Category : Banking

Banking

Bank

The word "Bank" is derived from the Greek word banque or the Halian word banco both meaning a bench-referring to a bench at which money lenders and money changers used to display their coins and transact business in the market place.

· A Banking company in India has been defined in the Banking Companies act 1949 as one "which transact the business of banking which means the accepting for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise and withdrawal by cheque, draft, order or otherwise

· Acceptance of chequable demand deposits and lending them to others are the two distinctive features of a banking institution. On this account, Post office saving banks are not regarded as banks in the true sense of the term, since they do not lend money, even though some of them have introduced the cheque system.

· There are other financial institutions like the unit Trust of India (UTI) the life insurance corporation (LIC), the industrial finance corporation of India (IFCI), the industrial Development Bank of India (IDBI) etc. which Lend money to others but do not accept chequable demand deposits. Therefore they are not regarded as banks. They are called non-Banking financial Institutions.

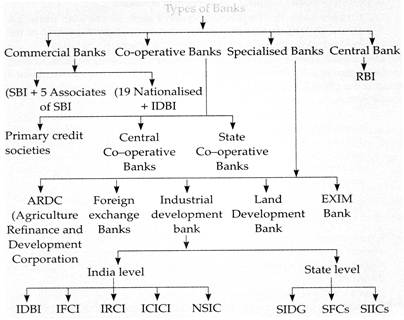

Type of Bank:

Banks in the organized sector may be classified into the following major forms ?

1. Commercial banks

2. Co-operative banks

3. Specialized bank

4. Central banks

1. Commercially banks: Commercial banks are joint stock companies dealing in money and credit. A commercial bank is as a financial institution that accepts chequable deposits of money from the public and also uses the money with it for lending.

· The most distinctive function of a commercial bank is that it accepts deposits called demand deposits from the public which are chequable deposits alone, however does not give it the status of a bank. It?s another essential function is to make use of the deposits for lending.

· Commercial banks usually give short term loans and advances. The copy a dominant place in the money market. They occupy a demirant place in the money market. The commercial bank in india are governed by the Indian Banking Regulation Act 1949, Under the law commercial banks are not supposed to do any other business except banking.

2. Co-operative Banks: Co-operative banks are a group of financial institutions organized under the provision of the co-operative society?s act of the states. These banks are essentially Co-operative credit societies organized by members to meet their short term and medium term financial requirements.

· The main object of Co-operative banks is to provide cheap credit to their members. They are based on the principles of self-reliance and mutual Co-operation.

· Co-operative Banking system in India has the shape of a pyramid a three tier structure, constituted by (i) primary credit societies (ii) Central Co-operative banks (iii) State Co-operative banks.

· Primary credit societies lie at the total or base level. In rural areas there are primary agricultural credit societies (PCAs), which cater to the short and medium term credit needs of the formers.

· The central Co-operative Banks (CCBs) are federations of primary societies belonging to a specific district. By furnishing credit to the primary societies, central Co-operative banks serve as an important link between these societies and the money market of the country.

· The state Co-operative Banks (SCBs) lie at the apex of the entire Co- operative credit structure. Every state Co-operative Bank's basic function is to furnish to furnish loans to the central Co-operative banks in order to enable them to help promote the lending activities of the primary credit societies.

3. Specialized Banks: There are specialized forms of banks catering to some special needs with these unique nature of activities. There are thus foreign exchange banks, industrial Banks/Development Banks, land development Banks etc.

(i) Foreign exchange Banks: These banks are primarily meant to finance the foreign trade of a country. They deal in foreign exchange business buying and selling of foreign currencies, discounting, accepting and collecting foreign bills of exchange.

· Foreign exchange banks also do ordinary banking business such as acceptance of deposits and advancing of loans but in a limited way.

(ii) Industrial Banks: Industrial banks are primarily meant to cater to the financial needs of industrial under takings. They provide long term credit to industries for the purchase of machinery, equipment etc.

(iii) Land Development Banks (LDBs): LDBs are meant to cater to the long and medium term credit needs of agriculture in our country. There are mainly district level Banks. There are state land development banks at the top level and primary land development banks at the base or local level.

(iv) Agriculture Refinance and Development Corporation (ARDC): It is a kind of agricultural development bank which provides medium and long term finance to agriculture in our country.

(v) Export Important Bank of India (EXIM Bank: It has been instituted for planning/ promoting and developing exports and imports of the country.

4. Central Bank: A central bank is the apex financial institution in the banking and financial system of a country. It is regarded as the highest monetary authority in the country.

· It supervises controls regulates the activities of the commercial banks. It is a service-oriented financial institution primarily concerned with the ordering, supervising regulating and development of the banking system in the country.

· Central bank is able to influence monetary and credit conditions and financial developments in a country, it is charged with the responsibility of carrying out the monetary and credit policies.

· Indians central bank is the Reserve Bank of India, established in 1935. It was nationalized after independence in 1949.

Function of commercial Banks:

· Commercial banks perform several functions, which may be classified into two categories ? (a) primary function (b) secondary function Primary functions of commercial bank include ?

1. Acceptance of deposits from the public

2. Lending of funds

3. Use of the cheque system

4. Remittance of funds

1. Acceptance of deposits from the public: Accepting deposits is the primary function of a commercial banks. Banks generally accept deposit in three types of accounts? (a) Current Account (b) Saving Account (c ) Fixed deposits Account (d) Recurring Account

(a) Current account: Deposits in current account are with draw able by the depositors by cheques for any amounts to the extent of the balance at their credit at any time without any prior notice.

· Deposits of current account are known as demand deposits. Such account are maintained by commercial and industrial firms and business me and the cheque system is the most convenient and very safe mode of payment

(b) Saving Accounts: Saving Accounts are maintained for encouraging savings of households -withdrawal of deposits from saving accounts are not frilly allowed. There are some restrictions on the number of withdrawals at a time and also on the number of withdrawals made during a period. Bank pay rate of interest on the saving account deposits as prescribed by the central bank.

(c) Fixed deposit account: Deposits in fixed account are time deposits. In the normal course, deposits cannot be withdrawn before the expiry of the specified time period of the deposits.

· A premature withdrawal is permitted only at the cost of forfeiture of the interest payable, at least partly. On these deposits commercial banks pay higher rates of interest and the rate becomes higher with the increase in duration.

2. Lending of funds: Another major function of commercial banks is to extend loans and advances. Bank advances to customers may be made in many ways 'such as over draft, cash credits, discounting trade bills, money at call or very short term advances, term loans, consumer credit and miscellaneous advances.

(i) Over draft: a commercial bank grants overdraft facility to an account holder by which he is allowed to draw an account in excess of the balance held in the account, up to extent of stipulated limit overdraft is permissible in current account only.

· For example: Suppose a customer has Rs. 100000 in his current account with the bank. Bank grants him overdraft facility up to Rs. 20000. The this customer is entitled to issue cheques up to Rs. 120000 on his account obviously, the overdraft facility sanctioned up to Rs. 20000 by the bank in this case is as good as credit granted by the bank to that extent.

(ii) Cash credit: Bank give credit in cash to business firms in industry and trade against pledge of goods or personal guarantee given by the borrowers.

· It is essentially a drawing account against credit sanctioned by the bank and is operated like a current account on which an overdraft I sanctioned. It is the most popular

(iii) Discounting Trade Bills: The Banks facilitate trade and commerce by discounting bills of exchange called trade bills. Traders often draw bill of exchange to meet their obligations in business transitions.

· Discounting of bills by the bank amounts to granting of credit to the party concerned till the maturity date of the bill. This method of bank lending is widely adopted for two reasons:

· Such loans are self-liquidator in character.

· These trade bills are rediscount able with the central bank.

