% tax on this amount will be Rs.16.3. He will sell it to retailer for Rs.179.30 (163+16.3.) |

Wholesaler adds margin of Rs.20 on good. Its value =Rs.153 (133+20) Under GST, he can set off the tax on his output (Rs.15.30) against the tax on his purchased good from the manufacturer (Rs.13). Thus, the wholesaler is only Rs.2.30 (15.30-13). He will set it to retailer for Rs.155.30 (153=2.30) |

|

Stage 3: |

Stage 3: |

|

To retailer purchase price of Rs.179.30 he adds margin of Rs.10. The gross up to Rs. 189.30 (Rs.179.3+10). The tax on this, at 10%, will be Rs. 18.93 He will sell it to consumer for Rs.208.23 (189.3+18.93). |

Retailer adds margin of Rs.10 on good. Its value =Rs.165.3 (155.3+10) Tax 10% =16.53 But by setting off this tax on his purchase from the wholesaler (Rs.15.30), the effective GST incidence on himself to Rs. 1.23 (16.53-15.30). Here good total value = 165.30+1.23=166.53. i.e consumer buys it for Rs.1666.53. So, the total GST on the entire Value chain from the raw material/input suppliers through the manufacturer, wholesaler and retailer is, Rs.10+3+2.30+1.23, or Rs. 16.53. |

GST Council

The Constitution (122nd Amendment) Act, 2016, brought into force Article 279A with effect from 12th September, 2016.

As per Article 279A of the amended Constitution, the GST

Council which will be a joint forum of the Centre and the

States, shall consist of the following members: -

|

A. Union Finance Minister |

Chairperson |

|

B. The Union Minister of State, in-charge of Revenue of finance |

Member

|

|

C. The Minister In-charge of finance or taxation or any other Minister nominated by each State Government

|

Members |

As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain states, etc.

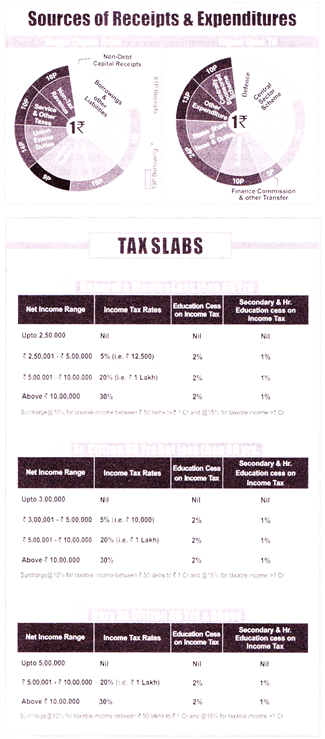

GST Rate Structure

A four-tier GST tax structure of 5%, 12%, 18% and 28%, with lower rates for essential items and the highest for luxury and de-merits goods that would also attract an additional cess.

With a view to keeping inflation under check, essential items including food, which presently constitute roughly half of the consumer inflation basket, will be taxed at zero rate.

The lowest rate of 5 % would be for common use items while there would be two standard rates of 12% and 18% under the GST regime targeted. Highest tax slab (28%) will be applicable to items which are currently taxed at 30-31 % (excise duty plus VAT).

Luxury cars, tobacco and aerated drinks would also be levied with an additional cess on top of the highest tax rate. The cess would be lapsable after five years.

The collection from this cess as well as that of the clean energy cess would create a revenue pool which would be used for compensating states for any loss of revenue during the first five years of implementation of GST.

Significance

Currently in India there are parallel systems of indirect taxation at the state and Central levels. There are multiple points of taxation and a cascading of taxes, that is, tax on tax. Interstate commerce has also been hampered due to the dead-weight burden of Central sales tax and entry taxes.

By minimising the cascading effect of multiple taxes, not only is GST expected to iron out the wrinkles in the existing tax system, it is hoped that it will spur much needed growth in the Indian economy.