(iv) Money at call or Call Money: Bank also grants loan for a very short period, generally not exceeding 7 days to the borrowers, usually dealers or brokers in stock exchange markets against collateral securities like stock or equity shares, debentures etc. offered by them. Such advances are repayable immediately at short notice hence, they are described as money at call or call money.

(v) Terms loans: Banks give term loans to traders, industrialists and now to agriculturists also against some collateral securities. Term loans are so called because their maturity period varies between 1 to 10 years.

· Term loans as such provide intermediate or working capital funds to the borrowers some times, two or more banks may jointly provide large term loans to the borrower against a common security such loans are called participation loans or consortium finance.

(vi) Consumer credit: Banks also grant credit to households in a limited amount to buy some durable consumer goods such as television sets, refrigerators etc. or to meet some personal needs like payment of hospital bill etc.

· Such type of consumer credit is made in a lump suit and is repayable in instalments in a short time.

(vii) Miscellaneous Advances ?Among other forms of bank advances there are packing credits given to exporters for a short duration, export bills purchased/discounted, import finance-advances

against import bills, finance to the self-employed, credit to the public sector, credit to the Cooperative sector and above all, credits to the weaker sections of the community at concessional rates.

3. Use or the cheqe system: It is a unique feature and function and function of banks that they have introduced the cheque system for the withdrawal of deposits.

· There are two types of cheques: (i) The bearer cheque (ii) The crossed cheque. A bearer cheque is encashable immediately at the bank by its possessor. Since it is negotiable, it serves as good as cash on transferability. A crossed cheque on the other hand, is one that is crossed by two parallel lines on its face at the left hand corner and such a cheque is not immediately encashable. It has to be deposited only in the payee's account. It is not negotiable.

4. Remittance of funds: Commercial banks, on account of their network of branches throughout the country also provide facilities to remit funds from one place to another for their customers by issuing bank drafts, mail transfer or telegraphic transfers on nominal commission charges.

Early growth of banks in India:

· The origin of modern banking in India dates back to 1770 when the first joint stock bank, named the Hindustan Bank was started by the English agency house of Alexander co. Calcutta. The bank was wound up in 1832.

· The real growth of modern commercial banking began in the country when the government was awakened to the need for banks in 1806 with the establishment of the first presidency Bank, called the Bank of Bengal in Calcutta in that year.

· After that. Then it followed the establishment of two other presidency Banks, namely the Bank of Bombay in 1840 and the Bank of Madras in 1843. To each of these banks, the government had subscribed Rs. 3 lakhs to their share capital.

· However, a major part of their share capital was contributed by the European shareholders. These presidency banks, however enjoyed the monopoly of government banking. They were also given the right of not issue in 1823, which was however with drawn in 1862.

· These three presidency Banks continued fill 1920. In 1921 they were amalgamated into the imperial Bank of India.

· Since 1860 fill the end of the 19th century, a number of Indian join stock banks came into existence. For instance, the Allahabad bank was started at Allahabad in 1865. In 1875, the Alliance Bank of Shimla started. In 1889 another Indian bank called Oudh Commercial Bank was established. In 1895, the famous Punjab National Bank came into existence.

· During the boom period of 1906-13, thus there was a mushroom growth of banks. Many prominent banks also came into existence during this period. These were the Bank of India (1906), the Canara Bank (1906), the Bank of Baroda (1908), the Central Bank of India (1911)

· On 19th July 1969, 14 large Commercial Banks whose reserves were more than Rs. 50 core each were nationalized. These nationalized bank are as follows:

|

(a) Indian Bank |

(h) Candara Bank |

|

(b) Syndicate Bank |

(i) Punjab National Bank |

|

(c) Allahabad Bank |

(j) Indian Overseas Bank

|

|

(d) Union Bank of India |

(k) Bank of Maharashtra

|

|

(e) United Bank of India |

(L) Central Bank of India |

|

(f) Bank of Baroda |

(m) Bank of India |

|

(g)United Commercial Bank |

. |

Lead Bank Scheme:

· The idea of lead bank scheme was initiated by the Gadget study group of the National credit council in October 1969. The lead bank schemes provide a new strategy of banking and area development in the branch expansion program of banks in the post nationalization phase of banking growth in the country.

· RBI introduced the "Lead Bank Scheme" tow adds the end of 1969. Under the scheme, 398 districts in the country were allotted to the public sector banks and a few private sectors bank.

· The lead banks are assumed to play the role of catalytic agents of banking and the rural economic development in their respective lead districts.

Functions of lead Bank:

(i) To identify and study local problems.

(ii) To survey the resources and potential for banking development by identifying unbanked centers in the allotted districts.

(iii) To set up branches in a phased manner.

(iv) To provide assistance to other primary lending agencies

(v) To keep contact and liaison regularly with government and semi government agencies.

(vi) To evolve an integrated credit plan by examining the shortage of marketing facilities for agricultural produce and industrial output stocking of fertilizers and other agricultural inputs and other services catering to local needs.

(vii) To recruit and train banking staff for counselling the small borrowers and farmers in the priority sectors and follow up and inspection of the end-use of bank credit.

Reserve Bank of India (RBI):

· It is the Central Bank of the country.

· It was established on April 1, 1935 with a capital of Rs. 5 crore. This capital of Rs. 5 crore was divided into 5 lakh equity shares of Rs. 100 each. In the beginning, the ownership of almost all the Share Capital was with the non-government shareholders.

· It was nationalized on January 1, 1949 as government acquired the private share holdings.

· Administration: 14 directors in central board of directors besides the Governor, 4 Deputy Governors and one government official. The Governor is the chairman of the board and chief executive of the bank.

Governor

First governor of RBI?Sir Smith (1935-37)

First Indian governor of RBI?CD Deshmukh (1948-49)

· Financial year June to July.

Functions of RBI:

RBI Function are follows:

(i) Monetary Management: According to preamble to the RBI Act 1934, the basic function of the bank is to "regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.

· RBI is mainly constituted as an apex authority for monetary management it also controls and regulates the now of credit in the economy. It uses quantitative controlling weapons, such as bank rate policy, open market operations and the reserve ratio requirement.

· Since 1956, it has increasingly relied on and resorted to selective credit controls for accelerating the rate of growth and for checking inflationary spurts.

(ii) Banker to the government: RBI acts as the banker, agent and advisor to the government of India. It has to maintain and operate the government's deposit accounts. It collects receipts of funds and makes payment on behalf of the government.

(iii) A Banker's Bank: According to the Banking companies Act of 1949 each scheduled bank has to maintain with the RBI a balance equal to 5% of its demand liabilities and 2% of its time liabilities.

· The Act amended in 1962, specifies that 3% of the total liabilities should be kept as reserve requirement.

· RBI also serves as lender of last resort, by rediscounting eligible bill of exchange of commercial banks during the period of credit stringency.

(iv) Issue of Bank notes: RBI has the sole right to issue currency notes, except one rupee notes which are issued by the Ministry of finance (V/S22ofRBI-Act)

· RBI follows a minimum reserve system in not issue. Initially it use keep 40% of gold reserves in its total assets. But, since 1957, it has to maintain only Rs. 200 crores of gold and foreign exchange reserves.

(v) Promoter of Development: Bank performs a number of developmental and promotional functions. RBI effectively channelizes credit, especially to priority sectors such as agriculture, exports, transport operations and small sale industries. It makes institutional arrangement for rural and industrial finance.

(vi) Custodian of Exchange Reserves: The bank has been entrusted with the responsibility of maintaining the exchange value of the rupee. It has the custody and management of the country's international reserves.

Credit control: The control of credit is main function of a Central Bank.

The objective of credit control is ?

· A Stabilization of the money market

· Promoting economic growth

· Stabilization of the general price level

· There are two instruments of credit control

1. Quantitative or general

2. Qualitative or selective

1. Quantitative or general: The general instruments are directed towards influencing the total volume of credit in the banking system/ without special regard for the use of which it is put.

· This method is used for the changing the total volume of credit or the terms on which bank credit is available without regard for the purpose for which credit is used by borrowers.

2. Selective or qualitative: Selective or qualitative instruments of credit control are directed towards the particular use of credit and not its total volume.

The credit policy of Central Bank of a country.

· The credit policy of any central Bank of a country (in India it is RBI) is to contract the economy or expand the economy in the money volume of a country.

· At the time of inflation we see that RBI has increased the bank rate, CRR, repo rate and other necessary measures. Where an RBI decreases the various rates for the support of economy.

· The various mechanism led by RBI (in the credit policy measures) for the economy can be categorized.

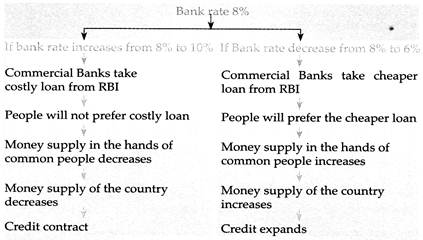

1. Bank rate: The rate at which RBI grant credit to Commercial Banks is known as Bank rate (Discount Rate). The credit (Loan Account) will be made available for the particular types of loans to the customers like, education loan, housing loan, car loans etc.

Bank rate is a tool which RBI uses for managing money supply and credit. Bank rate is the rate at which RBI lends to commercial Bank. Any revision in Bank rate by RBI is a signal to banks to revise deposit rates as well prime lending rate.

Modus operandi? of Bank Rate: The bank rate policy signifies manipulation of the rate of discount by the central bank in order to influence the credit situation in the economy.

· The principle underlying the bank rate policy is that charges in bank rate are generally followed by corresponding changes in the money market rates, making credit costlier or cheaper, and affecting its demand and supply.

· If the bank rate is raised that leads to a rise in the rate of interest and contraction of credit, which in turn adversely affects investment activities and consequently, the economy as a whole.

· The bank rate policy has two dimensions

(i) By changing the bank rate the cost of credit is influenced. Thus a rise in the bank rate implies a rise in the bank's cost of borrowings. A fall in the bank rate would mean a reduction in the cost of credit which in turn encourages bank's borrowing from the RBI.

(ii) By widening or narrowing the list of eligible securities, the member bank's borrowing capacity is directly affected.

· An anti-inflationary device of the controlled expansion program of the monetary policy in October 1960, the RBI introduced a system of slabs in interest rates. The borrowing of member banks from the RBI were regulated by means of three tier structure of rates ?

(i) Up to a specified quota for each quarter, equal to half the average amount of the statutory reserve which a member bank was required to maintain with the RBI during the previous quarter, the bank could borrow from the RBI at 4% bank rate.

(ii) The excess of borrowings up to 200 percent of the quota -was to be charged 5% interest.

(iii) Further borrowings were to be charged 6% interest.

· In 1973 the RBI has adopted a strictly dear money policy and resorted to a credit squeeze in order to reduce the inflationary pressure on the economy. Under the credit contraction policy, the RBI has employed series a monetary measures with the following objectives

(i) To improve increase rate on deposits and raise the cost of money lent to commercial banks.

(ii) To increase the cost and reduce the availability of money from the Reserve Bank.

(iii) To decrease over all loanable funds of banks.

(iv) To enhance the cost of credit to borrowers from banks.

Working of bank rate: For example let bank rate is 8% if it increases to 8 to 10% and it decreases to 8% to 6% than may be credit contraction and credit expansion happen.

2. Open market operations

Open market operations have a direct effect on the availability and cost of credit. The open market operation Polis has two dimensions ?

(i) It directly increases or decreases the loanable funds or the credit creating capacity of banks.

(ii) It leads to changes in the prices of government Securities aids the term. Structure, of interest rates.

Working of open Market Operation

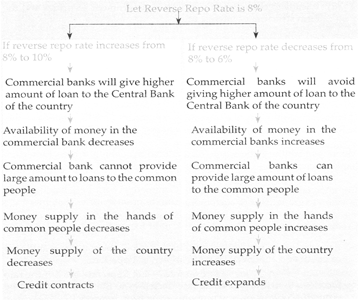

3. Repo rate: The rate at which commercial bank of the country grant loans or credit to Central Bank of the country is known as reverse repo rate.

Working of Repo rate For Example __ let repo rate is 8% if the rate increase the 8-10% and if the rate decrease to 8% - 6% 5than may be economy contraction and economy Expansion Happen

4. Reserve repo rate: The rate at which commercial bank of the country grant loans or credit to Central Bank of the country is known as reverse repo rate.

Working of reserve repo rate: Example

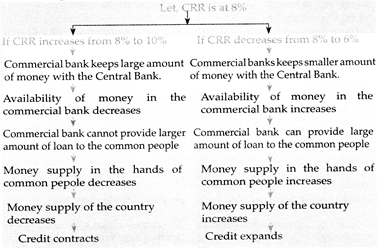

5. Cash reserve ratio: The rate at 'which commercial bank in maintain a certain ratio of its deposits and cash keep with Central Bank of the country is known as cash reserve ratio.

Working of cash reserve ratio: For Example

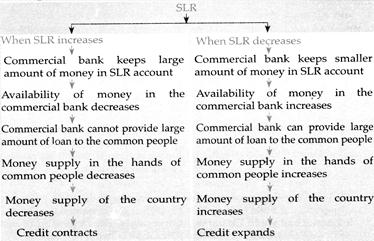

6. Statutory Liquidity ratio: The rate at which each commercial, bank is Required to maintain a fixed percentage of its assets in the form of cash or other liquid assets is known as SLR.

This SLR has to be kept by commercial banks with themselves,

Working of SLR:

Credit policy of RBI in cash of influence and recession:

|

In the case of inflation |

In the case of recession |

|

· RBI tries to decrease the price level of the country |

· RBI tries to increase the economic activities of the country. |

|

· At the tirne of inflation (or checking the price rise) RBI may adopt one or more than one credit policy measure. |

· At the time of recession (or increasing the price rise) RBI may adopt one or more than one credit policy measures |

|

Example : |

Example : |

|

Increasing Bank rate |

Decrease Bank rate |

|

Increasing Repo rate |

Decrease Repo rate |

|

Increasing Reverse Repo rate |

Decrease Reverse Repo rate |

|

Increasing CRR |

Decrease CRR |

|

Increasing SLR |

Decrease SLR |

|

Sellbonds and securities etc. |

Purchase bonds and securities etc. |

|

These all will ultimately decrease the availability of money in the hands of common people. |

These all will ultimately increase the availability of m.oney in the faands of cornmon people. |

|

\[\downarrow \] |

\[\downarrow \] |

|

If common people has less money they will |

If coinmon peopole has more money they will |

|

\[\downarrow \] |

\[\downarrow \] |

|

Demand less (consumption decreases) |

Demand more (consumption increases) |

|

\[\downarrow \] |

\[\downarrow \] |

|

Demand curve will shift Leftward |

Demand curve will shift Right ward |

|

\[\downarrow \] |

\[\downarrow \] |

|

|

|

|

According to Fig. The price level will auton-iatically corne down and inflation will be checked. |

According to Fig. The price level will slightly increase and recession may be covered with increasing business activities. |

Deposit Insurance" and credit guarantee Corporation (DICGC):

The Deposit insurance corporation was merged with the credit guarantee corporation of India Ltd. on July 15, 1978 and was named the Deposit Insurance and credit Guarantee Corporation. The Deposit Insurance and credit Guarantee Corporation (DICGO) has two major Function:

(i) Deposit insurance function i.e. to give insurance protection to small depositors in bank.