Some of the advantages of GST are:

· Simplified Tax System

Elimination of multiplicity of taxes and their cascading effects, the tax structure is expected to be much easier to understand. Paperwork will become simpler and there will be a reduction in accounting complexities for businesses. Wider tax base, necessary for lowering the tax rates and eliminating classification disputes. Rationalization of tax structure and simplification of compliance procedures. Harmonization of center and State tax administrations, which would reduce duplication and compliance costs. Automation of compliance procedures to reduce errors and increase efficiency

· Increased Tax Revenue

GST?s tax structure will bring about greater tax buoyancy as it creates interlocking incentives for compliance between vendor and customer. This will increase the number of tax payers and in turn tax revenues for the government.

· Fiscal Consolidation

A recent report by CRISIL states that GST is the country?s best bet to achieving fiscal consolidation. Also, there is not much scope to reduce the government's fiscal expenditure; increasing tax revenues is the best alternative to improve the fiscal health of the Government.

· Push to GDP

A simple taxation regime will also enhance the ease of doing business, making the manufacturing sector more competitive and saving both money and time. Experts opine that the implementation of GST would push up the GDP by 1%-2%1.

· Competitive Pricing

As GST eliminates all other forms of indirect taxing, taxes paid by the final consumer will come down in most cases. Lower prices will help in boosting consumption and demand, which will, in turn, be beneficial to companies. The biggest positive is that goods and services will be taxed on a common basis.

· Boost to Exports

With production costs falling in the domestic market, Indian goods and services will become more price-competitive in foreign markets. This will help exporters, who will now be able to compete with manufacturers abroad.

· Cooperative Federalism

Adoption of GST is an iconic example of cooperative federalism. While the states have agreed to give up their right to impose sales tax on goods (VAT), the Centre has given up its right to impose excise and services tax. In exchange, each of them will get a share of the unified GST collected nationally.

· An Unified National Market for Goods and Services

By eliminating barriers such as entry taxes, GST will result in a unified national market for goods and services that will be accessible to the smallest entrepreneur. It could potentially make sourcing, distribution and warehousing of goods easier and faster between the Indian states. Also, as companies will no longer need to pay interstate taxes, implementation of GST will free up capital that they can now use in their business.

IMPACT

· Removal of tax barriers on introduction of uniform GST across the country with seamless credit, will make India a common market leading to economy of scale in production and efficiency in supply chain. It will expand trade and commerce. GST will have favourable impact on organised logistic industry and modernised warehousing.

· GST will remove cascading effect of taxes imbedded in cost of production of goods and services and will provide seamless credit throughout value chain. This will significantly reduce cost of indigenous goods and will promote ?Make in India?.

· The sectors which have long value chain from basic goods to final consumption stage with operation spread in multiple states such as FMCG, pharma, consumer durables, automobiles and engineering goods will be the major beneficiaries of GST.

· GST will facilitate ease of doing business in India, Integration of existing multiple taxes into single GST will significantly reduce cost of tax compliance and transaction cost.

· Stable, transparent and predictable tax regime will encourage local and foreign investment in India creating significant job opportunities.

· Electronic processing of tax returns, refunds and tax payments through 'GSTNET without human intervention, will reduce corruption and tax evasion. Built-in check on business transactions through seamless credit and return processing will reduce scope for black money generation leading to productive use of capital.

· Significant reduction in product and area-based exemptions under GST will widen the tax base with a consequent reduction in revenue neutral rate. This will enable the government to keep GST rates lower which may have favorable impact on prices of goods in the medium term.

· The tax rate for services however may go up by 2 to 3 % from the present level of 15%. The adverse impact of rate increase on services will be partially neutralised by availability of seamless input tax credit.

· GST will eliminate the scope of double taxation in certain sectors due to tax dispute on whether a particular transaction is for supply of goods or provision of service such as licensing of intellectual properties like patents and copyrights, software, e-commerce and leasing.

· While the GST will simplify tax structure, it will increase the burden of procedural and documentary compliance.

Number of returns will increase significantly so also the extent of information. For instance, a real estate developer or contractor will have to file 61 returns in a year compared to 24 returns at present. Similarly a taxable person providing services from several states will have to take registration and file return in all such states.

Currently a single centralised registration is required in such cases.

GST will also have impact on cash flow and working capital. Cash flow and working capital of business organisations which maintain high inventory of goods in different states will be adversely affected as they will have to pay GST at full rate on stock transfer from one state to another. Currently CST/VAT is payable on sale and not stock transfers.