(ii) Credit guarantee function i.e. to provide guarantee support to credit facilities extended by eligible credit institution to certain categories of small borrowers, including farmers, village artisans etc. particularly those belonging to the weaker and neglected sections of the society as alto to SSI units.

National housing Bank. (NHB): National Housing Bank were established in December 1987. On July 9, 1988.

The NHB has been established as a statutory corporation. The NHB has the following functions:

(i) To provide Refinance facilities to housing finance institution and scheduled banks,

(ii) To promote and develop specialized housing finance institution for mobilizing resources and extending credit for housing.

(iii) To Co-ordinate the working of all agencies connected with housing.

(iv) To provide guidelines to housing finance institutions to ensue re their healthy growth.

(v) To formulate schemes for mobilization of resources and extension of credit for housing, especially catering to the needs of economically weaker section of society.

· To provide guarantee and under writing facilities to housing finance institutions.

Agriculture credit funds:

· RBI established the National Agriculture credit (Long-Term operations Fund in February 1956, to enable the Bank to provide long term loans and advances to land development Banks and the state governments for participating in the share capital of Co-operative banks and credit societies. Later on, it was renamed as the National Rural credit Fund, as its finance extended besides agriculture to others in rural areas.

· RBI established the another fund that is called the National Agricultural (stabilization) Fund "was constituted by the bank in June 1956 for the purpose of granting medium term loans to state Co-operative Banks (SCBs) when on account of drought, famines etc. they are not in a position to repay their short term debts to the bank.

· National Agricultural credit (Relief and guarantees) Fund was created by the bank for purpose of giving grants to Co-operative credit institution through the state governments to enable them to write off their irrecoverable arrears on account of severe famines.

Kisan Credit Card Scheme: The kisan credit card (KCC) scheme introduced in August 1998 for short term loans for seasonal agricultural operations, has made significant progress in reach and making available timely and cost effective credit to the agricultural sector. The Co-operative banking sector has made the most significant progress in expanding the KCC's outreach.

· NABARD enlarged the scope of the scheme to cover term loans for agriculture and allied activities NABARD has also advised banks to?

(i) Make a possible efforts to identify and lend to farmers including oral losses and ensure that KCCs are renewed.

(ii) Launch a time bound programme to motivate defaulters to clear their dues to enable them to avail of the benefits from the scheme.

(iii) Issue suitable guidelines to their branches to route crop loans only through KCC.

National Bank for Agriculture and Rural Development (NABARD)

· NABARD was established on 12 July 1982 by the government of India to act as agency fo promotion integrated rural development and to provide all sorts of production and investment credit for agriculture and rural development.

Functions of the NABARD:

· The NABARD is essentially a development Bank for promoting agricultural and rural development. Its main function is to provide refinance and credit to the state Co-operative Banks, the Regional Rural Banks and other Financial Institutions.

· NABARD is empowered to give short term as well long-term loans in a composite form. It can also make loans and advances to state governments for a maximum period of 20 years in order to enable them to subscribe directly or indirectly to the share capital of Co-operative credit societies.

· NABARD can also provide medium-term loans (for a period between \[{{1}^{1/2}}\] years and 7 years) to the SCBs and RRBs for agricultural and rural development.

· NABARD provides refinance assistance to these institutions for granting loans for the following purposes:

(i) For agricultural operations

(ii) For marketing of agricultural purpose

(iii) For marketing and distribution of agricultural inputs such as improved seeds, fertilizers, pesticides etc.

(iv) For production and marketing activities of rural artisans, small scale industries in the tiny and decentralized sector, village and cottage industries, handicrafts and other rural crafts.

(v) For allied activities important for agricultural and rural development.

· In 1988 onwards, the NABARD introduced Certain policy changes and schemes regarding farm short-term credit?

(i) Financing of seasonal agricultural operations

(ii) The scheme of fresh finance

(iii) Product marketing loan scheme

(iv) National oilseeds Development programmed (NODP)

· Some of the important policy initiatives in the agriculture and rural sector taken by NABARD is as follows:

(i) Introduction of kisan credit card

(ii) Augmenting flow of credit in the areas served by weaker Co-operative banks.

(iii) Accelerating flow of credit to the handler weavers through financing state Handloom Development corporations,

(iv) Stimulating investment in minor irrigation and wasteland development.

(v) Lowering of interest rates on refinance

(vi) Giving special thrust on micro credit development.

· NABARD initiates some policy for non-farm sector is as follows:

(i) Enhancing the ceiling under automatic refinance facility (ARF) and integrated loan scheme (ILS)

(ii) Enlarging the scope of soft loan assistance for margin money scheme.

(iii) Liberalising the small road Transport operators (SRTO) scheme.

Rural Infrastructure Development- Fund (RIDF):

· RIDF was set up with NABARD by the central government in 1995-96 to provide loans to the state governments for financing rural infrastructure projects.

· Commercial banks make contributions to the fund in accordance with the shortfall in their priority/agriculture sector lending.

· The scope of the RIDF has been widened since 1999-2000 to enable utilization of loan by panchayati ray institutions (PRTs), self-help groups (SHGs) and projects in social sector covering primary education, health and drinking water.

MICRO FINANCE:

· To provide the rural poor accessibility to credit from the banking system and for alleviating poverty, NABARD in 1992 had started a programmed of linking SHGs of the rural poor with banks.

· The micro credit programme in India is now the largest in the world. This led to a search for alternative policies, system and procedures, saving and loan products, other complementary services and new delivery mechanisms that would full fill the requirements of the poor.

· India has adopted a multiagency approach for the development of its micro-finance programme. All the major credit institutions i.e. commercial banks. Co-operative banks, RRB along with non- Governmental organizations (NGDs) have been associated with the micro finance programme. The role of delivering agents and their interface has led to alternative models of micro finance.

Deposit Mobilization:

· Deposit mobilization: is an integral part of banking activity. Acceptance of deposits is the primary function of commercial banks. Deposit mobilization is one of the basic innovations in current Indian banking activity.

· Deposit mobilization is essentially resource mobilization. It implies tapping of potential saving and putting them into the banking sector for productive uses. Indian banks are now trying to attract more deposits by introducing attractive saving schemes.

Deposit Mix:

· Deposit of scheduled commercial banks are categorized into demand and time deposits. Demand deposit consist of ?

(i) Current deposits

(ii) Demand liability portion of savings bank deposits.

(iii) Margins held against letters of credit guarantees.

(iv) Outstanding telegraphic transfers, mail transfers and demand drafts.

(v) Unclaimed deposits.

(vi) Balances in overdue fixed deposits, cash certificates and cumulative recurring deposits.

(vii) Deposits held as security for advances which are payable on demand.

(viii) Credit balances in the cash credit accounts.

(ix) Demand portion of participation certificates (PCs)

· There is no maturity period in demand deposit

· Time deposit consist of

(i) Fixed Deposits

(ii) Cash certificates

(iii) Cumulative and recurring deposits

(iv) Time liability portion of savings bank deposits

(v) Staff security deposits

(vi) Margins held against letter of credit, if not payable on demand

(vii) Fixed deposits held as securities for advances

(viii) Time portion of participation certificates (PCs)

· Time deposits could be further categorized into short term (time liability portion of saving deposits and term deposits with contractual maturity of up to one year) and long term deposits (term deposits with contractual maturity above one year).

Credit-Deposit Ratio (CDR):

· Credit Deposit Ratio is a major allocation of funds by banks credit extended in terms of cash credit, overdrafts, demand loans, purchase or discounting of commercial bills and instalment or hire purchase credit and Deposit consist on the basis of demand deposit and term deposit.

· C.D ratio provide an indication of the extent of credit deployment for every unit of resource raised.

\[CDR=100\left( \frac{C}{D} \right)\]

Where C =Total credit

D = Total Deposit

INNOVATIVE BANKINGS:

· Innovative Banking implies the application of new techniques, ne methods and novel schemes in the areas of deposit mobilization deployment of credit and bank management.

· To attract more deposits, Indian banks have introduced many attractive saving schemes such as education deposit plan, perennial pension plan, retirement scheme, recurrent deposit scheme, loan linked recurring deposits plan, Akshaya Nidhi Scheme, pygmy deposits scheme, unfixed deposit scheme etc.

Novel/Innovative Credit Schemes/Facilities

· In India, Commercial bank pay special attention to the various novel and innovative credit schemes and facilities in their operations for the benefit of the society at large some of these are as following:

(a) Differential Rates of interest Scheme: The public sector banks have introduced the Differential rates of interest (DRI) scheme in 1912 to extend bank credit to the -weaker sections at concessional rates of interest. Under the Deposit ratio scheme the banks are directed by the Reserve Bank to finance:

(i) SC/ST and others engaged on a modest scale in agriculture and allied activities.

(ii) People engaged in elementary processing of forest product.

(iii) Village artisans in the decentralized sector.

(iv) The physically handicapped people on a modest scale by offering loans for cottage and rural industries and vocations like sewing garments, making reasonably cheap edibles, running way side tea stalls, basket making etc.

(b) Credit Authorization Scheme (CAS): The credit authorization scheme for bank advances was introduced by the Reserve Bank of India in 1965. Under the scheme all scheduled commercial bank have to obtain prior authorization of the Reserve Bank before granting any fresh credit limit of Rs. 1 crore or more to any single Borrower. This limit was raised to Rs. 2 cores in 19.

· The CAS is being reviewed by the Reserve Bank from time to time and is progressively liberalized.

· Recently, following the vague committee's Report on money market certain changes have been introduced in the CAS for promoting the bill financing:

(i) From 1 April 1988 in the case of borrowers who enjoy aggregate working capital facilities exceeding the cut-off point under the CAS, the limit sanctioned against book debts should not be more than 75% of aggregate limits sanctioned to such a borrower for financing his inland credit salsa.

(ii) All borrowers subject to the CAS have to attain a ratio of bill acceptances to total inland credit purchases of 25%.

(iii) Sanctioning of separate additional ad hoc inland bill limit is left to the discretion of the banks.

(c) Employment-oriented Schemes- Commercial banks actively participated in the employment-oriented schemes introduced by the government during the sixth and seventh five year plan periods.

· On 15th August, the scheme called self-employment oriented schemes for educated unemployed youth was introduced by the government. Its object is to encourage the educated unemployed youth to get self- employed in manufacturing or service industries or business availing themselves of the provision of a package of assistance in the form of bank loan.

· In September 1986, the government introduced a new poverty alleviation programmed called the self-employment programmed for the urban poor (SEPUP). The scheme envisaged the provision of bank credit to create self-employment opportunities for the urban poor.

· The borrower's eligibility criterion is fixed at a monthly family income of Rs. 600. The credit limit is fixed at Rs. 5000. Interest rate is fixed at 10% per annum.

(d) Advances to Minority Cornmunitie: In July 1986banks were advised to ensure that adequate credit flow is made available to certain identified minority communities, namely. Muslims, Christians, Neo-Buddhists, Sikhs and Zoroastrians.

(e) Housing Finance: Banks are providing housing finance. The government has proposed to set up a National Housing Bank as a statutory corporations. Its major function would be to promote and develop specialised housing finance institutions at regional and local levels which will provide loans for acquisition of housing.

Merchant Banking: Merchant Banking institutions are to offer service like syndication o financing, promotion of projects, investment management and advisory services to medium and small savers and to provide funds and trusts to various type. It implies on following services:

· Loan syndication

· Project counselling

· Portfolio management

· Financial and management consultancy

· Guidance to non-resident Indians for investment in India

· Guidance on foreign trade financing

· Formulation of schemes of rehabilitation

Virtual Banking: Virtual banking denotes the provision of banking and related services through extensive use of information technology without direct recourse to the bank by the customer.

· The origin of virtual banking in the developed countries can be traced back to the seventies with the installation of ATM.

· Virtual banking services are include ATM, shared ATM networks, Electronic Funds transfer at point of sale (EFTPS), smart cards, stored value cards, phone-banking and more recently, internet and internet banking.

· The salient features of these services are the over whelming reliance on information technology and the absence of physical bank branches to deliver these services to the customer.

Financial Benefit of virtual Banking:

(i) Virtual banking has the advantage of having a lower cost of handling a transaction via the virtual resource compared to the cost of handling the transaction via the branch.

(ii) The increased speed of response to customer requirements under virtual banking vis-a-vis branch banking can enhance customer satisfaction.

(iii) Virtual banking allows the possibility of improved quality and an enlarged range of services being available to the customer more rapidly and accurately and at his convenience.

(iv) The lower cost of operating branch network along with reduced staff costs leads to cost efficiency under virtual banking.

Credit Card:

· Credit cards are innovative ones in the line of financial services offered by commercial banks. The idea of credit card was first developed by a Bavarian Farmer, Franz Nesbit McNanara, an American business man who found himself without cash at a weekend resort founded Diner's Card in 1950.

· A credit card is a card or mechanism which enables card holders to purchase goods, travel and dine in a hotel without making immediate Payments. The holders can use the cards to get credit from banks up to 45 days. The credit card relieves the consumers from the botheration of carrying cash and ensures safety. It is a convenience of extended credit without formality. Thus, credit card is a passport to safety, convenience, prestige and credit.

Criteria for credit card holder;

(i) A person who earns a salary of 6000 per annum is eligible for a card.

(ii) A reference from a banker and the employers of the applicant is insisted upon.

Types of credit card;

(i) Corporate credit cards

(ii) Business cards

(iii) Smart cards

(iv) Debit cards

(v) ATM card

(vi) Virtual card

(vii) E-wallet card

Differences between credit and debit card:

(i) The credit card is a "pay later product, where as a debit card is a pay now product".

(ii) In the case of credit card the holder can avail of credit for 30 to 45 days where as in a debit card the customer's account is debited immediately.

(iii) No sophisticated telecommunication system is required in credit card business. The debit card programmed requires installation of sophisticated communication network.

(iv) Possibility of risk of fraud is high in a credit card. The risk is minimized through personal identification number in debit card program.

(v) Opening a bank account and maintaining a required amount are not essential in a credit card. A bank account and keeping a required amount to the extent of transaction are essential in a debit card system.

BASEL COMMITTE

· In 1988, the Basel Committee on banking supervision introduced the Basel I accord or the risk based capital requirements to deal with the weakness in the leverage ratio as a measure for solvency.

· It was the very first attempt to introduce the concept of minimum standards of capital adequacy.

· Basel-II was established in 1999 with a final directive in 2003 for implementation by 2006 as Basel-11 norms. Unfortunately India could not fully implemented this but, is now gearing up under the guidance from the Reserve Bank of India to implement, it from 1 April 2009.

· Based-III norms have been introduced to overcome the Drawbacks of Basel-11 accord.