· It is also pertinent to note that all indirect taxes will not be subsumed in GST. Electricity duty, stamp duty, excise duty and VAT on alcoholic beverages, petroleum products like crude, natural gas, ETF, petrol and diesel will not be subsumed in GST on its introduction. These taxes will form part of the cost of these goods when used as inputs in downstream products. Hence those sectors where these goods form significant input cost such as plastics and polymers, fertilisers, metals, telecom, air transport, real estate will not get mil benefit of GST.

· Major beneficiary of GST would be sectors like FMCG, Pharma, Consumer Durables and Automobiles and warehousing and logistic industry.

· High inflationary impact would be on telecom, banking and financial services, air and road transport, construction and development of real estate.

· Inter-State procurement could prove viable. This may open opportunities to consolidate suppliers/vendors

· Changes in tax system could warrant changes in both procurement and distribution arrangements. Current arrangements for distribution of finished goods may no longer be optimal with the removal of the concept of excise duty on manufacturing. Current network structure and product flows may need review and possible alteration.

· Tax savings resulting from the GST structure would require repricing of products. Margins or price mark-ups would also need to be re-examined

· Removal of the concept of excise duty on manufacturing can result in improvement in cash flow and inventory costs as GST would now be paid at the time of sale/ supply rather than at the time or removal of goods from the factory.

Lessons from across the world

· All around the world, GST has the same concept. In some countries, VAT is the substitute for GST, but conceptually it is a destination based tax on consumption of goods and services. It is only Canada that has the concept of dual GST, similar to what is proposed to be introduced in India.

· The most contentious issue that these countries are yet to be resolve satisfactorily is the GST rate. Some of these countries are still struggling to rationalize an adopted rate structure. The Government of Canada has been pragmatic and worked towards reducing the GST rate a couple of times post implementation. While some others have had to increase the rates very soon after introduction. This issue is highly relevant in the India context where once revenue neutral rate was discussed at 27% and now realistically being talked about at 16-18%. It is imperative that a reasonable rate structure is adopted to ensure the success of GST.

· Another aspect encountered and accepted by most of the GST countries lies in the statistic that GST will be inflationary, especially if the effective tax rate is higher than what prevailed before. For instance, Singapore saw a spike in inflation in 1994 when it introduced the GST.

That makes it all the more important for administrators to keep tabs on how prices move after imposition of the tax.

Malaysia, to an extent, was able to mitigate this risk as price control on account of the GST was administered by the Ministry of Domestic Trade and Consumer Affairs.

· Another key lesson from Malaysian experience is that businesses need to start early with the implementation process to be GST-ready. The Malaysian Government received strong resentment even after providing 1.5 years for GST preparedness. Given the complex GST model proposed in India and the need for a businesses to undergo a transformation to adapt to the GST regime, it would be quite challenging for the Indian government to tackle the ask of requiring businesses to implement GST with 1 July 2017 as the potential date of implementation.

a One constructive learning that did come handy in the GST preparation in Malaysia was the release of sector specific guidance papers on tax treatment concerning each business sector. It aided in addressing the ?to be tax practice? associated with a particular business segment. Indian legislative bodies could look into similar publications to effectuate the implementation of GST in a smooth way.

· As GST is a tax on transactions, which for most business organisations is voluminous, the processes and changes required for GST compliance need to be automated and encapsulated in the IT system. It is learnt that many big businesses have either failed or struggled to achieve IT transformation for having not planned or started early. It would be a mistake to assume that IT software with GST capability from other countries may be adopted wholesale in India, due to peculiarities embedded in the proposed Indian dual GST model.

· Additionally, the India GST regime places the small and medium enterprises (SMEs) on the same footing as large-scale industries by keeping the exemption threshold very competitive (proposed at l 1 million) without any tax differentiation. This poses daunting task ahead for SMEs to be ready to invest, read and change in the same way as any large-scale player, without appreciating the limited resources available with them. Some post-implementation truths from the GST in Malaysia includes wide-spread unrest and anti-GST street protests by small & medium businesses in Kuala Lumpur for few months after implementation even with a simpler systemic requirements and much higher level of exemption threshold.