BASEL II Vs BASEL III

Basel II

|

Pillar I |

Pillar II |

Pillar III |

|

Minimum capital equirements |

Supervirvisory Review process |

Disclosure and Market Discipline

|

\[\downarrow \]

Basel III

|

Pillar I |

Pillar II |

Pillar III |

|

Enhanced minimum |

Enhanced |

Enhanced risk |

|

capital and liquidity requirements |

supervisory process for Firm wide Risk management and capital planning |

Enhanced risk disclosure and market discipline

|

· Basel-III proposes many new capital, leverage and liquidity standards to strengthen the regulation, supervision and risk management of the banking sector. The capital standards and new capital buffers will require banks to hold more capital and higher quality of capital than Under current Basel-11 rules. The new leverage ratio introduced a non- risk based measure to supplement the risk based minimum capital requirements. The new liquidity ratio ensure that adequate funding is maintained in case of crisis.

Guidelines for Small and Pavement Banks

The Reserve Bank of India issued draft guidelines for setting up of 'local feel' small banks and payment banks. Such banks can be set up with a minimum Capital of ` 100 Cr as against ` 500 Cr required for normal Commercial Banks.

Payment Banks

These Banks will cater to marginalized Sections of Society. Including

Migrant laborers, for collecting deposits and remitting funds.

· Such bank can set up with a minimum Capital of >100.

· Such bank will offer a limited range of products such as acceptance of demand deposits and remittances of funds.

· They will have a widespread network of access points. Particularly in remote areas, either through their own branch network or through Business Correspondents (BCs) or through networks provided by others.

· The existing non-bank pre-payment instrument issuers, Non-Banking Financial Companies (NBFCs), Corporate BCs, Mobile Telephone Companies, Super market chains. Company?s real Sector Cooperatives and public sector entities may apply to set up a payment bank.

Small Bank:

The proposed Small Banks will provide a whole suite of basic banking products such as deposits and Supply of credit but in a limited area of operation.

· In case of small banks, resident individual with 10 years of experience in banking and finance Companies and Societies will be eligible as promoters to set up small banks.

· NBFCs, micro finance institutions (MFIs) and local Area Banks can also opt for conversion into small Banks.

· Preference will be given to professionals from banking or financial sector, NBFCs and MFIs to set up small banks, if they meet the 'fit and proper" criteria.

· The area of operations of the small bank will normally be restricted to contiguous districts in a homogenous cluster of States / Union Territories So that the bank has the Local feel/ and culture.

· The bank may be allowed to expand in one or more states with geographical proximity.

Foreign investments in these new category banks would be as per the FDI policy. Local focus and the ability to serve smaller customers will be a key criterion in licensing such banks.

Account

Account is a formal contractual relationship established to provide for regular banking or banking or business services.

Types of Account

(a) Saving Accounts: Saving account is a type of individual account. Saving accounts provide a cheque facility and also have a lot of flexibility for Deposits and withdrawal of funds for the account. Saving account is opened with a minimum amount of Rs. 500 but when a cheque is issued then the minimum amount is Rs.1000 the interest on these accounts at present is regulated by Reserve Bank of India. Banks in India at present offer 3.50% interest rate on such deposit.

(b) Current Accounts: Current accounts are used by businessmen, and it is not used for the purpose of investment. In current account, there are no limit for transaction or the amount of transaction in a day. Most of the current account are firm/company account. No interest is paid by bank on Current accounts.

(b) Recurring Accounts: Recurring Accounts are suitable for people who want to save a small amount of money every month. These accounts are best when people wish to create a fund for child's education or marriage of daughter or buy a car without loans. A person has to usually deposit a fixed amount of money every month (usually a minimum of Rs. 100 p.m.). Such accounts are normally allowed for maturities ranging from 6 months to 120 months. These accounts can be opened in single or joint names. Nomination facility is also available in this account.

(d) Fixed deposit accounts: Fixed deposit account depends on the period of maturity. All banks offer fixed deposits schemes with a wide range of tenures for periods from 7 days to 10 years. The rate of interest for fixed deposits differs from bank to bank.

Loans India has suffered from unequal distribution of wealth, where the affluent class gets richer and the underprivileged become poorer. To bridge this financial gap and to satisfy their day to day requirements, banks play a vital role by offering various loans to the finance seekers.

Types of Loan

(i) Personal Loan: When loan is provided for the purchase of lands and constructions of house on the same. The rate of interest depend on two factors.

(a) The amount of loan

(b) Time period for which the loan is required.

(ii) Home Loan: When it is provided for purchase of a new house or construction of house.

(iii) Car Loan: When an individual is financed loan for purchase a car.

Types of loans provided to Indian Farmers:

Short terms loans - Less than 15 months

Medium term loans - 15 months to 5 years

Long term loans - More than 5 years

BANKING GLOSSAR

Access: the right of or opportunity for an institution to use the services of a particular payment system to settle payments on its own account or for customers. See also direct participant, direct Participant/member, indirect participant/member, participant/ member.

Acceptance Letter: Acceptance letter is the letter that a borrower or applicant gives to the lender after reading the terms of the loan. This letter denotes the borrower?s willingness to accept the loan offer within a particular time frame.

Account balance: Opening Account Balance / Beginning of the Day (BOD) Balance: The balance in an account at the beginning of each business day; includes all deposits and withdrawals that were posted from the previous night, whether or not funds have been collected.

Closing Account Balance: End of the Day (EOD) Balance: The account balance computed at the end of the business day, and is the adjusted balance of the credits and debits during the business day in the account of th customer.

Active account: A bank account in which there are regular transactions. A bank account that is not dormant or inoperative or under an attachment order of the court or enforcement authorities.

Additional cardholder: Another member added to an existing card thus extending its usage is called an additional cardholder. Thus by adding an additional cardholder the existing cardholder allows him/ her to make purchases and use the credit card. However, the responsibility to repay the monthly outstanding balance rests with the original (principal) cardholder.

Advance EMI: Number of equated monthly instalments, paid in advance at the time of disbursal of loan.

Affinity Card: Credit cards linked to special organizations like sports clubs, exclusive clubs and charities. Affinity credit cards can also help raise funds, when a part of income from every transaction goes toward the benefit of relevant organization.

Amortization: Amortization is the repayment of Principal and Interest components of a Loan, over a period of time. Certain category of expense or charges is also amortized over a period of time.

Anywhere- Banking: Customer can deposit/ withdraw cash at any branch other than the branch in which he holds the account. Anywhere banking frees the customer from geographical boundaries and limitations and gives the flexibility to the customer to use his account across the board.

Automatic Funds Transfer: An arrangement that moves funds from one account to another. Automatically on a pre-arranged schedule; for example, every payday or once a month.

Automatic payment: An arrangement that authorizes payments to be deducted automatically from a bank account (usually a savings/current account) to pay bills (such as insurance payments, rent, mortgage or loan payments). Payments are usually scheduled to be made on a certain day of the month.

Available Credit: Available credit is your credit limit minus your current Balance. It is the unused portion of your credit line.

Bad Credit: A term used to describe a poor credit rating including an account in default. Common practices which can damage your credit rating include late or missed payments, exceeding the limit on cards, defaulting on loans or declaring bankruptcy. "Bad Credit can result in the denial of future credit.

Bank Draft: An instrument issued by one branch of a bank on another branch of the bank containing an order to pay a certain sum on demand to the person named on the draft. It is used to transfer funds and to settle outstanding balances between banks, or to provide a customer with funds payable at a bank in a different location. Bank drafts are valid for certain. Period, generally, for 6 months, as indicated over face of draft.

Banker's Cheque: A cheque issued by a branch of a bank against consideration received. Banker's cheques are valid for a certain period as indicated on the face of the cheque, (also called Pay Order).

Bankruptcy: A legal action, in which a person who is not able to repayhis loans satisfactorily, is declared bankrupt by a court order. The collateral or security in this case becomes liable to be attached by administration to satisfy creditors.