· From the lessons learnt, there is no denying that acceptance of GST by general public, businesses and firms would not be an easy task, with advance planning and extending adequate time to industry, continued dialogues between businesses and administrators, engaging with industry on the implementation planning, a reasonable tax-rate, timely release of the legislative documents, has proven to aid in smooth GST implementation in many countries. Of course, GST is proven to be an efficient tax collection system despite teething problems in the -initial implementation period.

Challenges and Criticism:

· GST will based on accrual system of accounting.

Therefore, GST is to be paid following the month of raising an Invoice, irrespective of receipt against such Invoice. In fact, one has to pay GST even if he has received advance against supply of Goods/Services.

· CENVAT credit under GST can be taken only if the suppliers of goods and/or services have discharged their liability under GST. No such cushion is available to the output supplier against delays in payment of GST by its suppliers. This will make things complicated across industry.

· State-wise registration may become a big issue for those engaged in businesses like banking, Insurance, logistics etc where they have offices spread across the Country. It will be difficult to deal with different states, file monthly returns and manage various other GST related issues with each State Revenue Authority.

· At present States do not have any experience of handling Service Tax related issues, Under GST, States will be dealing with Service Tax related issues for the first time and that will make things more complex and may lead to unwarranted litigations and harassment for assesses.

· Exporters will have to deal with the increased requirement and blockage of working capital. For manufacturing a product, a firm buys locally or imports raw material and machinery. The current export schemes allow firms to buy these without payment of applicable duties through ab-initio exemption or subsequent refund of duties. The proposed GST system mandates that all duties must be paid at the time of a transaction while refund for these can be obtained after exports. This means the exporter will have to arrange money for the inputs, manufacturing and payment of duties and taxes. This will will increase tax collection, but will put immense pressure on exporters and will also make them non-competitive in International markets.

· There could be huge inflationary impact and blockage of free trade for some time due to adjustment to the new regime of taxation. The entire floating inventory of tradable goods will get costlier due to sudden increase in Rate of Taxes under GST.

· Another apprehension is the possible slowdown in movement of goods. The dealers and stockists would avoid investing into heavy inventory as GST will be levied merely upon supply of Goods. Therefore, if goods are moved to the showrooms/dealers, the Govt will be entitled to collect GST, even though there is no actual sale

is made to the consumer.

Economic Survey 2016

At A Glance

Indians on the move

· New estimates based on railway passenger traffic data reveal annual work-related migration of about 9 million people, almost double what the 2011 Census suggests.

Biases in Perception

· China's credit rating was upgraded from A+ to to AA- in December 2010 while India's has remained unchanged at BBB. From 2009 to 2015, China's credit to GDP coared from about 142. Percent to 205 percent and its growth decelerated.

New Evidence on Weak Targeting of Social Programs

· Welfare spending in India suffers from misapplications:

The districts with the most poor are the ones that suffer from the greatest shortfall of funds in social programs.

The districts accounting for the poorest 40% receive 29% of the total funding.

Political Democracy but fiscal democracy

· India has 7 taxpayers for every 100 voters ranking us 13th amongst 18 of our democratic G-20 peers.

· India's Distinctive Demographic Dividend India's share of working age to non-working age population well peak later and at a lower level than that for other countries but last longer. The peak of the growth boost due to the demographic dividend is fast approaching, with peninsular states peaking soon and. the hinterland states peaking much later.

India Trades More than China and a Lot within Itself

· As of 2011, India's openness- measured as the ratio of trade in goods and services to GDP has far overtaken China?s, a country famed for using trade as an engine of growth. India's internal trade to GDP is also comparable to that of other large countries and very different from the caricature of a barrier riddled economy.

Divergence within India, Big Time

· Spatial dispersion in income is still rising in India in the last decade (2004-14), unlike the rest of the world and even China. That is, despite more porous borders within India than between countries internationally, the forces of ?convergence? have been elusive.

Property Tax Potential Unexploited

· Evidence from satellite data indicates mat Bengaluru and Jaipur collect only between 5% to 20% their potential property taxes.