Base Rate: New reference rate used by banks for loan pricing w.e.f July 2010. Base rate captures cost of deposits, cost of capitals and unallowable (common) overheads. Banks are not allowed to lend base rate except for certain specified category or borrowers.

Basis Point: A unit of measurement which is equal to 1/100th of 1%. This is used to measure changes in interest rates, stock-market indices or yield on fixed income securities. For example, if an interest rate is reduced by 50 basis points it means an effective reduction of 0.5%.

Bill discounting: Under this type of lending. Bank takes the bill drawn by borrower on his (borrower's) customer and pay him immediately deducting some amount as discount/ commission. The Bank then presents the Bill to the borrower's customer on the due date of the Bill and collect the total amount. If the bill is delayed, the borrower or his customer pays the Bank a pre-determined interest depending upon the terms of transaction.

Bill Pay Service: Bill Pay is a service of Online Banking from bank that allows you to pay your bills online. In addition you can elect to receive

E-Bills- electronic versions of your paper bills - from your bank credit card and a variety of companies currently offering e-Bills.

Billing Statement: A monthly bill from your credit card issuer which describes and summarizes the activity on your account includes the out- standing balance, purchases, payments, credits, finance charges and other transactions for the month. Borrower The person/legal entity who is taking the loan with the promise to repay it back with interest under the credit or loan agreement.

Bounced cheque: A cheque, which a bank returns unpaid because there is not enough available balance in the account or for other reasons.

Business Credit Card: A reward credit card/that comes with special features and rewards for corporate users. Business credit card builds credit history for the associated business. They are a good way to separate business expenses from personal ones. Cancelled cheque a cheese that has been not paid and cancelled by the drawer -Account holder.

Capital Adequacy Ratio: Capital Adequacy Ratio is the capital to assets Ratio which banks are required to maintain against risks. It is also known as Capital to Risk (Weighted) Assets Ratio (CRAR).

Card Holder: Cardholder is a person who owns a debit or credit card Issued by a credit card company, financial institution or bank.

Card issuer: A bank, financial institution, credit union, or agency that issues a credit card to public or its members is called a card issuer

Card member Agreement: The issuer's terms and conditions relating to your credit card Account. The Card member Agreement is between the customer and the card issuing company and is a legal document. (When you sign up for a credit card understand the terms and Conditions).

Cash Advance (Credit Card): Applies to an advance taken against a credit card account. The advance may be through a cash withdrawal at an automated teller machine, bank teller or by use a convenience check. This cash is an instant loan from your credit card account. The credit card company will apply finance charges from the day you take the advance until the day you pay it off. A transaction fee may also be charged based on the amount of your withdrawal.

Cash Back (Credit Card): It is a special type of reward credit card, which pays back in cash. Whenever you use your cash back credit card to make purchases, a percentage of it is returned back to you. The cash back rewards can be redeemed as gift vouchers, or hard cash.

Certificate of Deposit CD: A time deposit that is payable at the end of a specified term. CDs generally pay a fixed interest rate and generally offer a different interest rate than other types of deposit accounts. If an early withdrawal from the CD prior to the end of the term is permitted, a penalty is usually assessed. CD is sold at discount value and being a money market instrument, can be transferred to other person through negotiation.

Charge back: A credit card transaction, which is returned or not honored, is called a charge back. Usually done by the credit card holder I response to faulty products, credit card fraud, a dispute or noncompliance with the rules and regulations, charge back restores the funds back with the credit card.

Charge back Period; it is the time period from a particular credit card transaction within which, the credit card holder must initiate a charge back.

Cheque or collection: An instrument drawn on

Another Bank or Branch tendered by a customer of a Bank or by his representative, at the branch or in the drop box provided for the purpose for collecting the amount of the cheque.

Cheque purchase: Bank may, at its sole discretion, purchase local/out- station cheese tendered for collection at the specific request of the customer or as per prior arrangement subject to levy of service charges.

Cheque return fee / EMI return fee): This is a service charge" that would be levied in the account due to return of cheque sent for collection EMI cheque. Usually, both collecting bank and paying bank levy cheque return charges on their customers.

Consolidation Loan: If you owe money to several creditors, you can combine your payments and balances into a single account with one creditor. This can be done in several ways. For example, you can transfer several high interest credit card balances onto one card with a lower rate. If you own home, you can consolidate your debt with a low-interest home equity loan. Or, you can get a loan specifically designed for this purpose.

Credit Management: The way you handle the money you borrow from banks or credit issuers. A good credit management will ensure optimum utilization of borrowed funds and meet repayment obligations on time.

Current Account: An account used for commercial purpose. It attracts no rate of interest and is generally charged by the bank with maintenance charges. There is no limit to the number of transactions in this type of account.

Deferred Payment: Payments put off to a future date or extended over a period of time. Interest will usually still accumulate during deferment.

Deposit at Call: Receipts issued to customers for amount deposited and repayable on demand. A facility normally extended for payment of earnest money deposits in tenders.

Disposable Income: Disposable income is the amount of income left after deductions such as income tax, pension contributions and personal insurance. It is often known as 'take home pay' - the actual pay a worker receives.

Documentation: The legal or other papers to be signed and presented during the loan process. It is also called the loan papers.

Down Payment: The amount, which has to be paid by the borrower up front while taking a loan. This amount is generally 10% -15% of the total fund required. It is also called the margin amount or margin money.

Draft: A written, signed and dated order from one Branch of a Bank to another, to pay a sum of money to a specific party.

Drawee: The person or entity on whom a draft/bill is drawn by the drawer.

Drawer: The party who draws or issues the draft/bill. In a Letter of Credit it is the Beneficiary. The person who makes or draws a bill of exchange or cheque is called drawer.

Due Date: The day a payment is due to a payee/creditor. After that date, a late fee can be charged, the payment can be recorded as late, and the account considered overdue/delinquent.

Early Repayment Charge (Pro-payment charge): Charge that banks and financial institutions levy on borrowers when they prepay the loan amount before the end of loan tenure. Early repayment charge is also called pre-payment penalty.

Electronic Clearing Service (ECS): Electronic Clearing Facility: An inter-bank arrangement whereby a customer can give instructions to his bank where he holds a current or savings account to pay the monthly instalments of payments due on loans/credit cards held with another bank

Electrum Funds Transfer (EFT): Any transfer of funds initiated by electronic means, such as an electronic terminal, telephone, computer, ATM or magnetic tape.

EMI: This refers to the Equated Monthly Instalment (EMI) to be paid to the Bank towards the loan taken by the borrowers on a monthly basis. The EMI comprises of Interest and Principal component.

Fixed Deposit: A deposit of funds in a bank under an agreement stipulating that the funds must be kept on deposit for a stated period of time a predefined interest rate

Fixed Rate: also called the fixed interest rate, it is a fixed amount of interest, which is chargeable for a specified duration or for the entire tenure of the loan.

Floating rate: or variable interest rate as it is also called doesn't remain fixed for the entire tenure of the loan. It varies according to the market conditions. This rate is linked to an external, market determined benchmark e.g. LIBOR. The lending is expressed with a spread above or below the bench mark rate. Reprising take splice after predetermine period say, 6 months when the lending rate will be revised with reference to the benchmark rate as on that day

Instalment Loan: A loan that you promise to pay back by paying the same amount of money on a regular basis, usually monthly, for a specific period of time. (Eg: EMI loan)

Interest: Interest is the periodic amount credited/debited to a deposit/ loan account by a Bank based on accepted agreed terms and conditions by the depositor and the Bank the loaned and the Bank. Interest is calculated at a specified percentage of the principal amount.

Joint account: any account owned by two or more people. Joint accounts can be operated jointly or by anyone/more or survivor(s) or any other mode mandated by the accountholders. Change in the mode of operation requires the mandate of all accountholders.