Economic Outlook and policy challenes

· This year has been marked by several historic economic policy development- Good and Services Tax, demonetisation on domestic front; and on the international front, Brexit and the US elections may herald a tectonic shift.

· Demonetisation is a radical governance cum social engineering measure. Aim of the action was fourfold to curb corruption, counterfeiting the use of high denomination notes for terrorist activities and especially the accumulation of ?black money?

· The action followed a series of earlier efforts to curb such illicit activities, including the creation of the special Investigation Team (SIT) in the 2014 budget, the black money act, 2015, the Benami Transactions Act of 2016, the information exchange agreement with Swizerland, changes in the tax treaties with Mauritius and Cyprus, and the Income Disclosure Scheme Disclosure Scheme.

· Demonetisation will create short term cost and provide the basis for long run benefits.

· Demonetisation has the potential to generate long term benefit in terms of reduced corruption, greater digitalization of the economy, increased flows of financial savings, and greater formalizations of the economy, all of which could eventually lead to higher GDP growth, better eventually compliance, all which could eventually lead to higher GDP growth, better tax compliance and greater tax revenue.

· Needed actions include remonetizing the economy expeditiously.

· Complementing demonetisation with more incentive compatible actions such reducing taxes and stamp duties and ensuring that the follow up to demonetisation does not lead to overzealous tax administration.

· The transformational GST bill will create a common Indian market improve tax compliance, boost investment and growth and improve governance; the GST is also a bold new experiment in the governance of cooperative federalism.

· In addition, the government overhauled the bankruptcy laws so that the ?exit? problem that pervades the Indian economy can be addressed effectively and expeditiously;

Codified the institutional arrangements on cemetery policy with the Reserve Bank of India (RBI); solidified the legal basis for Aadhaar, to realise the long term gains from the JAM trifecta,

· The national Payments Corporation of India (NPCI) successfully finalized the Unified Payments Interface (UPI) Platform.

· FDI reform measures were implemented, allowing India to become one of the worlds' largest recipients of foreign direct investment.

· These measures commented India's reputation as one of the few bright spots in an otherwise grim global economy.

India is not only among the world's fastest growing major economies, underpinned by a stable macro-economy with declining inflation and improving fiscal and external balances.

· There major challenges reducing "inefficient redistribution strengthening state capacity in delivering essential services and regulating market, and dispelling the ambivalence about protecting property rights and embracing the private sector.

· The government has made great progress in improving distributive efficiency by passing the Aadhaar law, a vital component toward realizing its vision of JAM.

· On state capacity delivery of essential services such as health and education remains impaired. There have of course, been important exceptions such as the improvement of die public distribution system (PDS) in Chhattisgarh, the incentivization of agriculture in Madhya Pradesh, reforms in the power sector in Gujarat, the efficiency of social programs in Tamil Nadu.

· The impact of Brexit and the US election though still uncertain, paradigmatic shifts in the direction of isolationism and negativism. The post war consensus in favour of globlisation of goods, services and labour in particular, and market-based economic organization more broadly, is under threat across the advanced economics.

· Given that India's growth ambitions of 8-10 percent require export growth of about 15-20 percent any services retreat from openness on the part of India's trading partners would jeopardize those ambitions.

· Private investment remains weak because of the twin balance sheet problem. Re-establishing private investment and exports as the predominant and durable sources of growth is the proximate macro-economic challenge.

· The steady progress on structural reforms made in the last few years needs to be rapidly built upon.

Global Context

· For India, three external developments are of significant consequence. In the short run the change in the outlook for global interest rates as a result of the US elections and the implied change in expectations of US fiscal and monetary policy will impact on India's capital flows and exchange rates.

· Second the medium term political outlook for globalisation and in particular for the world's ?political carrying capacity for globalisation? may have changed in the wake of recent developments. This change outlook will affect India?s export and growth prospects.

· Third developments in the US especially the rise of the dollar, will have implications for China's currency and currency policy. If China is able to successfully re-balance its economy, the spillover effects on India and the rest of the world will be positive. On the other hand further declines in the Yuan even if dollar induced could interact with underlying, vulnerabilities to create disruptions in

China that could have negative spillovers for India.

Review of developments in 2016-17

GDP and Inflation