Late Payment: Most charge and credit card bills list the date by which payments are due. If you miss the due date, the account is considered past due and you may be charged a late fee. Late payments may be reflected on your credit report. If you have paid late numerous times, it may be difficult to get additional credit.

Linked account: Any account linked to another account at the same financial institution so that funds may be transferred electronically between accounts, and, in some cases, the combined balance may be used to help meet the balance required to waive a monthly service

Charge on one of the accounts.

Loan Agreement: It is a written contract between the borrower and the bank or financial institution providing the loan. The loan agreement details the various aspects and terms and condition of the loan. The borrower must read the loan agreement carefully as once he enters

In to a legal contract with the bank by signing the loan agreement, the terms become binding.

Loan Disbursement: This is the second stage of the loan processing. Post sanction of the loan, the Bank conducts necessary verification and validation as per its credit criteria. The disbursal will be done on meeting the credit criteria set by the Bank.

Loan Sanction: This is the first stage of the loan processing. The 'Loan Sanction letter" (Arrangement letter) is a confirmation to the customer on the sanction of the loan facility.

Money Laundering: Money laundering means acquiring, owning, possessing or transferring any proceeds (or money) of crime or knowingly entering into any transaction related to proceeds of the crime either directly or indirectly or concealing or aiding in the concealment of the proceeds or gains of crime, within or outside India. It is a process for conversion of money obtained illegally to appear to have originated from legitimate sources.

Money Order; A financial instrument, issued by a bank or other institutions like post office, allowing the individual named on the order to receive a specified amount of cash on demand. Often used by people who do not have saving accounts?

Multicity Cheque: Cheque issued by a customer under a pre ? approved arrangement with the Bank whereby the Bank agrees to pay them at designated centers and branches in the country.

National Clearing Cheque: Those cheques that are drawn on other banks and payable at major cities of the country (as Per RBI list of centers participating in national clearing) are called as National Clearing Cheque.

National Electronic Funds Transfer (NEFT): An Electronic Payment System in which payment instructions between banks are processed and settled on deferred net settlement (DNS) basis, which settles transactions in batches at fixed times during the day. RBI acts as the service provider and transfers the credit to the other bank's account. Customer can send funds from any bank branch to other bank-branches, which have IFS Code, and joined in NEFT network. NEFT is enabled only in specific bank branches across India. A list of these branches is available in the RBI website.

Non-bank ATM (white labelled ATM): An ATM or cash machine that does not prominently display a bank's name or logo. Fees generally apply to cash withdrawals at non-bank ATMs. Non-bank ATMs generally do not accept deposits. In India Non-banks ATMs are not permitted.

Obligation of the Borrower: The things, which a borrower has to take, care of after taking the loan. These include proper repayment, providing the Banks with post-dated cheque and following the terms written in the loan agreement carefully.

Online Banking: A service that allows the account holder to access their account information and conduct a set of pre-defined banking transactions, such as bill payment, fund transfer using the Internet facility. However, a customer needs to have Customer ID and a unique Net Banking Password in order to undertake this facility.

Outstanding Cheque: Outstanding cheque is issued by the company but not yet cleared by the bank. In preparing the bank reconciliation, it is deducted from the bank balance. The exception is an unlearned certified cheque, which is not considered outstanding since parties, the company and the bank, know about it and have subtracted it.

Outstations Cheque: Cheque deposited by the customer of a branch for credit to his/her Account and not payable at Local clearing at the center where the branch is situated.

Outward Remittance: Remittance of funds from the account maintained by a customer or separately on his instructions to another account with the same bank or another bank in the manner indicated by the customer

(Demand drafts, electronic funds transfer, telegraphic transfers etc.). May levy service charges for affecting the remittances.

Overdraft: An overdraft occurs when you do not have enough available funds in your account to cover a cheque or other withdrawal, but the bank pays the items and overdraws your account.

Passbook: Book issued by a bank or financial institutions to record deposits, withdrawals, and interest earned in a savings account.

Personal Identification Nurnberg (PIN): Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). I the number they use is correct they will be allowed to access their account.

Prime Lending rate: The minimum short-term, interest rate charged by commercial banks to their most creditworthy clients. It is a reference interest rate used by banks for its lending purposes.

Prime rate: The Prime Rate is the rate on which each bank fixes its own prime lending rate for advances.

Promises note: a promissory note is a binding legal document that a borrower signs to obtain a loan. It lists your rights and responsibilities under the loan agreement; including how and when the loan must be repaid. Rights and responsibilities for credit card accounts are listed in the Card member Agreement.

Real time Gross Settlement (RTGS): RTGS is a system through which electronic instructions can be given by banks to transfer funds from their account to the account of another bank. The RTGS system is maintained and operated by the RBI and provides a means of efficient and faster funds transfer among banks facilitating their financial operations. As the name suggests, funds transfer between banks takes place on a 'real time" basis. Therefore, money can reach the beneficiary instantaneously and the beneficiary's bank has the responsibility to credit the beneficiary's account within two hours.

Refinancing: Repayment of existing loan by a fresh loan, usually on better terms and conditions. In case of loans secured through mortgage of property etc., the same asset is taken over as security. Banks also refinance their loans to certain category of borrowers through specified refining agencies which provide refinance with matching repayment schedule.

Repayment: The process of returning of the borrowed loan amount. The repayment has to be made for the entire tenure of the loan amount. Based on fixed or floating interest rates on the loan amount, the banks or financial institution decides on an EMI which has to be paid on or before a date mentioned in the loan agreement every month.

Repayment Mode: It refers to the payment instruction given by the customer for the repayment of the loan dues. Cash, cheque, ECS and other electronic channels are the primary payment modes.

Returned Cheque: When you do not have enough available funds in your account (including any overdraft protection transfer from another account) to cover a cheque, the bank may decide not to pay the cheque and to return it to the payee. A returned item fee may be charged to your account.

Savings Account: An account maintained by a customer with a bank for the purpose of accumulating funds over a period of time. Only the account owner or a duly authorized agent may withdraw funds deposited in a savings account. It attracts a modest rate of interest, which is fixed by RBI and is considerably lower than the rates applicable on the Fixed Deposits. There is generally a limit on the number of transactions that can be done without attracting a charge.

Secured Card: A credit card that is guaranteed by a cash deposit held in a special savings account or certificate of deposit. The deposit must remain in the account until the credit line is closed or the issuer decides security is no longer necessary. The credit line on the card is usually equal to the amount of the deposit. If the Card member defaults on the card, the issuer will apply the deposit toward the outstanding balance.

Secured Debt: Debt for which repayment is guaranteed through collateral property of equal or greater value than the amount of the loan. If you do not repay the loan, the issuer may take possession of the collateral. Collateral may be an asset such as a car or a home or, in the case of a secured credit card, a cash deposit held by the issuer. For example, a mortgage is a secured debt in which the home is collateral. If the person fails to repay the loan, the bank may take the home as payment.

Stop Payment: When you ask a bank not to pay a cheque or payment you have -written or authorized. Stop payments are generally placed on lost or stolen cheques or on cheques related to disputed purchases. Banks usually levy charges for registering stop payment instructions.

Surcharge: Surcharge is an additional charge imposed for a specific service, product or purpose. It is a fee charged on a card transaction by the acceptor to cover the additional cost of taking a card rather than cash or cheque.

Unsecured Debt: This is debt that is not guaranteed by collateral; there -fore, no assets are committed in the event of default. If the issuer is unable to collect on the loan, its value is lost. Most credit cards are unsecured.

Zero Balance: Zero balance is when the total outstanding balance is paid and there are no new charges or cash advances during a billing cycle.

You need to login to perform this action.

You will be redirected in

3 sec